There are many ways to invest and many types of investors, all with unique goals and risk tolerances. Some investors buy only a handful of stocks and bonds, hoping their high-conviction holdings will do well and willing to accept a great deal of individual company risk for the potential of outsized returns. Others are speculative traders, attempting to outsmart the markets with the hope of making a quick buck.

Yet many investors, including the clients we serve, are focused on the long-term. For these investors, the most important objective is protecting their original capital while earning a reasonable rate of return over time to ensure financial independence and achieve their life goals. Therefore, we believe it is most prudent to take a diversified approach — by holding a basket of different companies, countries and strategies — to balance returns with an emphasis on minimizing downside risk.

When selecting stocks, as well as bonds and other assets for that matter, we recommend a valuation-based approach. This can be easily confused with the more commonly known value stocks or companies. Here, I’ll explain the difference and how each concept fits into a diversified and balanced portfolio.

Valuation: Buying stocks on sale

In short, valuation-based investing is a sharp focus on the price we pay for an investment.

Price doesn’t mean the listed price of a stock. For example, Johnson & Johnson’s (JNJ) stock price as I write this is around $150 per share. Rather, when we talk about price, we refer to how much it costs to buy a stock relative to how much you expect to receive in earnings from the investment.

It’s much like when shopping the sales rack. Let’s say you notice a “50% off!” table with T-shirts on sale for $10 each. Just two weeks ago these same shirts were selling for $20. The shirt provides you with the same exact style, versatility and comfort whether you pay $10 or $20 for it. You’re getting a better deal when you pay less for the same long-run utility as the person who paid $20.

We apply this same philosophy to investing in stocks. We like to buy stocks when they’re on sale. The way many investors determine if a stock is on sale is by looking at valuations.

Valuations are generally a ratio of the share cost relative to current and future expected earnings. In the investment world, that’s known as the price-to-earnings ratio or P/E. Today JNJ’s P/E is 28x. In other words, JNJ costs 28x to participate in the company’s investment returns to shareholders. Over the past 20 years, this ratio has been between 10x and 35x — so today’s 28x is a bit expensive, but not the most expensive. The average valuation has been around 23x, so below 23x the stock could be considered on sale or a better deal.

The JNJ example is for an individual stock. But when building diversified portfolios, this approach also applies to asset classes, sub-asset classes and style differences. An example would be analyzing global equities (asset class), U.S. equities (sub-asset class), and value and growth equities (style) within the U.S.

Value style: Typically more mature

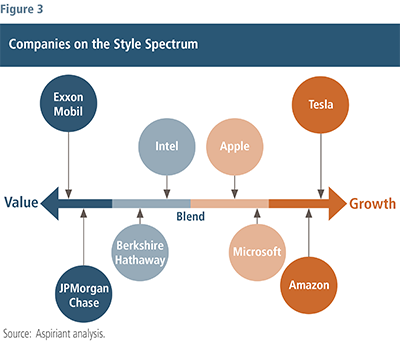

Throughout market history, investors have classified stocks as being either a growth investment or a value investment. The concept was brought further to the mainstream in 1992 when research firm Morningstar introduced the Morningstar Style Box. The Style Box divided investments into three different style classifications based upon their underlying attributes. According to Morningstar, the three styles are value, growth and a blend of the two. Importantly, the value classification used by Morningstar is not the same as the valuation-based methodology discussed earlier.

The value style of investing traces its early roots to renowned economist Benjamin Graham and his protégé, the venerable investor Warren Buffett. It tends to focus on companies with lower trailing valuations (P/E ratio) with a fundamental concentration on historical, current and reasonable expectation of future earnings. Many of these companies tend to come from more mature areas of the market closely tied to the business cycle. Generally, value stocks tend to perform best in the early stages of an economic recovery, but lag during the late stages of an economic expansion.

On the other end of the spectrum is growth investing. The growth style of investing tends to reflect companies with higher trailing valuations with a concentration on predicting which companies will grow the most in the future.

Figure 3 may look straight forward, but in reality, many companies rotate between being classified as a value stock and a growth stock. For example, in the 1960s and 1970s the Nifty Fifty group of popular growth stocks included Eastman Kodak, IBM, GE, Polaroid and Texas Instruments. Of course, today, we would hardly expect anyone to classify these companies as growth stocks. Over recent years many of these companies’ growth slowed, and they became value stocks — or ceased to exist entirely. During the Nifty Fifty era, many investors falsely believed these stocks would remain growth stocks forever. At the moment, six growth companies dominate the market. Read more about them in our First Quarter 2021 Insight, Part 2.

When deciding whether to invest in value stocks or growth stocks, we go back to relying on our valuation-based investment philosophy. There are market environments where growth stocks valuations are lower compared to history, and there are other times when value stocks are a better deal.

All things being equal, we favor a balanced approach, but lean marginally in favor of the value style. We tilt toward value because, over the long run, value style companies tend to be less volatile and align with our objective to provide stable returns and increased odds of meeting your financial goals. Of course, there are certain environments where we will favor growth stocks, particularly when their valuations are cheap and the other market participants have reduced their future expectations of growth.

Why do we care so much about valuations?

We believe valuations are the single best tool for predicting long-term expected investment returns. The shortest time horizon we look at is seven years, and the longest is up to 20 years into the future. Valuations tend to be a less reliable tool when making investment decisions over shorter time periods.

Between 1948 and today, the price or valuation you pay for an investment (P/E) and the future return received by shareholders have a meaningful relationship.

As shown in figure 4, if you start investing when the market is expensive relative to history (the P/E is above 22x), your expected return over the next 10 years is 6%. On the opposite end, when markets are cheap relative to history (the P/E is below 11x), your return over the next 10 years would have been 16%.

Implications for the short- and long-term

Whether leaning toward value or growth style, we will always be focused on valuations. Concentrating on valuations will not provide a great framework for making near-term timing decisions with immediate payoffs. However, in the short-term, investing capital at lower valuations does provide portfolios with a greater margin of safety.

In the longer-term, we expect focusing on valuations will provide portfolios with a stabilized return pattern, with above-average returns, that ultimately and most importantly increases the odds of achieving your financial goals and objectives.

Important Disclosures

Aspiriant is an investment adviser registered with the Securities and Exchange Commission (“SEC”), which does not suggest a certain level of skill and training. Additional information regarding Aspiriant and its advisory practices can be obtained via the following link: https://aspiriant.com.

Investing in securities involves the risk of a partial or total loss of investment that an investor should be prepared to bear.

Any information provided herein does not constitute investment or tax advice and should not be construed as a promotion of advisory services.

The views and opinions expressed herein are those of Aspiriant’s investment professionals as of the date of this article and may change at any time without prior notification. The charts and illustrations shown are for information purposes only.

All information contained herein was sourced from independent third-party sources we believe are reliable, but the accuracy of such information is not guaranteed by Aspirant. Any statistical information in this article was obtained from publicly available market data (such as but not limited to data published by Bloomberg Finance L.P. and its affiliates), internal research and regulatory filings.

Talk to us

Talk to us