April 24, 2018

Aspiriant News

Aa

Aa

When you go searching for wealth management services, you’ll typically face an “alphabet soup” of letters behind the name of each advisor you see. These letters provide important information about the individual’s qualifications and experience, but keeping them straight can be confusing.

Nevertheless, it’s worth taking the time to understand them, because finding the right level and type of expertise will assure that you receive the optimal advice for your specific needs while avoiding frustrating mistakes and unnecessary costs. This begs the question: What designations should your advisor have to best support what you are trying to achieve with your wealth?

First and foremost, please note that all the designations referenced in this article are guided by a code of ethics and a “fiduciary” standard of care. The fiduciary standard requires a financial adviser to act solely in the client’s best interest when offering personalized financial advice. A fiduciary must always put the client’s interest above their own. Consequently, a major benefit of selecting a professional advisor with one of these designations is that they are voluntarily committed to a higher standard of trustworthiness.

Banks and broker-dealers, by contrast, are governed by a less demanding “suitability” rule, which requires merely that any recommendation made to a client be suitable in terms of the client’s financial needs, objectives and circumstances. Under the suitability rule, the recommendation need not necessarily be the best available option for the client. For example, if an investment recommendation meets the suitability standard, the advisor is free to recommend a product that generates a larger commission than a similar product that might be more cost-effective for the client.

So, what is a professional designation, and what does it tell you? A professional designation is a standard established and maintained by a professional self-regulating body. The characteristics of a professional designation are:

In addition to professional designations, many professionals complete master’s degree programs which give them a deeper level of knowledge in their area of specialization. These programs are usually offered by academic institutions and generally involve no further regulation once acquired.

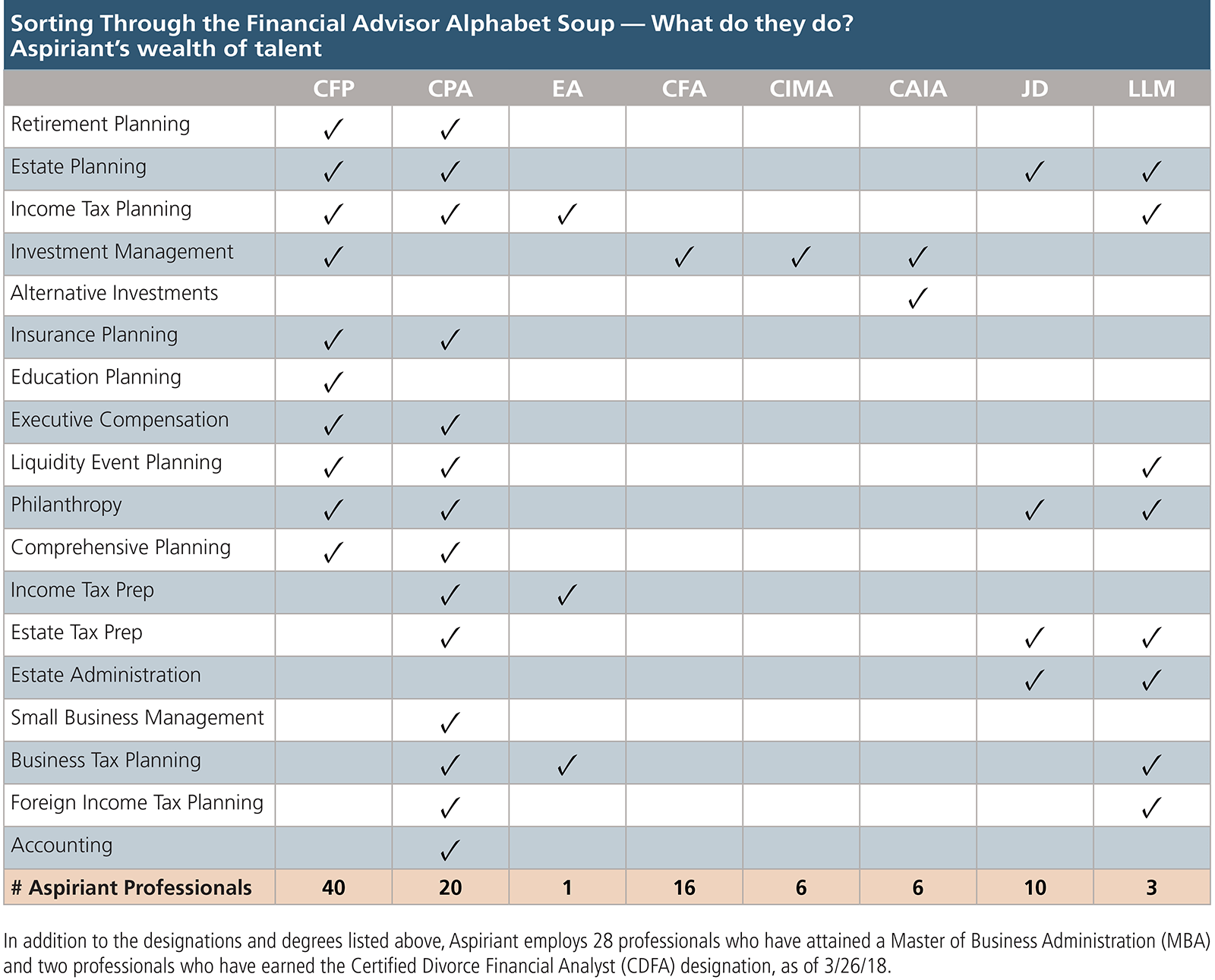

What does this mean to you? It all depends on what service(s) you need.

