Wealth is a paradox.

It can feel like both a gift and a burden at once. The more there is, the more moving parts you’re expected to manage. Investments, taxes, trusts, insurance, philanthropy, businesses, even the financial education of the next generation.

For many ultra-high-net-worth (UHNW) families in California, New York and everywhere in between, there comes a moment when the current approach stops working. Sometimes it’s sudden—the “now what?” after a sale, inheritance or IPO. Other times it’s gradual—the longtime do-it-yourselfer realizing, “this is too much.” And sometimes it’s lifelong—being born into wealth and realizing, over years, that legacy assets and responsibilities need a more deliberate, professional structure.

Often, it’s an undercurrent of fatigue or worry: Are all the pieces of my financial life truly coordinated? If something happened to me, who would know the whole picture?

We often meet clients at this tipping point—when their financial lives have become more complex than any one advisor can effectively manage. The coordination of attorneys, accountants and investment managers starts to feel like a full-time job. Without integrated support, even simple decisions become exhausting. That’s when many begin asking, “What do families like ours do?” or “What am I missing?”

Those questions often mark the realization that what’s needed isn’t just more advice, but a more connected approach. One that brings order, expertise and cohesion to every dimension of wealth.

What is a family office?

A family office exists to manage the full scope of an ultra-high-net-worth family’s financial life—not just investments, but everything wealth touches. Rather than juggling multiple outside advisors, families centralize strategy, integration and execution in one place to align cash flow, taxes, estate planning, philanthropy, governance and more.

So, what does a multi-family office do? It brings together investment, estate, tax and philanthropic strategy into one cohesive structure—designed to simplify complexity and preserve wealth across generations.

|

“Across California, we’re seeing more multi-generational families turn to multifamily offices like ours to bring order, clarity and confidence to their financial lives.”

— Michelle Eversman CFP®, CPA |

Not all “family offices” are truly family offices. The term is often used broadly in the industry—sometimes to describe firms that focus solely on investment management. But managing investments alone represents only a small part of the overall value a true family office provides. The greater impact comes from integration—uniting every part of a family’s financial world so decisions work together rather than in silos.

Imagine having your own comprehensive family command center—one integrated team handling strategy, administration and execution across cash flow, investments, taxes, insurance, estate planning, philanthropy and even the personal decisions that carry financial weight—from structuring trusts and entities to guiding family education, prenuptial planning or household employment.

The result is clarity, confidence and peace of mind—a framework that supports your family today and across generations. Curious about the difference between a multi-family office and a single-family office? We explore both in the next section.

| Family office: A brief history

The concept dates back to the 19th century, when families like the Rockefellers and Rothschilds established private offices to manage growing fortunes, investments and philanthropic efforts. These single family offices served one family exclusively and laid the foundation for today’s multi-family office (MFO) model—where multiple families share access to institutional-caliber expertise, infrastructure and scale while maintaining personalized guidance. Put simply, some family offices are privately established for a single family, while others serve multiple families through a shared platform. Both share the same purpose—bringing strategy, integration and execution under one roof. |

Single family office vs. multi-family office services

Families of significant wealth often face a key decision: Should we build our own dedicated team or join a shared platform with families like ours?

At first glance, the distinction between a single family office and a multi-family office seems simple—one serves one family, the other serves many. But in reality, the implications go far deeper, impacting how decisions are made, how services are delivered, and how seamlessly your financial life is managed.

What is a single family office?

A single family office (SFO) is a dedicated, in-house team that serves only one family. It may include investment professionals, tax advisors, attorneys, accountants and even lifestyle staff. The family has complete control over how the office is structured and run.

This SFO model can be ideal for families with extraordinary wealth—typically or more—who want maximum privacy and direct oversight. Think of dynastic families like the Rockefellers or Waltons, who built entire offices to manage their money as well as their philanthropic and governance activities.

The tradeoff is scale and cost. Running a single family office requires significant overhead: salaries for specialized professionals, dedicated systems and technology and ongoing management. For many families, even ones with considerable wealth, the cost is prohibitive.

What is a multi-family office?

