December 15, 2021

While nowadays the idea of holding investments that reflect and promote one’s values may seem instinctive, profits and purpose weren’t widely intertwined until only a few decades ago. Before then, investing was largely considered a means to compounding returns, and philanthropy was the means to accruing good karma.

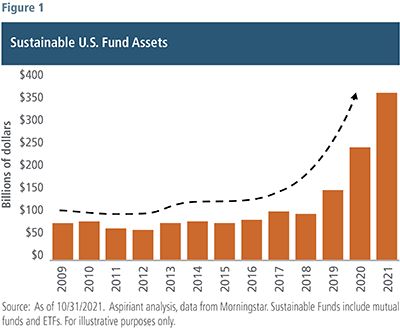

Financial media and asset managers alike have seized the opportunity to gain traction with more socially conscious investors, driving eyeballs and capital into this premise, as seen by the growth of dedicated U.S. sustainable fund assets to approximately $350 billion in 2021 (Figure 1). Globally, more than $35.3 trillion is invested in strategies that incorporate sustainability considerations, according to the Global Sustainable Investment Alliance.

Yet, many investors still wonder if sustainable investing is worth the time of wading through an alphabet soup of new terms and considering it for their portfolios. So here’s a primer to explain the various approaches to sustainable investing and help facilitate a conversation with your advisor about whether it’s right for you.

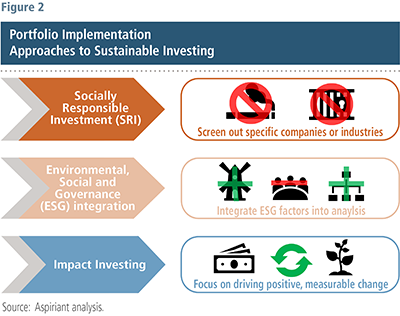

What is sustainable investing? It’s the practice of incorporating environmental, social and/or governance factors into the portfolio construction process to achieve positive financial and nonfinancial outcomes. Various approaches to sustainable investing have been around since the 1960’s and evolved into three main strategies widely recognized today: SRI, ESG and impact investing.

SRI was the first iteration of sustainable investing that allowed investors, originally religious institutions, to exclude investments that did not align with their values. SRI is typically associated with individual stock portfolios that do not hold certain securities or industries, such as tobacco, gambling, private prison or heavy carbon-emitting companies. However, critics suggest this exclusionary approach isn’t robust or meaningful enough to drive real change. Some believe it’s best to drive change through active ownership.

This approach is typically associated with  strategies that score or grade companies based on data related to environmental, social and/or governance issues. Securities with higher scores represent a relatively larger portion of your portfolio, while securities with lower scores represent a relatively smaller portion or are excluded altogether. The ESG approach is commonly associated with equity focused mutual funds or exchange traded funds (ETFs). However, recently the number of available fixed income products has increased significantly. While the SRI approach is a fairly straight-forward exclusion of securities, the ESG approach can be slightly more complex in its implementation, introducing some key considerations:

strategies that score or grade companies based on data related to environmental, social and/or governance issues. Securities with higher scores represent a relatively larger portion of your portfolio, while securities with lower scores represent a relatively smaller portion or are excluded altogether. The ESG approach is commonly associated with equity focused mutual funds or exchange traded funds (ETFs). However, recently the number of available fixed income products has increased significantly. While the SRI approach is a fairly straight-forward exclusion of securities, the ESG approach can be slightly more complex in its implementation, introducing some key considerations:

In 2015, the United Nations launched the Sustainable Development Goals (SDGs) seeking to standardize targeted outcomes such as eliminating poverty and hunger, providing affordable and clean energy, quality education, water and sanitation, and building sustainable cities and communities. The SDGs enabled asset managers, including those managing mutual funds and ETFs, to map their investments to globally recognized goals for the first time. They also help investors familiarize themselves with focus areas to consider during the process of prioritizing goals to target in their portfolios and beyond.

The Global Impact Investing Network (GIIN) defines Impact investing as investments made with the intention of generating positive, measurable social and environmental impact alongside a financial return. Examples include investing in a new battery start-up that can help reduce our reliance on fossil fuels, building affordable housing or lending money to a municipality to buy electric vehicles instead of diesel buses. Historically, these strategies have focused on private market opportunities and range from borderline philanthropic investments to investments that prioritize financial outcomes. Due to the illiquid nature of private markets, these opportunities were largely inaccessible to many investors.