Imagine you are 60 years old and winding down your full-time working career as you approach retirement. You may be wondering if you have saved enough to comfortably support your retirement spending needs. You also must make a near-term decision regarding your employer’s pension plan in the form of a lump sum or lifetime income stream. Your oldest child just had her first baby, and you would like to help start a higher-education savings account for your new grandchild. A Certified Financial Planner™ (CFP®) can help you plan around all those things and much more.

The CFP designation is the premier professional certification mark for financial planners. The CFP must earn a college degree, complete a broad curriculum of study, satisfy a three-year work requirement and pass a rigorous exam before using the designation. The CFP curriculum includes goal setting and planning in the areas of investments, taxes, retirement, estates and trusts, insurance, and education. CFPs must meet continuing education requirements every two years to maintain their designation.

With this broad base of knowledge, CFPs can help you to see the big picture and to prioritize your efforts so that the most important issues are addressed first. CFPs often function as the “quarterback” of the financial advisory team, acting for many families like a chief financial officer or a sounding board, helping to coordinate all of their financial responsibilities. CFPs can also help avoid unintended consequences by considering how each area of your financial affairs affects all the others.

As your net worth grows, your personal and business tax situations become more complex. More complexity can mean larger tax liabilities. However, it also can open the door for greater tax savings with advance tax planning.

A Certified Public Accountant (CPA) can assist you with all your tax questions and planning. A CPA is authorized to advise, represent and prepare tax returns for individuals, partnerships, corporations, estates, trusts, and any entities with tax-reporting requirements. A CPA is a trusted advisor who must earn a college degree, pass a rigorous examination, meet a work experience requirement (generally one year), and take continuing professional education courses to maintain their CPA certification. Each state Board of Accountancy determines the specific requirements for those who wish to practice in their state, such as education, age, experience and other qualifications. The CPA exam covers four areas: audit, financial accounting and reporting, regulation, and business concepts.

While most people know CPAs are tax professionals, the designation was originally created to certify the accuracy and fairness of an entity’s financial condition. All publicly traded companies are required to have their financial statements certified by a CPA. Therefore, CPAs with audit work experience can be especially helpful to entrepreneurs and business owners because they are familiar with both the owners’ business and personal affairs, and can advise on a plan for them to best work together.

An alternative option for tax preparation is the Enrolled Agent (EA), a tax practitioner authorized by the Internal Revenue Service to prepare tax returns for individuals and entities and to represent clients before the agency. Unlike CPAs, with their broad collection of valuable knowledge, EAs are specifically qualified for tax preparation and representation only. EA’s must pass a series of three exams, but they are not required to meet an education or experience requirement.

The investment universe is a complex world of stocks, bonds, mutual funds, ETF’s, and hundreds of other financial instruments. These instruments are available on different platforms and exchanges in countries and markets around the world. The prospect of managing a portfolio can be daunting for most investors, which is why most choose to hire a professional investment advisor. Investing requires a formidable level of discipline that prevents your emotions from interfering with your long-term investment strategy, which is where an objective advisor can be helpful.

Here are a few common designations you may encounter when seeking an investment advisor:

You and your spouse have finally decided to sit down and talk about your estate plan. Where to begin?

A knowledgeable estate planning attorney can review your current estate plan documents to ensure they meet your needs. They can also draft new documents that give you greater control over who may receive your assets and how the assets may be transferred. These professionals can help you avoid conflicts and delays in estate distribution while saving you estate and income taxes. Importantly, estate planning professionals can help avoid lawsuits and family squabbles regarding wealth transfer.

To become an estate planning attorney, one must earn a Juris Doctor (J.D.) degree by graduating from an accredited law school and passing a rigorous examination in each state where they choose to practice.

Master of Laws (LL.M.) is a postgraduate academic degree that most commonly has a concentration in taxation. An attorney with an LL.M. in tax will have been exposed to a much wider body of tax knowledge than the ordinary J.D. An LL.M. can be essential when dealing with complex business transactions, business succession planning, unique and original structures to minimize estate and income tax, ownership of foreign assets, tax litigation and lesser known and highly specialized areas of the law.

The truth is that it generally takes a team to help you manage your wealth and achieve your goals. The more complex your wealth, the greater the need for those professionals to have the right education and experience.

Although designations cannot guarantee the right advice or the best performance, they are a measure of the minimum standards that your advisory team should meet and, therefore, are a good starting point to help you assemble your team with confidence.

At a minimum, the team should only include players who you can trust to act in your best interests. As mentioned above, every professional discussed in this article is bound by their designations to act in a fiduciary manner and put your best interests first.

Want the latest wealth management tips, investment insights and Aspiriant news delivered straight to your inbox. Sign up for regular Fathom updates so we can send you the most relevant content you selected below.