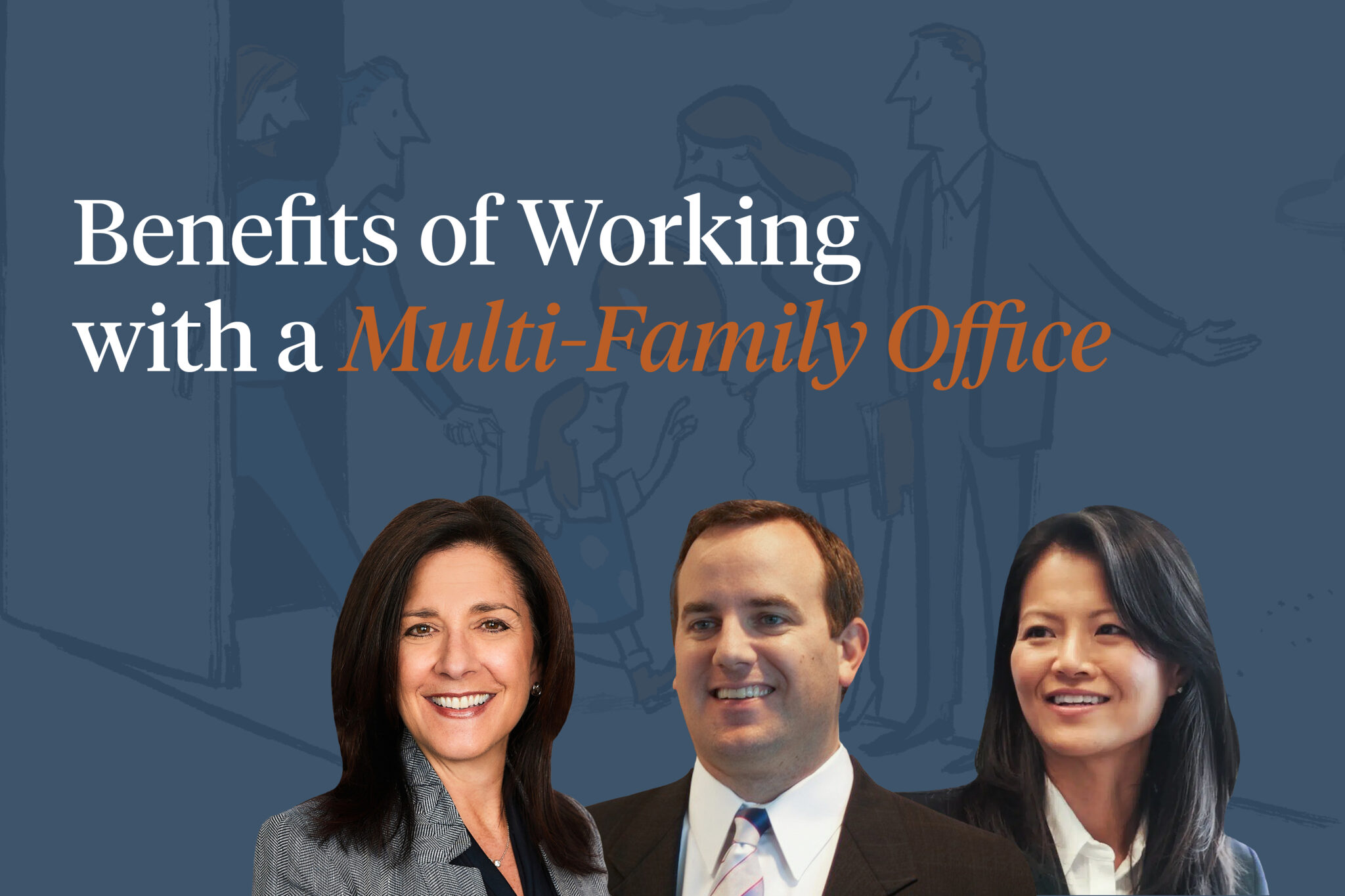

A multi-family office (MFO) offers the depth and coordination of a single family office without the burden of building and managing it on your own.

Families share access to a multidisciplinary team of specialists—including investment advisors, tax professionals, estate planning, philanthropic consultants, risk management and more. The infrastructure is shared, but the guidance is still highly personalized.

This model is ideal for families with significant wealth who want integration, scale and expertise—without having to build a dedicated institution from scratch.

Modern MFOs offer the same level of planning and service found in a single family office, but at a fraction of the cost. Because resources are spread across several families, clients benefit from both tailored advice and access to best practices across a broader base.

Today’s multi-family offices simplify complexity, support future generations and help families make thoughtful decisions that align with their values.

Comparing single family office vs. multi-family

| Single Family Office (SFO) | Multi-Family Office (MFO) | |

| Who it serves | One family | Multiple families |

| Control | Full control over staff, structure and day-to-day operations | Shared platform and infrastructure, with highly personalized financial services |

| Cost | High (salaries, dedicated infrastructure, ongoing overhead) | Shared across families for greater cost efficiency |

| Expertise | Varies, depends on who the family hires and retains | Deep bench of specialists across investment, tax, estate, philanthropy and more |

| Best suited for | Families who want full autonomy and are willing to absorb the associated cost | Families with significant wealth of $50M+ who want integration, expertise and scale–without building it themselves |

When each model makes sense

Family offices orchestrate every dimension of your financial world. And while no two are exactly alike, the most effective ones bring together a coordinated team of credentialed, multidisciplinary specialists—planners, investors, tax professionals, attorneys and more—who work in concert to simplify complexity and align every decision.

