Deep thinking, distilled.

Investment Management

Value Stocks: Ready to Grow?

As the markets become more detached from economic reality, it appears value stocks may soon have their day in the sun. Find out what catalysts…More

Investment Management

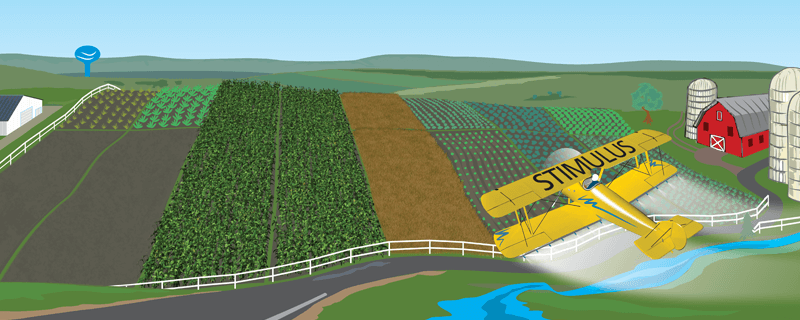

Third Quarter 2020 Insight

The global pandemic created many uncertainties. Learn how social distancing affects our economy, how day traders impact the markets, and how to plant a diversified…More

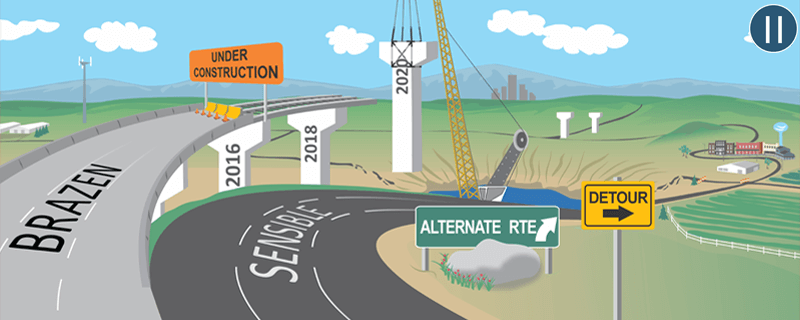

Investment Management

First Quarter 2020 Insight-Part 2

The economic hole brought by the COVID-19 pandemic is tens of trillions of dollars wide. In Part II, we examine several potential solutions to bridge…More

Investment Management

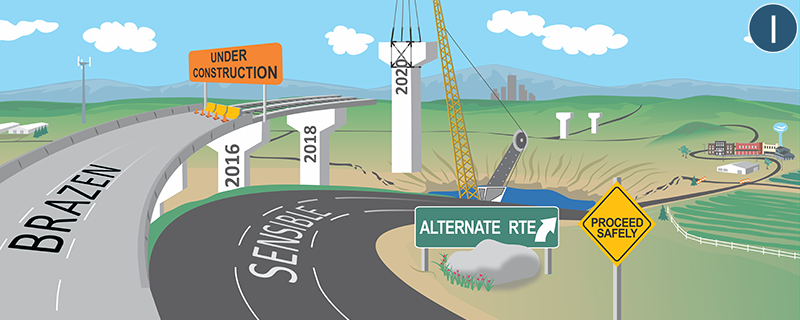

First Quarter 2020 Insight-Part 1

The COVID-19 pandemic has dramatically changed the global market landscape. We assess the size of the growing economic hole and the potential ability of government…More

Investment Management

The Market Cycle and the Business Cycle: A Layman’s Guide

Market cycles and business cycles generally run in tandem. But as investors get wary about future economic growth, the magnitude of resulting stock price declines…More

Investment Management

Third Quarter 2019 Insight

Like the ocean's rip currents, the financial markets have a similar force of nature. Learn how globalization, along with monetary and fiscal policies, have acted…More

Investment Management

Second Quarter 2019 Insight–Part III

As we near the limits of monetary and fiscal policy, learn why the galvanizing political divides among voters make remedying a potential economic downturn through…More

Investment Management

Second Quarter 2019 Insight–Part II

The Fed is running out of room to lower interest rates, and the U.S. Treasury may be maxing out the country’s national debt capacity. Understand…More

Investment Management

Second Quarter 2019 Insight-Part I

Our economic foundation requires the right mix of financial liquidity and debt capacity to build a sturdy capital base and strong financial markets. In Part…More

Investment Management

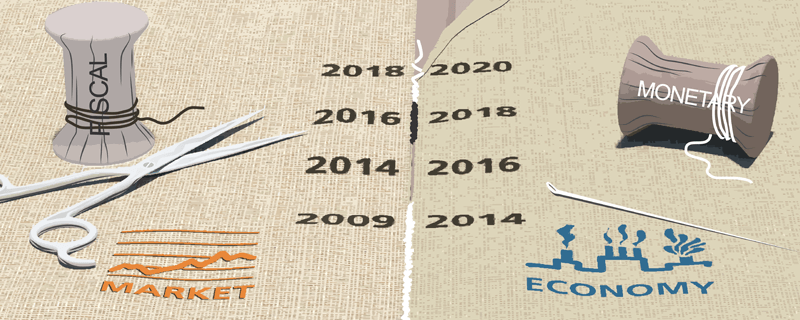

First Quarter 2019 Insight

When it comes to stitching the seam between the financial markets and the real economy, our federal government appears to be running out of thread.…More

Investment Management

The Benefits of Adding Diversifiers to a Portfolio

Stocks and bonds have been the primary asset classes used to manage risk in a portfolio. But frequently, they trade in tandem, driving up volatility.…More

Investment Management

Understanding Risk and Volatility

“Volatility” is the buzzword in the financial media these days. But what does it really mean and how does it impact your investments? Aspiriant investment…More

Talk to us

Talk to us