May 14, 2023

Around the pandemic, banks were flooded with deposits from multiple pathways – government transfers through the CARES Act, people accumulating savings by being quarantined in their homes for weeks/months, and very active capital markets (SPACs, IPOs, M&A activity and private market fundraising) in the months following the initial shutdowns. With the rapid influx of deposits, banks could not make loans at the same pace. So, instead, banks invested those funds in securities and, in many instances, longer term government securities that offered a yield premium to the deposit rate, which was effectively zero. That model worked well and fairly consistently until the Fed started aggressively raising interest rates beginning in March of last year and into 2023.

U.S. government securities are viewed as having virtually no credit risk, but they do have interest rate risk. As interest rates crept higher, the value of these investment securities declined. You can see that on the far right of Figure 1.

In 2022, unrealized gains quickly started turning to substantial unrealized losses. Without getting into technical accounting details on the classification of these losses, the important thing to know is that banks can manage the mark to market valuation adjustments to their securities portfolios – as long as deposits are stable. Once deposits flee, banks are effectively forced to sell or pledge assets to meet those demands, and these unrealized losses can become realized losses, triggering capital impairment and loss in confidence in the bank’s solvency or viability. In short, this is what occurred and caused the failures of Silicon Valley Bank (SVB), Signature Bank and First Republic and is pressuring the broader regional bank system.

The FDIC’s list of problem banks has grown, not surprisingly, and with the collapse of SVB and Signature Bank, so too have bank failures, as seen in Figure 2. From the Global Financial Crisis (GFC) to today, there have been a few bank failures. Around the GFC, from 2008 to 2013, 80 banks failed, on average, per year with those banks holding $120 billion in total combined assets. As of March 2023, SVB and Signature Bank had total combined assets of $320 billion. In April, First Republic Bank had approximately $213 billion more.

While bank failures are occurring, it is important to note that the largest banks at the center of the crisis in 2008 appear to be in much stronger financial positions today. For a point of reference, the five largest banks account for roughly 50% of overall deposits and the top 10 largest banks hold about 65%. So, there have always been risks in the banking system – but, in our opinion, they are not systemic or widespread.

In fact, almost $600 billion in deposits have been withdrawn from banks. With lower deposits, the capacity to make loans lessens. With a higher cost of capital for banks, credit will be less available and likely more expensive, creating a further financial drag above and beyond the tightening affected by the Fed.

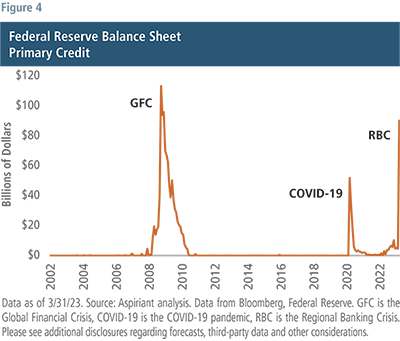

Around bank crises, the Fed typically steps in as a lender of last resort and provides needed liquidity to banks. For example, Figure 4 shows spikes in the Fed’s balance sheet or primary credit provided through the Fed’s discount window around the global financial crisis (GFC), later during the COVID pandemic, and now again with the regional bank crisis (RBC).

Unfortunately, the regional banks have much greater exposure to commercial real estate loans, representing about two thirds of their overall exposure. This may be the next looming risk to the regional banking system, particularly over the next two years, when several billion dollars of commercial mortgages come due. At this time, it remains very difficult to understand regional bank loss potential coming from their commercial real estate loan portfolios given the wide dispersion and variety of properties, sectors, locations, quality of underwriting and so on. Nevertheless, it certainly could continue to weigh on the outlook for regional banks and on the minds of investors.

Important Disclosures

Aspirant is an investment adviser registered with the Securities and Exchange Commission (SEC), which does not suggest a certain level of skill and training. Additional information regarding Aspiriant and its advisory practices can be obtained via the following link: www.aspiriant.com.

Information contained herein is considered confidential, private and Aspiriant proprietary inside information that is intended only for the audience to which Aspiriant has knowingly distributed this presentation to, either by way of request or voluntarily. Any redistribution of this material without our prior express written permission is a violation of Aspirant’s privacy policy adopted to comport with various state and federal privacy laws that may subject any unauthorized distributor to legal action.

All opinions, figures, charts/graphs, estimates and data included in this document are as on date and are subject to change without notice. The statements contained herein may include statements of future expectations, for general market performance or economic conditions, and other forward-looking statements that are based on our current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Forecasts, projections and other forward-looking statements are based upon assumptions, current beliefs and expectations. Forward-looking statements are subject to numerous assumptions, estimates, risks and uncertainties, including but not limited to: economic, business, market and geopolitical conditions; U.S. and foreign regulatory developments relating to, among other things, financial institutions and markets, government oversight, fiscal and tax policy. Any forward-looking information should not be regarded as a representation by Aspiriant or any other person that estimates or expectations contemplated will be achieved, as the future is not predictable.

Past performance is not indicative of future results. There can be no assurances that any strategy will meet its investment objectives. All investments can lose value. The performance and volatility of an investor’s portfolio will not be the same as the index. Indices are unmanaged and have no fees. An investment may not be made directly in an index. The data used in this material was obtained from third-party sources the firm believes are reliable and internally. Aspiriant is not responsible for the accuracy of any third-party data used in the construction of this presentation. This information alone is not sufficient and should not be used for the development or implementation of an investment strategy. It should not be construed as investment advice to any party. Investing in securities, such as equity, fixed income and mutual funds, involves the risk of partial or complete loss of capital that prospective investors should be prepared to bear. Any reference to securities, directly or indirectly, is not a recommendation and does not represent a solicitation to buy or an offer of a solicitation to sell such securities. Any statistical information contained herein has been obtained from publicly available market data (such as, but not limited to, data published by Bloomberg Finance L.P. and its affiliates), internal research and regulatory filings.

Want the latest wealth management tips, investment insights and Aspiriant news delivered straight to your inbox. Sign up for regular Fathom updates so we can send you the most relevant content you selected below.