Deep thinking, distilled.

Uncategorized

Fourth Quarter 2022 Insight

Skilled investing, like good driving, means proceeding along one’s journey at a reasonable and safe pace, using sound decision making.More

Investment Management

Market Perspective: The Future for Bonds is Looking Up

Bond investors are generally willing to forego higher returns and expect to receive lower, steadier returns with smaller losses. Over the past year, this expectation…More

Inside Aspiriant

Aspiriant Ranked on Barron’s 2022 Top Wealth Management Firms List

Our ranking as a top-rated independent wealth management firm reflects our deep commitment to independence through our ownership model, serving clients with distinction and our…More

Uncategorized

Market Perspective: Volatile Times

As the Federal Reserve continues raising rates, recession fears have resurfaced and triggered equities to resume the selloff that began earlier this year.More

Wealth Planning

Managing Lock-Up Periods During Volatile Markets

During volatile markets, managing equity compensation during a lock-up period can be particularly stressful. The key is to plan ahead. Read some tips to managing…More

Uncategorized

Third Quarter 2022 Insight

Frothy markets driven by globalization, easy monetary policies and a wave of capital during the pandemic have shifted to real risks of a recession or…More

Uncategorized

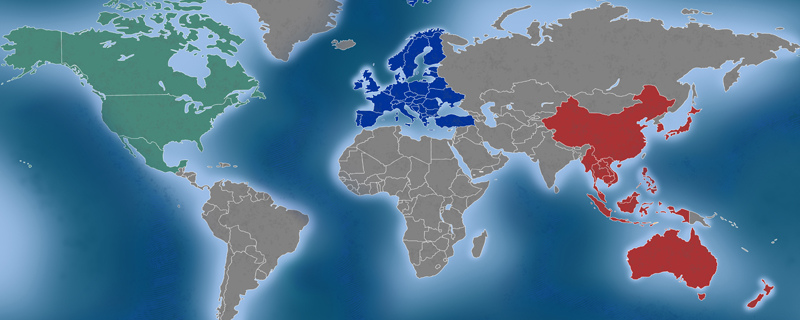

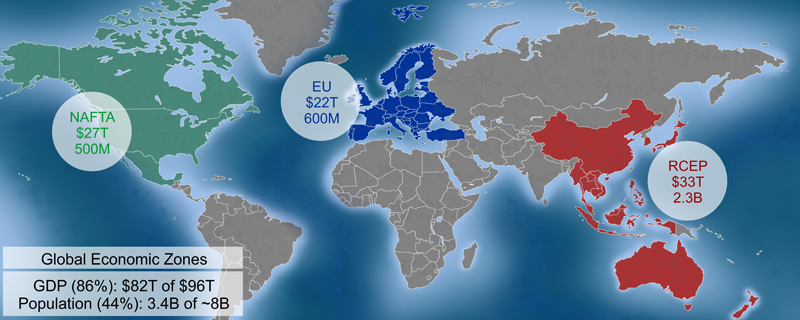

Nationalization: The Tidal Power Surge

Globalization, and its deflationary effects, are receding as global trading alliances grow. Find out what that could mean for investors.More

Wealth Planning

Answers to 12 Top Long-Term Financial Planning Questions

When we talk to clients about their money, certain questions pop up again and again. Find out what we generally say, depending on each client’s…More

Wealth Planning

Aging Wisely: Stay put or move on?

We all need to plan for where we’ll live and who will help take care for us in our later years. But there’s a lot…More

Investment Management

Market Perspective: Managing Recession Fears

Market volatility continues to fray investor nerves. Read how you can avoid emotional investing with diversified portfolios that may help you brace for a potential…More

Wealth Planning

Envisioning Life After Your Family Business Succession

Have you envisioned what your life will look like after you’ve transitioned from the family business? The emotional side needs succession planning too.More

Wealth Planning

Series I Bonds: A Bright Side of Higher Interest Rates

During these days of rising inflation and interest rates, federal Series I bonds are a good savings option. Learn what they are and how they…More

Talk to us

Talk to us