Advances in healthcare have led to increased longevity for individuals, many of whom will need additional assistance as they age. The population of Americans over 65 grew by more than 34% (13.79 million people) from 2010 to 2019. Baby Boomers and Generation X, with their children’s help, will need a plan for how they spend their advanced years.

For many, future housing and health care in retirement are difficult topics to discuss, let alone plan for. These decisions are easy to push aside when you’re healthy and young at heart. Plus, who wants to lose their independence, move out of their home, or change their lifestyle? Unfortunately, those who fail to plan may experience the stark reality of increasing demand at a time of potentially more limited resources.

Mike Fitzhugh, a director in wealth management and partner at Aspiriant, noted the complexities of choosing where to live in retirement. “A retirement community is both a housing decision, whether to purchase or rent, and a health-care decision,” Mike observed. “We know that deciding either of those individually is a chore, but the combo is huge.”

Elizabeth C. Krivatsy, an established estate planning attorney in the San Francisco Bay Area, has considerable experience helping older adults plan for the future. She explains three basic choices: staying put, moving in or moving on.

Staying put — Aging in place or in the same community

Many of us want to remain in our homes for as long as possible for a variety of reasons. Comfort is an overarching theme, as we don’t want to lose our independence, safety or familiar surroundings. Home is what we know and love best.

Living at home sounds ideal, but it’s important to consider your needs today and what they might be tomorrow, all the parties involved, and the resources available to you to ensure it’s an appropriate alternative for you. Who do you expect to care for you if your health deteriorates? How often will they need to come by, and who will be their back-up when they get sick or are away? Is your home suitably equipped for physical limitations?

“Aging in place may require a fully ADA-outfitted bedroom and bathroom on the ground floor, or the ability to create those from existing space,” notes Sandi Bragar, Chief Client Officer and partner. “Working with an architect who is experienced in disability access is important.”

These are just a few questions to ask yourself when considering aging at home. The keys to success are to plan ahead and realistically assess your current situation with regards to your home, your health and the financial resources available to fund possible future assistance and home modifications.

Moving in — Bunking with the kids

For some, this is an easy solution and may provide the lifestyle and care desired. For others, it may cause friction and new challenges.

Moving in provides not only the comfort of additional assistance and care when needed, but also a social aspect, which shouldn’t be overlooked. This may be an attractive solution for relatives, as Elizabeth noted that 78% of all caregivers are already family members. Moving in may alleviate worries about aging parents living on their own and the burden of traveling to and fro.

Unfortunately, it is the last option for many Americans and explains the sharp increase in multi-generational households in the last several decades. Moving in places a lot of stress and burden upon family members, and it is important to weigh the pros and cons when making a decision. The same questions about disability access and proper medical care still need to be addressed.

Moving on — Continuing care retirement communities

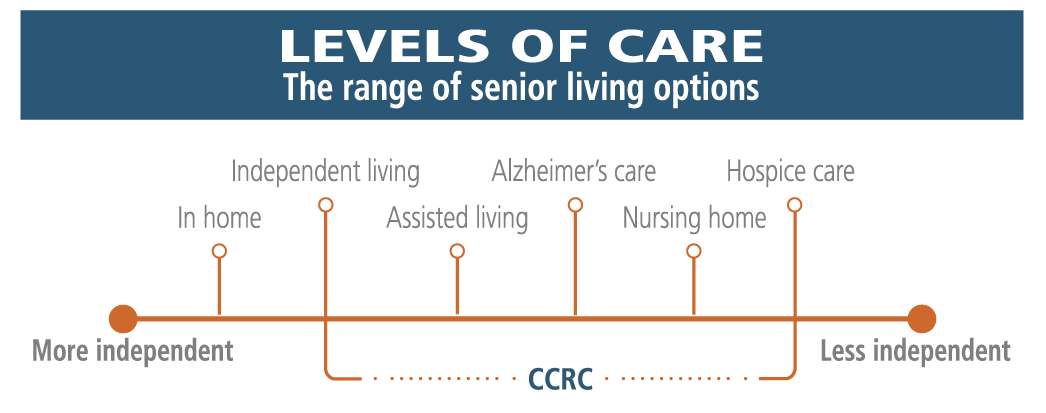

Continuing care retirement communities (CCRCs) are a popular option for people looking for a retirement home that can provide a continuum of care, from independent living to hospice.

CCRCs are also ideal for retirees looking for a community of friends to reside with throughout their retirement and organized activities to stay active.

“Having a social life during retirement is important and can help improve longevity. CCRCs provide the opportunity to build community, while the ‘staying put’ and ‘moving in’ situations require intentional planning to make sure an active social life is maintained when one’s health begins to decline,” Sandi noted.

These communities are expensive, and the cost keeps rising due to increased demand, lack of available properties, and rising health-care costs. Adequate staffing is also a problem, especially in light of recent U.S. immigration policies and the impact of COVID-19. So many of the caregivers in our country come from other places, and as that supply is cut off, the cost of care will go up, Elizabeth pointed out.

“Those who want to live in a CCRC in the Bay Area will be in for a shock. The price of land here makes the economics of additional communities practically impossible. So, there’s a nearly fixed supply and sharply increasing demand,” Mike explains. “For many, growing old in the Bay Area simply won’t be an available option at any price. Others may have to buy a unit in a facility years before they intend to move into it simply because there may not be any units left if they wait.”

“Those who want to live in a CCRC in the Bay Area will be in for a shock. The price of land here makes the economics of additional communities practically impossible. So, there’s a nearly fixed supply and sharply increasing demand,” Mike explains. “For many, growing old in the Bay Area simply won’t be an available option at any price. Others may have to buy a unit in a facility years before they intend to move into it simply because there may not be any units left if they wait.”

Fortunately, CCRC operators typically offer a variety of payment options including equity; non-equity with a high, refundable entry fee; or rental. Also, Elizabeth pointed out that reading and understanding the CCRC’s financials and all the required contract terms are important steps to take before committing to this path. Learn more by reading A Look at Continuing Care Retirement Communities by my colleague, Myles Rush.

Make it your decision

Whatever your decision, Elizabeth reinforces the importance of planning ahead to ensure that your retirement care and lifestyle are what you choose.

For more information, see Elizabeth’s suggested reading list.

Editor’s note: This article has been updated since its original June 20, 2018, publication.

Talk to us

Talk to us