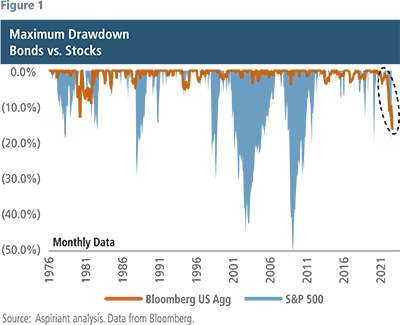

As an equity investor it’s common to experience losses, and occasionally large losses exceeding 20%, especially when recession appears around the corner. In exchange for accepting higher risk of loss, equity investors are usually compensated with higher long-term returns.

Bond investors, on the other hand, are willing to forego higher returns and generally expect to receive lower, albeit steadier, returns with much smaller losses. Over the past year, this expectation has been shattered as bonds endured one of their worst periods in history with losses ranging between 12-16% for a diversified investment grade bond portfolio.1

This has created an odd situation: amidst the current equity market drawdown, low and medium-risk portfolios, which typically maintain sizeable, fixed income allocations, are suffering double-digit losses very similar to high-risk portfolios. Not surprisingly, the bond market’s behavior has led to much consternation from investors—it’s not supposed to work this way. However, we believe it will not continue to be this way. In fact, we think bond investors have good reason to hang on here.

Bonds are ‘Low Risk’, but They Have Never Been ‘No Risk’

Equities regularly incur 10% losses, occasionally lose 20%, and at times have lost more than 40%. By comparison, a typical decline in bond values is between 1%-3%. Less frequently we observe declines in the 3%-5% range and there have been two periods (including the current drawdown) where market values fell by more than 10%.

A low risk profile for bonds makes sense because their interest and principal payments are often secured through some form of collateral (e.g., government guarantee, essential services revenue, hard asset, etc.). There is greater certainty to the future cash received from a bond that you do not get with equities.

Additionally, bonds usually provide a higher priority claim against the assets of the entity issuing the bond should it run into problems. While there is some risk of default for any single bond issuer, those risks can largely be mitigated through diversification.

A bond portfolio’s more pressing, non-diversifiable risk stems from interest rates and inflation. This is a short-term risk based on changes in interest rates and does not impact the long-term return received from holding a bond. When interest rates/inflation move sharply higher, the value of bonds move lower to reflect the change in the present value/buying power of those fixed cash flows.

Though bond market values may fluctuate, a primary reason we invest in bonds is to generate income by earning interest and that will continue. In other words, a bond portfolio that generated $75,000 in interest income last year is largely expected to generate the same amount of income this year even though the market value of the portfolio is lower.

Strategy Adjustments We’ve Made

We’ve had several strategy initiatives at work to better shelter our bond portfolios from rising interest rates and inflation. A smaller allocation to bonds, having bond portfolios with lower sensitivity to interest rate changes, reducing high yield exposure and moving away from passive solutions have all helped.

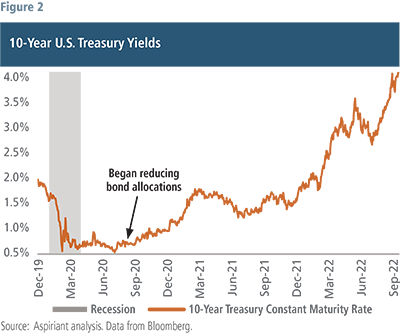

From an asset allocation perspective, we have been and remain underweight bonds relative to our policy benchmarks. Recall we significantly reduced our bond allocation in 2020, at what turned out to be near the very top of the market for bond prices. Back then, the yield on the U.S. 10-year Treasury ranged between 0.75%-0.85% whereas today it’s closer to 4.2%.

Note: Bond prices are inversely related with interest rates e.g., a lower interest rate means a higher bond price

Note: Bond prices are inversely related with interest rates e.g., a lower interest rate means a higher bond price

Our bond portfolios generally exhibit lower sensitivity to changing interest rates as assessed by duration. Duration is a measure of bond price sensitivity to changes in interest rates. A lower duration implies the bond portfolio will lose less in a rising rate environment. We have positioned our municipal and taxable bond portfolios with a shorter duration posture vis-à-vis their respective benchmarks.

Normally, a lower duration positioning would add good value but given the large parallel shift in interest rates across the entire yield curve, there haven’t been many places to hide within the bond market.

A similar strategy change was undertaken in April 2022 when we reduced high yield bond exposure in all portfolios. In our view, compensation for investors in this higher risk bond area was scant especially with the Fed moving rapidly to tighten policy and the subsequent operating challenges likely to materialize for these issuers.