Single family office

A single-family office usually becomes practical when a family has at least $250 million to $500+ million in investable assets. That threshold exists because running a private, in-house office involves meaningful fixed costs—staffing, infrastructure, compliance, technology and investment operations—which can total $3–10 million per year.

Multi-family office

For families with less concentrated wealth, a multi-family office offers the same level of sophistication and institutional-grade expertise, but with shared costs, broader resources and scalable support.

While every family’s needs are unique, we often see certain scenarios where the MFO model provides the greatest value.

A multi-family office is especially valuable for families who:

- Have outgrown their advisor or traditional wealth manager

- Want proactive, cross-disciplinary coordination

- Are preparing for a liquidity event or generational wealth transfer

- Value efficiency and integration as much as investment results

How Aspiriant’s Exclusive Family Office is different

Aspiriant’s Exclusive Family Office (EFO) builds upon the true multi-family office model—integrating every aspect of a family’s financial life under one coordinated structure.

While many firms describe themselves as “family offices,” our approach goes beyond portfolio management or basic coordination. We operate as your family’s executive team—a long-tenured group of specialists across planning, investments, tax, accounting and philanthropy who think and act as one.

Here’s what distinguishes the Aspiriant EFO model:

- True, full integration

- Proactive engagement

- Built for the long-term

- Next-gen support

- Supporting business owners before the liquidity event

It’s a model refined over decades of serving complex, multigenerational families who value simplicity, stability and peace of mind—without having to build an institution themselves.

| Curious what clarity and peace of mind look like? Talk with us. |

|

Full integration

Few multi-family offices provide integration as deeply or seamlessly as Aspiriant’s Exclusive Family Office. Our team brings together seasoned professionals across planning, investment, tax and accounting disciplines—many holding advanced designations such as CFA®, CFP®, CPA and JD. Financial planners, investment managers, tax experts, estate planners, accountants, philanthropic advisors—our multidisciplinary team works in concert, always thinking across.

When there’s a change in one area, the others adjust in tandem. Without you lifting a finger.

Without integration, one advisor’s decision can ripple through your financial life—triggering tax surprises, liquidity gaps or missed opportunities. With integration, every move is coordinated in real time. Your investment, tax and estate strategies work in harmony—not in silos.

Proactive engagement

We don’t wait for change—we plan for it.

Our team spots opportunities and tackles challenges before they surface. For instance, we often work with business owners and entrepreneurs well before a sale or IPO, helping them separate business and personal finances, clarify their walk-away number and prepare for the eventual transition.

This proactive approach extends beyond liquidity events. It might mean anticipating tax implications before year-end, preparing heirs to receive wealth or identifying governance structures that prevent future conflicts.

The result: fewer surprises, intentional decisions and more confidence. It’s one of the ways you experience not just peace of mind, but better outcomes.

Built for the long term

Our firm is designed to go the distance—for your family and the next.

While many advisory firms experience turnover or get acquired, Aspiriant’s 100% employee-owned structure provides long-term stability and continuity across generations. Your wealth managers aren’t just employees—they’re owners, deeply invested in your success and the firm’s future.

That continuity means your advisory team stays with you. Relationships are nurtured. Institutional knowledge is preserved. And you can plan for generations with confidence.

Next-gen support

Continuity isn’t just about advisors—it’s about families.

We serve the full family, not just the wealth creators. Our work with the next generation begins early, helping them build confidence and capability as they grow into financial responsibility. That might mean introducing financial education, planning for a first home or understanding how budgeting and credit work.

Support isn’t always financial; it’s about creating readiness and resilience.

By meeting each generation where they are, we help create stewards of wealth–people who understand not only what they have, but how to care for it and use it wisely.

Supporting business owners before a liquidity event

For business owners heading toward a sale, the most valuable advice often comes before the deal closes. Early engagement is a hallmark of our Exclusive Family Office—we invest time to understand the family’s goals long before the transaction documents are signed. By building the relationship ahead of a sale, IPO, or succession event, we can help shape smarter outcomes—financially, strategically, and emotionally.

Engaging early lets us capture planning opportunities that may disappear once documents are signed, including:

- Entity structuring: Review limited liability companies (LLCs), S corporations (S corps), and partnerships to improve tax efficiency and align with your long-term estate plan.

- Trust and estate strategies: Fund trusts such as grantor retained annuity trusts (GRATs) or intentionally defective grantor trusts (IDGTs) before the sale to shift future appreciation outside the taxable estate.

