Massive contracts, sudden wealth and the need for smart planning

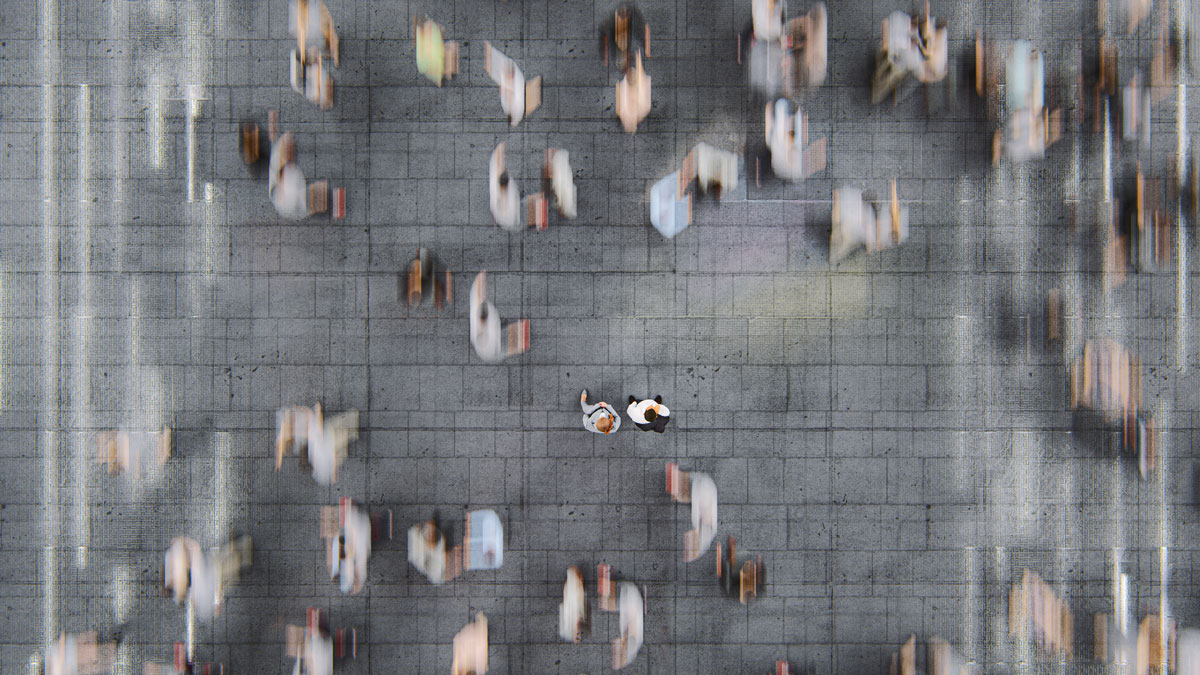

For decades, professional athletes represented the pinnacle of outsized earnings. Multi-million-dollar contracts, endorsement deals, signing bonuses and long-term brand partnerships created a world where income arrived in powerful front-loaded bursts. But today, a new class of high earners is emerging. Founders, engineers and early-stage employees across Silicon Valley and the broader tech ecosystem—especially in artificial intelligence (AI) and fintech—are securing massive equity packages, licensing agreements and compensation structures that rival, and in some cases, exceed the salaries of elite athletes.

The financial landscape that once belonged almost exclusively to sports now extends into advanced technology. And with it comes a familiar pattern: accelerated accumulation, brief periods of high income and the need for measured, forward-thinking planning to help sustain wealth beyond peak earning years.

Like athletes, many in tech experience a sudden rise in compensation that can taper as markets shift, innovation evolves or new talent enters the field. Recognizing this natural cycle is essential to building financial confidence.

Navigating peak performance and big financial moments

Athletes and tech professionals share a common reality: the window for peak performance is often limited. In both worlds, the focus is on transforming strong earning years into lasting flexibility and security.

Tech compensation often includes equity awards, stock options and performance-based bonuses, all of which create a complex, time-sensitive environment that benefits from thoughtful coordination. A disciplined, integrated approach helps align immediate opportunities with long-term goals.