Lastly from an implementation perspective, we have been migrating exposure from passive bonds to more actively managed solutions. Normally in periods where rates are rising, passive portfolios with much more concentration in U.S. government and agency securities tend to fare slightly worse. While not all our actively managed solutions outperformed from a total return standpoint, most have delivered higher income year-to-date which has cushioned losses.

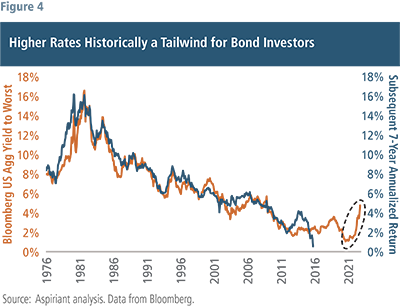

A Few Good Reasons to Remain Invested

Higher rates are good for long-term bond investors. We’ve said this many times before and it bears repeating. There is a strong positive relationship between current yields and future long-term performance (see chart below). While the adjustment to higher rates has been unsettling, your current bond portfolio now has the potential to generate significantly more income over the next 7-10 years.

Recall at the start of the year a diversified investment grade bond portfolio offered a yield of only 1.9%, today that number is close to 4.5%. Moreover, taxable equivalent yields in the municipal market are higher than 6%3 today. So yes, it has been a painful experience, but we view higher interest rates as a largely positive development for bond investors long-term.

Assuming no material changes to interest rates, the higher income should be sufficient to offset any current losses over the next 2-3 years. While this isn’t great news, it is very different than a permanent loss of capital. Moreover, should we enter a recession and yields move lower (like they normally would do) we would expect a quicker payback.

Inflation should gradually cool. The most recent year-over-year saw core inflation increase 6.6% as measured by the Consumer Price Index. However, many forward-looking inflation indicators suggest prices may have already peaked. Broad commodity, housing and auto prices have all moved sharply lower along with slowing wage growth and a very strong USD. Also helping are improvements in available supply, higher inventories, and slowing aggregate demand.

Likely seen worst of bond losses. While no one can forecast interest rates consistently well, it’s likely we’re closer to the end of the Fed hiking cycle than the beginning. Recall, the Fed has already raised rates roughly 3% with future increases expected to amount to another 2.0%. Importantly, the Treasury market has already largely factored in a Fed Funds rate in the 4.5-5.0% range, so any further pain to bond investors can only come from the Fed tightening more (or for longer) than the market expects.

Over the last four tightening cycles, interest rates in the market have peaked an average of two months prior to the last Fed hike.4 With the Fed currently expected to pause in early 2023, rates could very well peak before the end of this year. Lastly, we also know the average length of time between the last Fed rate hike and the first Fed rate cut tends to be roughly six months which raises the possibility of potential rate cuts later in 2023, which would bode well for capital appreciation especially for longer-term bonds.

We Have Met the Enemy and it is Us

We know financial markets have a way of causing investors to take the wrong action at precisely the wrong time. Could things get worse for bond investors? Sure, but in our view not by much more. This perspective rhymes with history and is supported by what we see as a gradual cooling of inflation pressures and a policy view that says we are likely near the end of the rate-hiking cycle with future rate increases already largely discounted.

Along the way, we will receive sharply higher bond income as coupons gradually get reinvested at higher current rates. We expect bonds to resume their more normal role in a portfolio of providing income, stability and an important source of capital protection should we enter a recession over the coming year.

1Total return losses for Bloomberg US Aggregate Bond Index & Bloomberg Municipal Bond Index are (16.8%) & (11.6%), respectively from 1/01/2022 to 10/20/2022.

2Short-Term Bonds, Intermediate-Term Bonds and Long-Term Bonds are proxied by the Bloomberg US Aggregate 3-5 Year Index, 5-7 Year Index and 7-10 Year Index, respectively. High Yield bonds are proxied by Bloomberg US Corporate High Yield Index.

3Taxable equivalent yield assumes 37% income tax rate with 3.8% Medicare Tax.

4Blackrock Municipal Market Monthly October 2022.

Important Disclosures

Aspiriant is an investment adviser registered with the Securities and Exchange Commission (“SEC”), which does not suggest a certain level of skill and training. Additional information regarding Aspiriant and its advisory practices can be obtained via the following link: https://aspiriant.com.

Investing in securities involves the risk of a partial or total loss of investment that an investor should be prepared to bear.

Any information provided herein does not constitute investment or tax advice and should not be construed as a promotion of advisory services.

The views and opinions expressed herein are those of Aspiriant’s investment professionals as of the date of this article and may change at any time without prior notification. The charts and illustrations shown are for information purposes only.

All information contained herein was sourced from independent third-party sources we believe are reliable, but the accuracy of such information is not guaranteed by Aspirant. Any statistical information in this article was obtained from publicly available market data (such as but not limited to data published by Bloomberg Finance L.P. and its affiliates), internal research and regulatory filings.

Talk to us

Talk to us