- Charitable planning: Establish a donor-advised fund (DAF) or private foundation early so you can contribute closely held shares rather than post-sale cash.

- Liquidity modeling: Stress-test deal scenarios against lifestyle goals and capital needs to define a confident walk-away number.

- Tax timing: Coordinate income recognition, option exercises, and installment or earn-out structures to manage one-time exposure.

- Governance and education: Prepare heirs for sudden wealth and create decision frameworks that promote unity.

The result is a transaction that funds your vision—on your terms—and a post-close plan that’s ready on day one.

| We find simplicity on the far side of complexity.

It’s what guides our work across every office, every family, every story. |

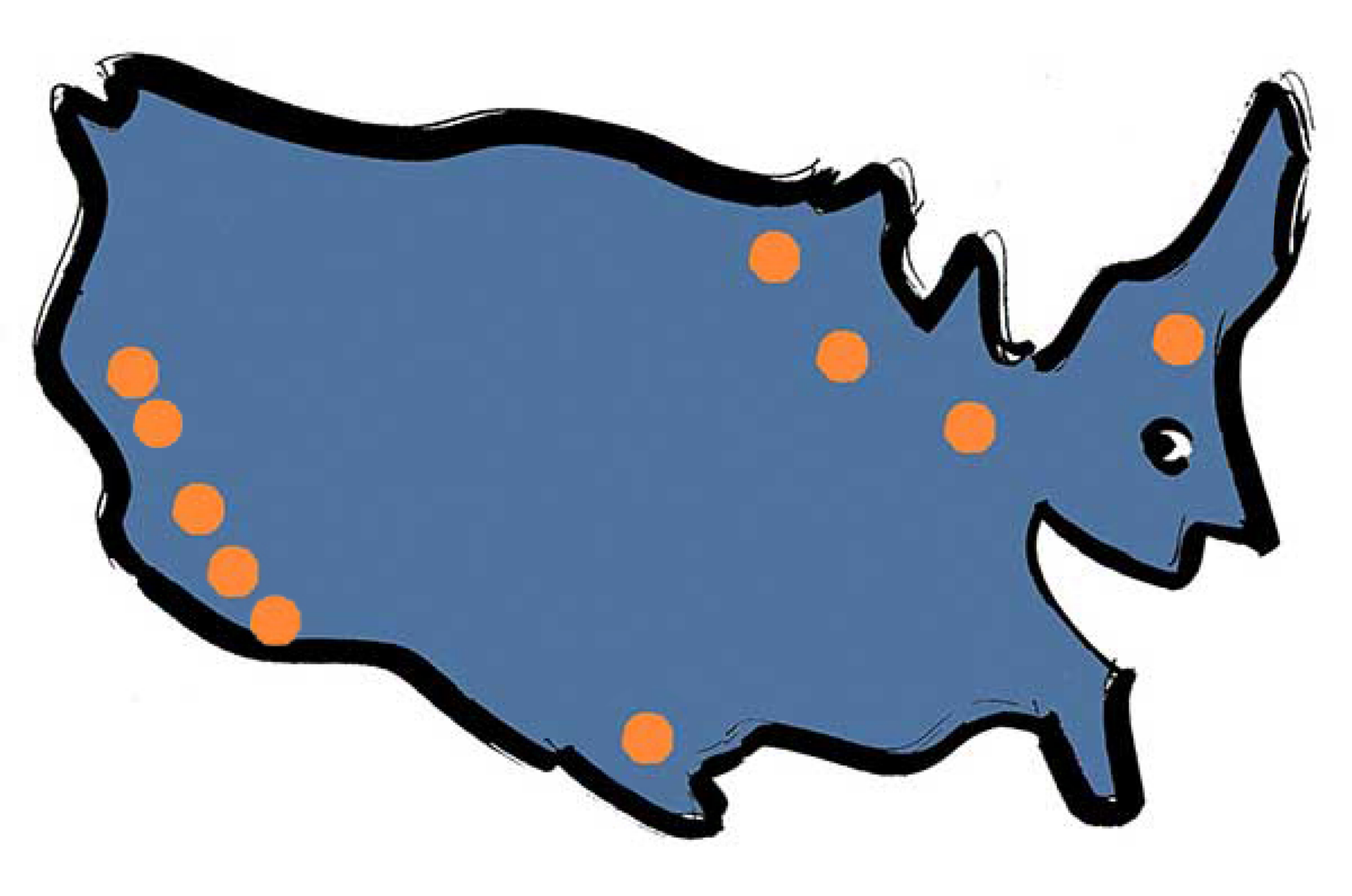

Family office hubs in Los Angeles, San Francisco, New York and beyond

Where you build your life shapes how you build your legacy.