Building a durable foundation for long-term wealth

Managing sudden wealth thoughtfully can help create clarity during periods of financial acceleration, ensuring that short-term success supports goals. The combination of equity compensation, shifting markets and evolving career goals can feel both exciting and uncertain. Taking the time to pause and evaluate can help your current achievements support tomorrow’s ambitions.

For both athletes and tech professionals, sustainable financial well-being requires intention, perspective and adaptability. The following principles can serve as guideposts for turning moments of high performance into a foundation for wealth preservation:

- Equity management: Stock diversification can help mitigate the risks of a concentrated equity position while maintaining growth potential. Concentrated stock positions can create both potential and exposure. Like an athlete’s contract shaping their net worth, tech professionals may need to balance opportunity with diversification. Our equity compensation planning process helps explore strategies for exercising stock, managing risk and building a well-rounded portfolio.

- Long-term strategy: A values-driven, long-term wealth management approach helps align investments and priorities over time. A values-driven investment plan built around personal timelines and risk comfort helps maintain steadiness as life and markets evolve. The most effective strategies are flexible, adjusting to milestones, liquidity events and shifts in market dynamics.

- Comprehensive protections: Athletes rely on contracts and insurance to protect their livelihood; tech professionals can benefit from coordinated legal structures, asset titling and thoughtful coverage. Our wealth planning services are designed to help safeguard assets through changing career and stages.

- Lifestyle and major decisions: Mapping out big-ticket purchases or life transitions—homes, startups, sabbaticals, philanthropic endeavors—helps align daily decisions with long-term intent. With awareness and preparation, it’s possible to support the life you envision while remaining resilient through change.

- Diversified income and tax awareness: Leverage expertise across multiple channels, such as angel investing, advisory roles or teaching can add dimension to your financial life. Coordinated tax and liquidity strategies, including timing stock sales or incorporating charitable vehicles, may improve efficiency and flexibility.

- Liquidity and flexibility: Accessible cash and brokerage accounts provide room to navigate market swings or life transitions thoughtfully. Liquidity lets you seize opportunities—or weather storms—without prematurely liquidating long-term investments.

The human side of wealth and financial independence

The tech industry moves quickly, and as new talent enters the market and innovation accelerates, the roles that once defined your success may no longer be the ones that maximize your impact. Recognizing this natural shift allows you to pivot into positions that leverage your experience in more strategic and meaningful ways. A well-structured financial foundation can help create the space to pursue meaningful goals and adapt to changing priorities over time.

A case in point: Managing sudden wealth after a liquidity eventWhen a 32-year-old senior AI engineer at a San Francisco Bay Area company participated in a secondary tender offer, they converted part of their vested equity into liquidity ahead of schedule. The event introduced new complexity to their financial picture. Recognizing the importance of thoughtful planning, they began diversifying assets, established a donor-advised fund (DAF) for philanthropic giving and worked with their Aspiriant advisors to review asset titling and protection. The outcome was a financial structure designed to support evolving career paths, new ventures and future flexibility. This example illustrates a growing reality for today’s innovators: as wealth arrives earlier, so does the need for clarity, organization and foresight. |

As your career progresses, organizing your assets with flexibility becomes increasingly important. A well-structured financial foundation can offer flexibility to explore new opportunities, step into advisory roles or pursue entrepreneurial ventures without relying solely on employer-based income. Just as athletes must take care of their physical health, tech professionals can benefit from managing their careers and finances with awareness and intention.

A thoughtful next step toward financial clarity

Working toward financial independence over time may provide the flexibility to make decisions that reflect both your ambitions and your values.

Building wealth in a fast-moving industry isn’t just about timing or opportunity—it’s about designing a plan that supports your goals at every stage. Whether you’re navigating equity compensation, preparing for a liquidity event or simply aiming for greater financial clarity, we can help you explore strategies to align your opportunities today with your long-term goals for tomorrow and beyond.

Talk with us to explore a strategy designed to help you stay grounded through each stage of growth.

Explore more:

Talk to us

Talk to us