Few federal programs touch as many lives as Social Security. As of August 2019, more than 68 million Americans were receiving Social Security benefits, with many of them relying on the income to help fund their retirement lifestyles. Meanwhile, millions more will begin receiving benefits over the coming years and must make decisions around optimizing their Social Security income.

Unfortunately, many people don’t fully understand the complexities involved with starting the collection of Social Security benefits and are unaware that choosing the wrong strategy can result in adverse financial impacts for them and their family.

While every Social Security filer has their own unique circumstances and objectives, here’s a high-level overview of the key need-to-knows about Social Security, along with examples of different filing strategies.

The basics

Almost all U.S. workers and their employers pay a Social Security tax on their earned income (via the Federal Insurance Contributions Act, or FICA), which is used to fund the U.S. Treasury’s Social Security trust funds. In turn, these funds use their available capital to pay benefits and cover the program’s administrative costs.

Who’s eligible to receive benefits from the trust funds?

You are eligible to receive Social Security retirement benefits after reaching 40 work credits, with a max of four credits earned per year of employment. As a result, you are eligible to receive benefits after working a total of 10 years.

When can eligible individuals begin receiving benefits?

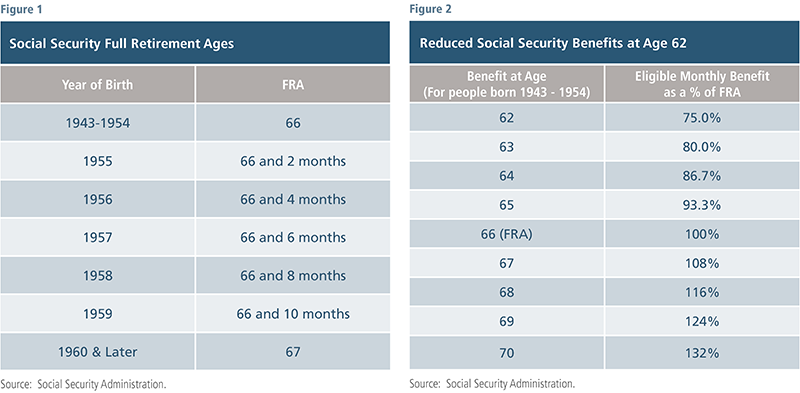

You may begin receiving benefits at your full retirement age (FRA), which is based on the year you were born (see Figure 1). However, you can begin taking a reduced benefit starting at age 62 (Figure 2).

How are benefits calculated?

Luckily, the Social Security Administration will calculate benefits on your behalf. Benefits are based on a filer’s 35 highest income-earning years (indexed for inflation). Further, a person’s benefit increases each year based on an annual cost-of-living adjustments (COLA). For example, the COLA in 2019 was 2.8%. You can see your estimated benefit amount (based on your current work history) by creating a personal “my Social Security” account at www.ssa.gov/myaccount/.

Using this account, you can also:

- Receive estimates of future benefits

- See your latest Social Security statement

- Review earnings history

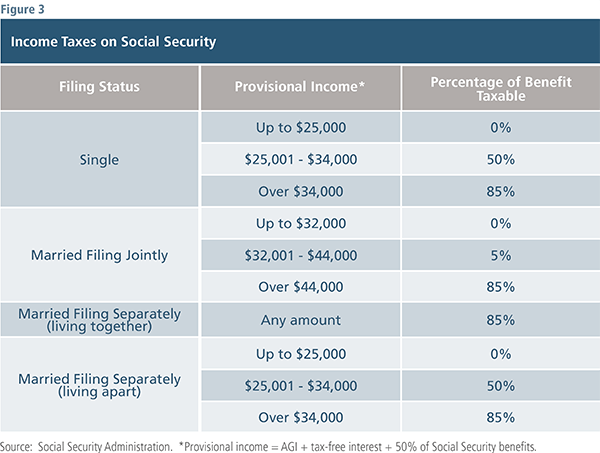

You’ve determined your Social Security benefit. Now, is it taxable?

Unfortunately, benefits are taxable, but not fully — and only if your provisional income (adjusted gross income plus tax-free interest and half of your Social Security benefits) is above a certain amount:

Do I have to apply to begin receiving benefits?

Yes, you must apply to begin receiving benefits and should do so three months prior to your intended start date. There are a few different ways to apply:

- Online at ssa.gov

- In person at a Social Security Administration office

- By phone at 800.772.1213

Types of benefits

Individual benefit

The Social Security program is robust in that individuals can collect benefits in several different forms. The most common benefit, which we described above, is for an individual to collect benefits based on their own employment history.

Spousal benefit

The second most common benefit is known as the spousal benefit, where an individual has the option to collect benefits based on their spouse’s employment history. Under a spousal benefit, a person is eligible to receive the higher of their own benefit or 50% of their spouse’s FRA benefit. In order to collect this benefit, the person’s spouse must have already filed for their benefit.

Divorcee benefits

Divorcees are also eligible to receive spousal benefits on their ex-spouse’s record if:

- The marriage lasted 10 years or longer

- Divorcee is unmarried

- Divorcee is age 62 or older and the ex-spouse is 62 or older (If ex-spouse has not filed for benefits yet, the divorcee can still receive benefits on their ex-spouse’s record if they’ve been divorced two or more years.)