At Aspiriant, our EFO team serves families from coast to coast through our hubs in Los Angeles, San Francisco, New York, Austin, Milwaukee and San Diego. Each office reflects the same purpose: to simplify complexity for families whose wealth spans generations, businesses and geographies—while staying grounded in what truly matters.

Los Angeles family office

Our Southern California family office in Los Angeles has become a cornerstone for founders, executives and legacy families navigating the crossroads of entrepreneurship and wealth. Many began their journeys with liquidity events in the region’s vibrant business landscape—from technology to entertainment to real estate—and continue to rely on our team to bring structure, clarity and calm to their next chapter.

San Francisco and Silicon Valley family office

In San Francisco and Silicon Valley, our family office has guided Bay Area families for decades, integrating sophisticated tax, estate and investment strategies for those whose wealth often bridges public and private markets. Relationships here are built to last—grounded in trust, collaboration and care that extends far beyond the balance sheet.

New York family office

Our NY family office team serves as a steady hand for multigenerational families, executives and entrepreneurs navigating the complexities of concentrated equity, cross-border assets and shared family governance. Proximity to global financial centers keeps our perspective sharp, while our independence ensures every recommendation begins and ends with what’s best for your family.

Austin, Milwaukee and San Diego family offices

Further inland, our Austin and Milwaukee family offices extend that same thoughtful service to families across the central U.S.—often business owners and wealth creators looking to preserve what they’ve built and prepare the next generation for what’s ahead. And in San Diego, our Southern California team continues to serve long-time clients who value deeply personal relationships, guided by understanding, steadiness and care.

But while we talk about our locations, what truly sets us apart is our people—a long-tenured team working in sync across borders and disciplines to serve every family as one. Over time, these relationships often grow into something more.

So many of the families we serve invite us into their lives—to weddings, anniversaries and milestones that mark the chapters of their stories. It’s a privilege we never take lightly. In many ways, we become a quiet constant—trusted partners, steady guides, and yes, sometimes, the guardian angels who make sure everything behind the scenes stays aligned and at peace.

|

“What makes our reach special isn’t the number of offices. It’s really the people behind them. Families feel that no matter where they meet us, they’re surrounded by one connected team that knows them, coordinates for them and genuinely cares about their success.”

— Ryan T. Nelson CFA® |

Inside Aspiriant’s EFO: Comprehensive services

A family office is more than a collection of financial services. It’s a tightly integrated ecosystem built around your life.

At Aspiriant, our Exclusive Family Office (EFO) brings that ecosystem to life. We deliver the depth and coordination of a single-family office—without the complexity or cost building one yourself. It’s a holistic model designed for complex, multigenerational families who value simplicity, continuity and control.

What key services does Aspiriant’s Multi-Family Office provide?

| Financial planning | Estate planning | Accounting & banking |

| Investment management | Philanthropy & charitable giving | Family governance & education |

| Tax planning & compliance | Risk management & insurance oversight | Entity oversight & compliance |

Aspiriant’s multi-family office delivers a full range of multi-family office services — from financial planning and investment management to estate, tax and philanthropic strategy—all working together to simplify the lives of complex, multigenerational families.

From there, our team coordinates every aspect of your financial life through an integrated suite of services. Each designed to bring structure, clarity and confidence to your wealth.

Financial planning

For families with significant wealth, financial planning isn’t about “how much to save” or “when to retire.” It’s about possibility.

What level of spending supports the life you envision? How much can you commit to philanthropy with real impact? What can you transfer to the next generation—now or over time—while still feeling confident you’ll meet long-term goals?

Our planning answers those questions with rigor: aligning lifestyle, giving and legacy decisions within clear guardrails so you can move forward decisively.

And while financial planning is not unique to a family office, the depth, integration and foresight required at this level is.

Investment management

If your financial plan is the map, the portfolio is a set of purpose-built vehicles—not just one.

Because we manage the entirety of a family’s wealth, we tailor distinct strategies to the jobs each pool of capital must do:

- A stable, tax-aware sleeve to fund lifestyle and near-term needs

- Higher-growth, longer-horizon mandates to build next-generation wealth

- Mission-aligned, sustainability-focused capital to support philanthropy and impact initiatives

Within that framework, Aspiriant’s investment philosophy remains disciplined, globally diversified and value-oriented, with access to institutional-caliber public and private opportunities.

The aim isn’t performance for its own sake; it’s alignment. Each dollar is invested according to its purpose, time horizon, liquidity needs and tax profile.

The goal? A portfolio that supports not just your lifestyle, but your legacy.

