Hoping it to be the final support beam that completes the financial bridge to the dawning of a post-COVID future, President Joe Biden signed the $1.9 trillion American Rescue Plan Act of 2021 (Rescue Plan) on March 11. The massive legislation provides a third round of sweeping coronavirus relief provisions spanning vaccination funding, aid to state and local governments, and direct fiscal assistance to individuals.

Many people have already received their Recovery Rebate stimulus payments, if they qualified. In addition to providing larger payments to those at the lower end of the income spectrum, the Rescue Plan gave a big boost to families through Recovery Rebate qualifications, the Child Tax Credit and the Child and Dependent Care tax credit. It also provides further relief for the unemployed and those with discharged student debt.

Read on to learn more.

New Recovery Rebates

The Rescue Plan includes $1,400 Recovery Rebate payments to each eligible individual. This is an increase from the $600 per person payments authorized in past COVID-19 financial relief legislation.

Notably, the definition of eligible individuals was expanded to include all children who are dependents on a taxpayer’s return, as well as other qualifying dependents, such as parents. Previously, only children under the age of 17 qualified. This is a meaningful expansion of the benefit as taxpayers can now qualify if they have dependent children over 16 or in college. An eligible individual cannot be a nonresident alien, claimed as a dependent on another taxpayer’s return, or an estate or trust.

To qualify, a child must:

- Be the taxpayer’s child, stepchild, adopted child, foster child, sibling, stepsibling or descendant

- Be claimed as a dependent on the taxpayer’s tax return

- Not have provided over half of their own support for the year

- Be a U.S. citizen, national or resident

- Have a Social Security number or other identification number that is reported on the taxpayer’s tax return

However, Recovery Rebates are phased out quickly with narrow Adjusted Gross Income (AGI) ranges. The cumulative credit amount for each family member is phased out proportionally if the taxpayer’s AGI exceeds the AGI Phase-Out Threshold below. The Recovery Rebate is not available to taxpayers with AGI more than the maximum amounts shown:

| Filing Status | AGI Phase-Out Threshold | Maximum AGI to Qualify |

| Married Filing Jointly | $150,000 | $159,999 |

| Head of Household | $112,500 | $119,999 |

| Single | $75,000 | $79,999 |

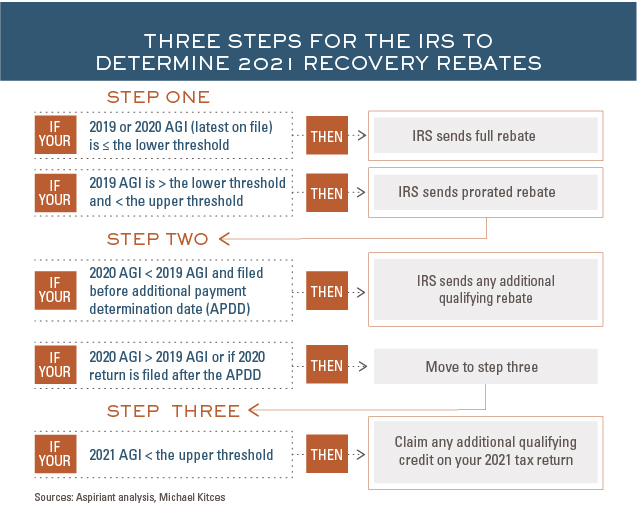

The Recovery Rebate three-step

In a new twist, there are three steps that the IRS will employ to determine if you’re eligible for a 2021 Recovery Rebate.

Step 1. The first step is similar to prior Recovery Rebates in that the 2021 version will be paid in advance based on your most recent AGI information filed with the IRS, which can be determined by either your 2020 tax return, if already filed, or your 2019 return, if not. If your 2019 or 2020 AGI is equal to or less than the lower limit of the applicable phase-out range ($75,000 for single filers, $150,000 for joint filers), the IRS will send the full amount.

Since the April 15 filing deadline was extended to May 17, the most recent AGI information the IRS has for many individuals is their 2019 AGI. However, if you receive a prorated portion or no rebate at this time, subsequent steps in the process provide the opportunity for another bite at the apple.

