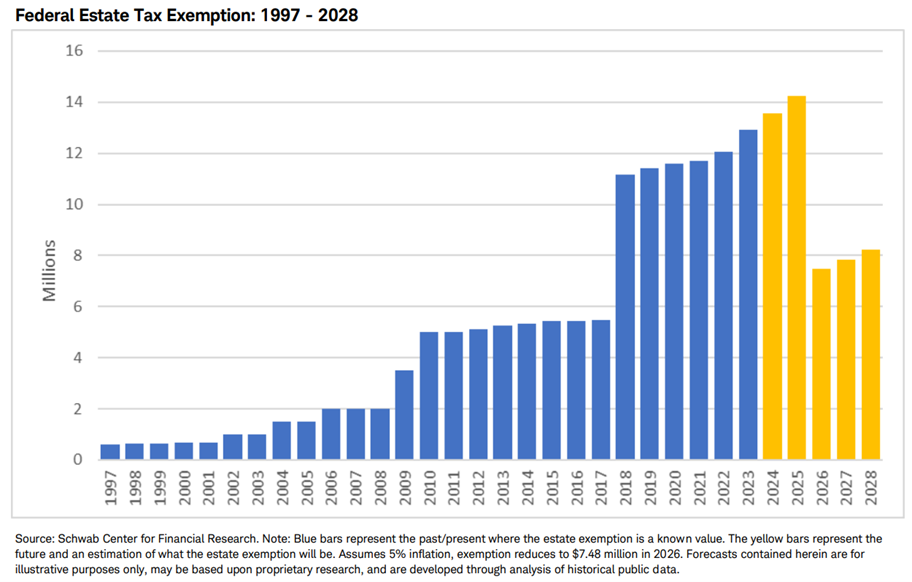

| Editor’s Note — July 2025: This article was originally written to address the upcoming Tax Cuts and Jobs Act (TCJA) sunset expected in 2026. However, with the passage of the One Big Beautiful Bill Act (OBBBA) on July 4, 2025, several key TCJA provisions, including the higher estate tax exemption, have been made permanent. While this shifts the strategy from urgency to opportunity, the planning techniques outlined below remain powerful tools for preserving and transferring wealth. For our updated perspective post-OBBBA, see: What the One Big Beautiful Bill Act (OBBBA) Means for You. |

When it comes to estate planning, thinking ahead is essential. While many ultra-high-net-worth individuals implemented strategies to leverage the elevated estate and gift tax exemption in anticipation of the Tax Cuts and Jobs Act (TCJA) sunset in 2026, the passage of the One Big Beautiful Bill Act (OBBBA) on July 4, 2025, changed that course. The OBBBA made key TCJA provisions permanent, including the increase to the estate and gift tax exemption — now set at $15 million per person (or $30 million per married couple), indexed for inflation.

That permanence shifts the focus of planning. Rather than racing to use expiring benefits, families can take a longer view — exploring advanced wealth transfer strategies aligned with legacy, control, and tax efficiency over generations.

Below, we outline timeless estate planning techniques that remain relevant under the OBBBA framework.

SOURCE: Preparing for the TCJA Sunset in 2026 | Charles Schwab

Estate planning opportunities under the OBBBA framework

Estate planning is a fundamental pillar of financial management, ensuring the orderly transfer of assets and the preservation of wealth for future generations. Several strategies stand out as valuable tools in today’s dynamic environment, each offering distinct advantages.

The following methods offer a spectrum of benefits, including asset protection, tax minimization and the ability to maintain flexibility and control over one’s assets:

Defective Grantor Trusts (DGTs) are irrevocable trusts intentionally structured to be “defective” for income tax purposes. Because the grantor retains certain powers over the trust, any trust income is taxable to the grantor (rather than the trust or the beneficiaries). However, assets transferred to the trust are deemed to have been moved out of the grantor’s taxable estate and thus will not be subject to estate tax at the grantor’s death. Since the grantor pays all income taxes earned by the DGT, the trust assets can continue to grow “tax-free” outside the estate. Additionally, by using their personal funds to pay income taxes on behalf of the trust, the grantor can continue to reduce the value of their estate over time.

Family Limited Partnerships (FLPs) enable individuals to transfer wealth to their loved ones without relinquishing centralized management of family funds. The general partner controls and manages the partnership, while the limited partners’ pooled assets allow them to capitalize on economies of scale. After contributing assets to a limited partnership, individuals can transfer partnership interests to their friends or family members, typically by gifting or selling the interest to such DGTs set up for their intended beneficiaries. Due to the limited partners’ lack of control (and often, a lack of marketability resulting from transfer restrictions), it may be appropriate to discount the value of the transferred limited partner interest(s) as well.

Spousal Lifetime Access Trust (SLAT) is an irrevocable trust created by an individual to benefit their spouse. During the beneficiary spouse’s lifetime, they may receive trust distributions for health, education, maintenance or support. After the beneficiary spouse’s death, the trust assets pass to the heirs (usually the children and grandchildren) free of estate tax. The SLAT structure may appeal to a married client interested in wealth transfer, as the client can use their increased lifetime exemption while ensuring their spouse will continue to have adequate access to assets after the client passes away. However, the SLAT must be administered carefully; if the IRS determines that the grantor spouse has benefitted from the SLAT in any way, all the trust assets could be brought back into the grantor’s estate.

These strategies are no longer about racing the clock. They’re about planning with purpose. With the exemption now permanent under the OBBBA, families can focus on using tools like SLATs and DGTs to align their estate plan with their values and long-term legacy goals.

While these methods are sophisticated strategies for wealth transfer and tax minimization, if you are just starting out on your estate planning journey, our Estate Planning 101: Back to Basics article covers the important documents you will need for an estate plan.

Alternative gifting avenues that preserve the Lifetime Exemption amount

Further opportunities exist within estate planning that do not diminish the lifetime exemption amount. These exceptions include:

- Annual exclusion per person: For 2025, individuals can gift up to $19,000 per recipient ($38,000 for married couples) without using their lifetime exemption. This amount is adjusted annually for inflation, rounded to the nearest $1,000.

- Tuition payments: Payments made directly to educational institutions for qualifying education costs are not subject to transfer tax.

- Medical expenses: Payments made directly to medical providers for qualifying medical expenses are not subject to transfer tax.

- Charitable contributions: Payments to qualifying charities.

With the TCJA sunset no longer imminent, the focus shifts to opportunity rather than urgency. Strategic planning remains essential. Not because of deadlines, but to ensure your estate plan reflects your values, priorities and family’s future.

To navigate these tax changes effectively and achieve your tax planning and estate planning objectives, talk with your wealth manager or estate planning attorney to discuss your specific circumstances and how to best attain your desired estate planning goals.

Talk to us

Talk to us