Survivor benefit

The last and most complex type of benefit is a survivor benefit. Surviving spouses (including divorced spouses) and dependents are eligible for benefits on their deceased spouse’s or parent’s record. Surviving spouses can receive up to 100% of their deceased spouse’s benefit, whereas dependents can receive up to 75% of their parent’s benefit. There are numerous requirements associated with these benefits, so we recommend contacting a professional if you are dealing with Social Security survivor benefits.

Strategy

Determining when to take Social Security is a strategic decision driven by multiple variables. To maximize benefits, key considerations are:

- Age difference between spouses

- Life expectancy or health of both spouses

- Reliance on benefits to cover living expenses

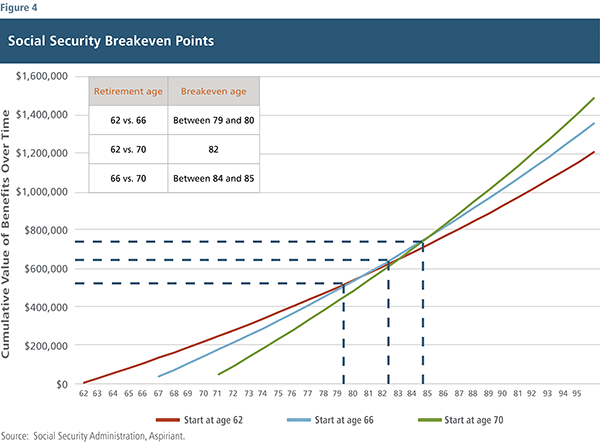

Healthy individuals with ample liquid resources should generally delay collecting benefits until age 70. In doing so, their FRA benefit increases 8% per year. Figure 4 shows the ages an individual must achieve to breakeven on the cumulative maximum benefit amounts depending on the age at which they start receiving benefits.

As you can see, delaying benefits until age 70 is optimal if you expect to live beyond a certain age, generally around age 85. Importantly, the above table does not assume an investment return on benefits. If you invest your Social Security paychecks, the breakeven age is generally extended, depending on assumed rates of return.

Spousal benefit considerations

Strategizing around spousal benefits can be considerably complex. However, it is often optimal to take spousal benefits if:

- The spousal benefit is greater than the benefit the individual will receive on their own earnings at age 70

- Liquidity is not a concern

- Both spouses are healthy

For those who fit the above fact pattern and are of a certain age relative to their spouse, it may be advantageous to take their individual benefit at their FRA and then switch to a spousal benefit once their spouse files for benefits.

Example 1: Giselle B. and Tom B. are both 67 years old. Giselle will receive the maximum Social Security benefit based upon her prior work experience and has decided to delay collecting her benefit until age 70, increasing her FRA benefit by 8% per year. Tom has limited work history and a relatively small benefit. His FRA benefit is less than 50% of Giselle’s FRA benefit. Therefore, it makes sense for Tom to collect his own benefit and then switch to the higher spousal benefit once Giselle files for her benefit at age 70.

Spouses with the potential for a higher individual benefit than their spousal benefit, and who were born before January 2, 1954, have the ability to use a “Restricted Application.” Under this strategy, a spouse can file for a spousal benefit (once their partner is receiving benefits) and then switch to their own benefit later.

Example 2: Kevin is 67 years old and Rachel is about to turn 70. Rachel delayed collecting her FRA benefit and will receive an increased benefit at age 70. Kevin is confident in his longevity and also plans on waiting until age 70 to commence benefits. Because Kevin was born before January 2, 1954, he’s allowed to file a restricted application and receive spousal benefits on Rachel’s record as soon as she starts collecting benefits. In doing so, he’ll receive 50% of Rachel’s FRA benefit and can then switch to his own higher benefit in a few years.

The future of Social Security

The problem

At one point or another we’ve all heard about the fragile state of the Social Security program. While it’s extremely unlikely the program will disappear altogether, actuarial projections indicate that systematic changes are needed to ensure the program’s sustainability over the long run.

The grim reality is, without reform, the Social Security Trust funds are projected to be exhausted in 2033, at which point incoming Social Security taxes are expected to only cover 75% of scheduled benefits, according to the 2018 Social Security Trustee’s report. Many factors have contributed to this problem, but the biggest issue is demographic: the fact that the largest generation in American history (baby boomers) is retiring, and program beneficiaries are living longer than expected due to advances in health care.

Potential solutions

While the problem is real, there are several potential solutions. Unfortunately, most of them require Congressional action, which is currently at a standstill. Options include:

Raising program revenues:

- Increase the Social Security payroll tax rate

- Increase the Social Security wage base (the income threshold on which Social Security tax can be applied) or eliminate the wage base altogether. This would have no effect on individuals making below the current base but would impact earners above the current threshold.

Lowering program costs:

- Delay the FRA beyond age 67

- Modify the payout formula (means testing)

- Change or eliminate auxiliary benefits (e.g. spousal benefits, etc.)

- Reduce the annual COLA adjustment

Because of the uncertainty of the program, if you are still many years from receiving benefits, we advise you to be conservative when estimating your future benefits within the context of your long-range financial plan.

Seek advice

Social Security is an important benefit program, but creating an appropriate strategy is often a challenging task. There are a number of important considerations to sift through when looking to maximize your benefits, and there is no “one size fits all” approach. Accordingly, it’s often best to work with a financial professional when it comes time to develop a Social Security strategy that will best help you achieve your personal goals and objectives for retirement.

Talk to us

Talk to us