If you already filed your 2020 return and didn’t qualify for the full rebate, jump to Step 3.

Step 2. This step is designed for the taxpayer who has not yet filed their 2020 tax return but is confident their 2020 AGI is likely significantly less than their 2019 AGI due to disruptions in employment and income resulting from the pandemic. These taxpayers could potentially receive a larger Recovery Rebate once their 2020 tax returns are filed. To address this situation, the Rescue Plan introduces the Additional Payment Determination Date (APDD), which is the earlier of:

- 90 days after the 2020 calendar year filing deadline

- September 1, 2021

If you file your 2020 tax return before the APDD, your rebate amount will be recalculated based on the newly reported AGI. If the 2020 AGI produces a higher Recovery Rebate compared to the amount based on 2019’s AGI, the IRS will send an additional check to true up the amount.

The upshot here is if your income was temporarily lower in 2020, pay particularly close attention to the APDD. Why? Because it could be the only year that you will qualify for a Recovery Rebate. Both 2019 and 2021 AGI could prove too high.

If you file your 2020 return after the APDD, you forfeit the opportunity to use 2020’s unusually low income, and instead, move on to Step 3. So, if you filed for an extension, don’t wait until the October 15 extension deadline, especially if your income is rebounding higher in 2021.

What’s up with the September 15 date?

Doesn’t the IRS know that 90 days after April 15, 2021, is earlier than September 1, 2021? Yes, it does, but it appears Congress created wiggle room in case the IRS extended the 2020 calendar year tax filing deadline. The Treasury Department has already done it once (to May 17). If it pushes the tax filing deadline out further, September 1 will represent the drop-dead Additional Payment Determination Date.

Step 3. The third and final step used to determine an individual’s 2021 Recovery Rebate is when filing their 2021 income tax return next year. On the plus side, if your 2021 AGI is lower than the 2019 or 2020 AGI used to calculate the initial Recovery Rebate, and that income is low enough to produce a larger rebate, you can credit the remaining amount not already received on your 2021 income tax return.

No clawback of any 2021 Recovery Rebates!

Happily, the steps described above represent a one-way path to increase the amount of your 2021 Recovery Rebate Credit.

Any Recovery Rebates paid based on your income on file with the IRS (2019 or 2020) at the time of payment is yours to keep. The IRS will not claw back any rebate amount previously paid, even if your 2020 or 2021 income is high enough to completely phase out the credit.

Temporary boost to the Child Tax Credit for 2021

The Rescue Plan includes significant changes to the Child Tax Credit for 2021 that could dramatically lower the tax bills of families with young children. These changes include increases in the maximum amount of the credit, the maximum age of a qualifying child, increased refundability, and provisions for advance payment of the credit during 2021.

In general, the Rescue Plan increases the maximum amount of the credit to $3,000 (up from $2,000) per qualifying child for 2021. Additionally, the maximum credit is further increased to $3,600 per qualifying child under the age of six (as of December 31, 2021).

But the additional Child Tax Credit (exceeding $2,000 per qualifying child) begins to phase out at significantly lower income amounts than the standard Child Tax Credit. Specifically, the Rescue Plan phases out the temporary 2021 increases in the Child Tax Credit by $50 for each $1,000 that a taxpayer exceeds their applicable threshold, which are:

- Joint Filers: $150,000

- Head of Household: $112,500

- All other filers: $75,000

The phase-out for the standard $2,000 per child tax credit remains $50 for every $1,000 of AGI generated over $200,000 per taxpayer.

The Rescue Plan also temporarily increases the maximum age for a child to qualify for the Child Tax Credit in 2021 to age 18 and under. Normally, to receive a Child Tax Credit, the child must be under the age of 17 as of the end of the year.

Lastly, until the Tax Cuts and Jobs Act of 2017, the Child Tax Credit was a non-refundable credit. When the act doubled the credit amount per qualifying child from $1,000 to $2,000, $1,400 of that amount became refundable and taxpayers received a refund if the credit made the household’s total tax liability negative for the year.