That is beginning to change, especially for fixed income investments since the first green bond was issued by the World Bank in 2008. Whereas traditional bonds raise money that can finance a broad range of potential initiatives, green bonds are issued by companies, organizations and governments to finance specific climate or environmental projects exclusively. Green bonds must adhere to impact reporting requirements and typically fund clean energy, water, transportation, buildings and infrastructure projects that seek to mitigate climate change or help affected people adapt to it.

Given impressive growth and maturity of sustainable investing opportunities in recent years, the range of strategies available to investors today is much more attractive than in the early days. Some companies have been successfully operating under sustainable philosophies for decades, proving profit and purpose can go hand in hand. Longer-range performance metrics and deeper analyses to compare and contrast the growing array of investment vehicles are available. And the influx of capital in the space has broadened the opportunity set across a range of industries and asset classes, facilitating the development of balanced portfolios.

The growing list of options means we believe it is possible to implement sustainable investing while adhering to the core tenants of portfolio construction:

What objectives would you like your portfolio to achieve? Thoughtfully defining this is a crucial component of the equation and a deeply personal topic your investment advisor or wealth manager can help you navigate. We encourage you to reach out to them to understand if and how you would like to incorporate these approaches into your investment strategy, to meet your near and long-term goals.

1Kahn, Serafeim, Yoon, Corporate Sustainability: First Evidence of Materiality, Harvard Business School Working Paper.

2Chaca, Sudheer, Environmental Externalities and Cost of Capital, June 18, 2014.

Important Disclosures

Past performance is no guarantee of future performance. All investments can lose value. The charts and illustrations shown are for information purposes only.

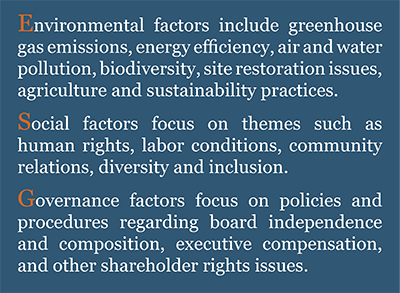

Sustainable investing is defined as the practice of incorporating Environmental, Social and or Governance considerations into the portfolio construction process. Sustainable Investing or Sustainability are terms that are often used synonymously with ESG investing, socially responsible investing, mission-related investing, impact investing or screening. “Environment” focuses on themes including, but not limited to, climate impact and greenhouse gas emissions, energy efficiency, air and water pollution, water scarcity, biodiversity, sustainability practices and site restoration issues. “Social” focuses on themes including, but not limited to, human rights, local community impact and employment, child labor, working conditions, health and safety, and anti-corruption issues. “Governance” focuses on themes including, but not limited to, the alignment of interest, executive compensation, board independence and composition, and other shareholder rights issues. There are multiple approaches to Sustainable Investing, which may include the exclusion, integration, evaluation and/or engagement of particular companies, countries, municipalities, factors, trends or other investment opportunities. Securities are not necessarily classified as an ESG security, rather each manager determines the securities’ fit for a particular strategy based on their own analysis.

Important Disclosures

Aspiriant is an investment adviser registered with the Securities and Exchange Commission (“SEC”), which does not suggest a certain level of skill and training. Additional information regarding Aspiriant and its advisory practices can be obtained via the following link: https://aspiriant.com.

Investing in securities involves the risk of a partial or total loss of investment that an investor should be prepared to bear.

Any information provided herein does not constitute investment or tax advice and should not be construed as a promotion of advisory services.

The views and opinions expressed herein are those of Aspiriant’s investment professionals as of the date of this article and may change at any time without prior notification. The charts and illustrations shown are for information purposes only.

All information contained herein was sourced from independent third-party sources we believe are reliable, but the accuracy of such information is not guaranteed by Aspirant. Any statistical information in this article was obtained from publicly available market data (such as but not limited to data published by Bloomberg Finance L.P. and its affiliates), internal research and regulatory filings.

Want the latest wealth management tips, investment insights and Aspiriant news delivered straight to your inbox. Sign up for regular Fathom updates so we can send you the most relevant content you selected below.