Tax planning and compliance

The tax code is dense—and like life, it’s always changing. A smart tax strategy helps keep wealth where it belongs: with your family.

In a family-office setting, tax planning goes far beyond annual filings. We plan early and often, developing sophisticated, proactive strategies that reduce exposure and adapt as life evolves. That includes cross-disciplinary coordination to structure income, time liquidity events, manage charitable giving, and align trust distributions. Then we execute precisely and adjust as needed.

It’s big-picture strategy and boots-on-the-ground implementation—under one roof.

Estate planning for multi-generational wealth

Estate planning isn’t just about documents; it’s about clarity, continuity and peace of mind.

We make the plan understandable—translating legal language into plain English and mapping it visually so everyone can see how assets move and who decides what, when.

For family office clients with significant wealth, we pair that clarity with proven strategies to transition assets efficiently and intentionally. Depending on goals, that can include annual exclusion gifts, Grantor Retained Annuity Trusts (GRATs), Intentionally Defective Grantor Trusts (IDGTs) and other irrevocable trusts, intra-family loans/notes and charitable remainder or lead trusts (CRTs and CLTs).

We also oversee the details—beneficiary designations, titling across accounts and entities and coordination with outside counsel—and keep everything current as life evolves. Our estate planning for multi-generational wealth focuses on clarity, continuity and family harmony, ensuring your legacy endures in both structure and spirit.

Our job is to make them clear,

coordinated and confidently executed.

Philanthropy and charitable giving

Giving is often where wealth becomes most meaningful. It’s a way to express values, create impact and connect generations. Without structure, though, it can feel scattered or inefficient.

We help bring clarity and cohesion to your philanthropy, from vision to execution. That starts with articulating a family mission and priorities, then exploring the full spectrum of how to give—time, money and expertise.

Together, we determine how involved you want to be and how to thoughtfully include the next generation so giving becomes a shared value, not just a tax strategy.

From there, we design the right vehicles—donor-advised funds (DAFs), private foundations, charitable trusts and strategic one-time or multi-year grants—and align them with your overall financial plan. Our team can also facilitate the sourcing and due diligence on grantees that match your mission and help you measure results so you can understand the return on your charitable dollars in terms of real-world good.

The outcome is a philanthropic strategy that’s clear, coordinated, and purpose-driven—turning generosity into part of your family identity and legacy.

Risk management and insurance oversight

Wealth attracts complexity—and risk. Insurance is often overlooked until something goes wrong, but when you need it, it has to work.

We take a proactive, comprehensive approach: working with trusted brokers and specialists to review coverage across property, liability, business, life and unique assets like art, wine or collectibles. Then we identify and gaps so protection is coordinated and effective.

Beyond traditional coverage, we also address modern exposures—identity theft, cybersecurity and privacy. That includes partnering with industry experts to assess personal and family cyber risk, and recommending protective measures such as credit monitoring and freezes, password and device hygiene, secure document sharing, home-network hardening, travel protocols, and, where appropriate, personal cyber and fraud coverage.

The result is a risk program that protects both your assets and your information—when it matters most.

Accounting and banking services

Wealth comes with a mountain of logistics—tracking expenses, reconciling accounts, and keeping every bill paid on time. We lift that load.

Our team handles bill pay, manages cash flow, monitors and categorizes expenses, reconciles accounts, and delivers tailored, decision-ready reports across entities and trusts.

These reports don’t just total numbers. They create context. Such as showing trends in spending, the true cost of lifestyle, upcoming liquidity needs and where complexity may be hiding. That way, you can make confident choices quickly.

We also flag unusual charges, coordinate with vendors and maintain clean, audit-ready records. In a nutshell, we turn invisible, stress-creating tasks into clear, actionable insight—freeing you to focus on what matters most.

Family governance and education

A financial plan protects your future; a family strategy protects your relationships.

We help families navigate the human side of wealth—the roles, expectations, values and decision rights that determine whether wealth is preserved or frays over time.

Our work spans facilitated family meetings, shared mission and values statements, and clear governance structures such as charters, voting and distribution policies and participation guidelines. We also develop succession frameworks for leadership and trusteeship that sustain clarity and connection across generations.

For rising generations, we build tailored education tracks—financial literacy, investing basics, taxes, stewardship and philanthropy. These capabilities rarely appear on a services menu, yet they’re often the difference between a durable legacy and avoidable loss.

Entity oversight and compliance

Complex wealth often lives across multiple entities, Trusts, limited liability companies (LLCs), partnerships and operating companies.

We provide end-to-end entity oversight and compliance: maintaining governance documents, tracking filing calendars, coordinating with attorneys, and CPAs, and ensuring timely state and federal filings.