The Rescue Plan goes one step further, making the full $3,000 per child (and $3,600 per child under age 6) of the 2021 Child Tax Credit refundable. The increased credit and the fully refundable feature make for a powerful combination for many families.

Child and Dependent Care credit upgrades

The Rescue Plan brings more good news for parents of young children as the Child and Dependent Care Tax Credit gets major upgrades for 2021.

Generally, a taxpayer is allowed a maximum credit of up to 35% of $3,000 in expenses for one qualifying individual ($6,000 in expenses for two or more qualifying individuals). A qualifying individual includes a dependent qualifying child under the age of 13, or a spouse or other dependent who is physically or mentally incapable of caring for themselves and who has the same principal home as the taxpayer for more than one-half of the tax year.

For 2021, the dollar limit on employment-related child and dependent care expenses is increased from $3,000 to $8,000 in the case of one qualifying individual and from $6,000 to $16,000 in the case of two or more qualifying individuals. Moreover, the maximum reimbursement percentage is increased from 35% to 50%, so the maximum credit allowed is $4,000 ($8,000 for two or more qualifying individuals). These two changes mean many taxpayers will receive significantly larger Child and Dependent Care Tax Credits in 2021.

On the flipside, the Rescue Plan applies a two-part credit phase-out, which means certain high-earning taxpayers who once received a relatively small Child and Dependent Care Tax Credit will get no credit in 2021. The 50% maximum credit rate is reduced by one percentage point for each $2,000 a taxpayer’s AGI exceeds $125,000 until it reaches 20%. The 20% credit rate is then reduced by one percentage point for each $2,000 of AGI that exceeds $400,000.

What the What the Child and Dependent Care Tax Credit looks like for 2021

| Maximum Eligible Expenses | Maximum Credit Rate | Maximum Credit | ||

| 2020 | 1 Qualifying Child | $3,000 | 35% | $1,050 |

| 2020 | 2 or More Qualifying Children | $6,000 | 35% | $2,100 |

| 2021 | 1 Qualifying Child | $8,000 | 50% | $4,000 |

| 2021 | 2 or More Qualifying Children | $16,000 | 50% | $8,000 |

Notably, the credit is fully refundable for eligible taxpayers who lived in the United States for more than half of 2021.

Finally, the Rescue Plan increases the exclusion for employer-provided dependent care assistance to $10,500 for 2021.

Extended unemployment insurance for workers

The $300 per week increase in unemployment benefits that was part of the Consolidated Appropriations Act of 2021 has been extended through September 6 and continues to include workers who are not usually eligible for unemployment insurance, such as the self-employed, independent contractors and those with limited work history. The Rescue Plan also extends the Pandemic Unemployment Assistance, which provides an additional $100 per week benefit to self-employed, independent contractors and gig workers.

Furthermore, the Rescue Plan includes another potential tax break for individuals who received unemployment compensation for some or all of 2020. Specifically, if your AGI is less than $150,000, up to $10,200 of unemployment compensation received in 2020 will be characterized as non-taxable income. However, all the unemployment compensation must be included to determine the AGI. So if you exceed the $149,999 limit, the full amount of unemployment compensation becomes taxable.

COBRA subsidies for terminated employees

COBRA health insurance coverage is often prohibitively expensive. To increase the number of people who can continue to afford such coverage, the Rescue Plan provides substantial COBRA subsidies if you’ve been laid off.

If you’ve been involuntarily terminated from work and are within your COBRA coverage window, you can maintain your existing health insurance via COBRA from April 2021 through September 2021 at no cost!

Premiums for COBRA coverage during the seven-month period will be paid by the former employer and will be reimbursable for the employer in the form of a refundable payroll tax credit.

Student debt: Preview of coming events?

Although the Rescue Plan currently doesn’t include any student loan forgiveness, it does contain a provision that hints at the prospect of debt forgiveness in the future.

The Rescue Plan permits you to exclude discharged student debt from income, provided the debt is forgiven between 2021 and 2025. The provision applies to federally backed student debt and private student loans.

In short, this provision may be signaling a potentially broader effort to secure future student debt relief. Stay tuned.

Talk to us

Talk to us