The result is a clean, coordinated structure that supports your overall strategy—without adding unnecessary risk.

Inside the Aspiriant EFO: Integration in action

Wealth is complex, and life moves quickly. Even the most thoughtful families can find that important details slip through the cracks when their advisors aren’t working in sync. Below are real-world examples of how an integrated family office anticipates needs, prevents oversights and simplifies complexity.

Real-world family office coordination examples

An art purchase Without integration: It’s a beautiful $80,000 purchase—admired and enjoyed, but handled like any other transaction. A charitable gift Without integration: You write a $100,000 check to a cause you care about and hope it was the best move. A liquidity event Without integration: Advisors operate in silos, and valuable opportunities can be missed. From there, our team coordinates pre-close entity structuring, trust funding (e.g., Grantor Retained Annuity Trusts [GRATs] and Intentionally Defective Grantor Trusts [IDGTs]), charitable strategies (such as DAFs or Charitable Remainder Trusts [CRTs]), qualified small business stock (QSBS) and option timing, and a post-close cash-flow and tax map—ensuring every dollar knows its purpose on day one. Complex coordination for extraordinary familiesEvery family we serve has a unique story. However, the common thread is complexity made simple. Below are a few examples of how our team quietly integrates every detail behind the scenes. Planning for a sports franchise owner A minority owner of a North American professional sports franchise wanted to plan for intergenerational wealth transfer. Our Exclusive Family Office team coordinated with league officials and estate attorneys to carve out part of the ownership interest into a revocable trust for the owner’s children. It’s a complex process requiring valuation work, tax analysis and negotiation with league counsel. The outcome: A compliant, tax-efficient structure that preserved family control and achieved significant projected estate-tax savings. Helping the next generation launch a business When a client’s daughter set out to launch her first business, our team provided full-spectrum guidance. From introducing her to trusted real-estate and banking partners, to structuring a loan from a family trust, to forming a new LLC. The outcome: A confident next-generation entrepreneur and a structure that balanced independence with family stewardship. |

|

“From our Los Angeles family office, we have the privilege of walking alongside families through every season of life. It’s about helping them find balance—between opportunity and responsibility, ambition and peace of mind.”

— Michael Wu, CFA® |

Recognition and industry leadership

We don’t do this work for recognition. But it’s certainly meaningful when others take notice.

Aspiriant’s Exclusive Family Office is trusted by the families we serve and respected across the wealth management community. Recent honors reflect both the depth of our team and our thoughtful approach to helping families navigate complex, multigenerational wealth:

- Family Wealth Report Award — 2025

Winner in the Multi-Family Office category ($5B–$15B AUM/AUA), recognizing our independence, client experience and 100% employee-owned model. - Forbes Top Women Wealth Advisors – Best-in-State (New York)

Lisa Colletti, CFP®, JD, Managing Director and Partner, has been named to Forbes’ Top Women Wealth Advisors list multiple times, including 2025, 2024, 2022 and 2021. - Schwab ACE Award — 2025

Lynne Born, Chief Practice Officer and Partner, was honored for leadership in strategy, succession and family-office innovation. - Forbes Top Next-Gen Advisors Best-in-State — 2025 Michelle Eversman, CFP®, CPA, Partner and Director in Wealth Management, was recognized among Forbes’ 2025 Top Next-Gen Advisors Best-in-State.

- Barron’s Top 100 RIA Firms — 10 Consecutive Years (2016–2025)

Aspiriant has ranked on Barron’s Top 100 RIA Firms list for 10 years running—a testament to enduring trust and excellence. - Forbes America’s Top RIA Firms — 2025, 2024 and 2023

For the third consecutive year (2023–2025), Aspiriant was named to Forbes’ list of America’s Top RIA Firms, reflecting our continued growth and client-first philosophy.

|

Recognized among the best family offices for multigenerational wealth planning in California, New York and across the U.S. |

With teams spanning our San Francisco family office, Los Angeles and New York, these recognitions reflect the consistency of our approach nationwide. See Disclosure on Awards and Rankings.1

Awards are never the goal but they are meaningful markers of the impact we strive to have: building something enduring for the families we serve while offering clarity and peace of mind.

Real stories behind the family office experience

Before we close, we invite you to hear directly from those who’ve walked in your shoes and lived these conversations. Our Money Tales podcast explores the human side of wealth, bringing to life the decisions, values and relationships that shape family legacies across generations. Here are two episodes worth a listen.

Multigenerational abundance

featuring Taylor Adams

A fifth-generation family member turned family office executive, Taylor shares how he moved beyond pressure and prestige to embrace a purpose-driven, empowerment-focused approach to multigenerational wealth.

Be Curious

featuring Josh Gentine

A third-generation family business owner turned advisor, Josh helps multigenerational families and their leaders navigate the complexities of shared enterprise ownership. Drawing on experience as an investor, corporate director and certified Hogan and Gallup Strengths coach, he offers practical insights into leadership, legacy and family dynamics.

Looking ahead, for you and your family

Wealth is many things. A coveted opportunity. A safety blanket. And at times, a heavy responsibility. But with the right structure and guidance, that weight can turn into clarity.

Aspiriant’s Exclusive Family Office stands beside families through every step of their journey. We help make sense of complexity, anticipate blind spots and create a thoughtful framework that protects both assets and intentions.

Change is inevitable. In tax laws, in markets and even within families themselves. What doesn’t change is the need for a long-term fiduciary partner you can trust to adapt with you.

If you’re feeling the paradox of wealth and wondering how to manage all that comes with it, we invite you to talk with us. Sometimes, peace of mind begins with the single step of asking for help.

Whether you’re exploring family office services in California, New York, somewhere in between, or beyond, we’re here to help you navigate what’s next with confidence and care.

FAQs about family officesWhat’s the difference between a family office and a wealth manager or financial advisor?A wealth manager or financial advisor helps families invest wisely and plan for the future. They typically focus on portfolio management, retirement planning, and high-level financial strategy—which is ideal for many households. A family office, however, is designed for families whose wealth has reached a level of complexity that requires broader and deeper support. In addition to investment management and planning, a family office integrates tax compliance, estate planning, philanthropy, bill pay, family governance, and even education for the next generation. Think of it as a matter of scope: wealth managers provide advice and oversight, while a family office builds the infrastructure around your entire financial life. Both are valuable—the right fit depends on the complexity of your needs and where you are in your financial journey. How do I know if a family office is right for me?The tipping point usually comes down to complexity. Some common signs include:

If managing your wealth is taking up too much of your time or mental bandwidth, a family office can help harmonize your finances. What’s the difference between a single family office and a multi-family office?A single family office serves just one family. It’s fully customized and controlled by that family, likely employing a staff of attorneys, accountants, investment managers and more. This model is usually best suited for families with $250M+ in assets, because the overhead of running such an operation can be significant. A multi-family office pools resources across several families. Each family still receives personalized guidance, but the costs and infrastructure are shared. The MFO model is much more accessible for families with significant but not ultra-concentrated wealth. How much wealth do I need to work with a family office?There’s no single threshold, and it depends on your complexity and goals. At Aspiriant, our Exclusive Family Office is generally best suited for families with $30M+ in assets or facing complicated planning needs. We even support families whose financial picture is tied up in a business or other illiquid assets. This way, we can help them prepare for the future well before those assets are converted into a marketable portfolio. In short, if managing your wealth feels unmanageable, you may already be at the point where a family office makes sense. Can you help before I sell my business?Yes—and this is one of our most important differentiators. Many firms hesitate to engage with business owners until after a liquidity event, when assets are liquid and available for professional management. But some of the most impactful planning opportunities exist well before the sale. For example, we often help owners:

These steps are only possible in the years leading up to a liquidity event—not afterward. By engaging early, we help business owners achieve far better outcomes. Does your team work with clients across the country?Yes. Aspiriant offers comprehensive Family Office Services in California and across the country. While Aspiriant has offices in Los Angeles, San Francisco, New York and other major hubs like Austin, Milwaukee and Silicon Valley, geography isn’t a barrier. We serve families nationwide (and even globally) by combining in-person relationships with leading-edge technology. Because Aspiriant is employee-owned, families can rely on long-term stability in their advisory team, no matter where they live. That means fewer disruptions, smoother transitions and confidence that your wealth is being managed consistently across generations and time zones. How does Aspiriant’s Exclusive Family Office stand apart from others?Quite a few things set us apart. Aspiriant’s Exclusive Family Office is designed for families who want true partnership and simplicity in a complex financial world. True, full integration — One connected team of 60+ professionals collaborates across bill pay, investment, tax, estate, philanthropic planning and more so every decision works in harmony. Proactive engagement — We anticipate needs before they arise—from liquidity events to daily details—so your plan always stays one step ahead. Built for the long term — As an employee-owned firm, our advisors are long-term partners in your success, providing continuity and stability across generations. Next-generation support — We help rising generations gain confidence and skills to be thoughtful stewards of wealth. Support before liquidity events — We engage early with business owners to structure entities, trusts and charitable strategies ahead of a sale or IPO. Ours is a thoughtful model built on care, connection and continuity. We’re helping families turn complexity into clarity for generations to come. |

Talk to us

Talk to us