The high price of popularity

Benjamin Graham is considered by many professional investors to be the father of value investing. Graham was one of Warren Buffett’s professors at Columbia Business School, where he indelibly shaped Buffett’s approach to investing. Buffett even named him one of his most influential teachers, behind only his mother and father. In his book “The Intelligent Investor,” Graham compared investing to a voting machine as well as a weighing machine. He argued that in the short run, the market is like a voting machine — tallying investment popularity. In the long run, however, the market is like a weighing machine — assessing investment results.

A voting machine, like short-term market performance, can be guided by any number of influences, including biased reasoning and emotional behavior. If gone unchecked, such impulses often lead to adversity and, quite possibly, misfortune. To the contrary, a weighing machine, like long-term market performance, only reflects unbiased reasoning and unemotional calculations. In the end, a portfolio’s value is determined, not by a desired outcome, but by the actual results generated.

Price is what you pay, value is what you get.

— Warren Buffett

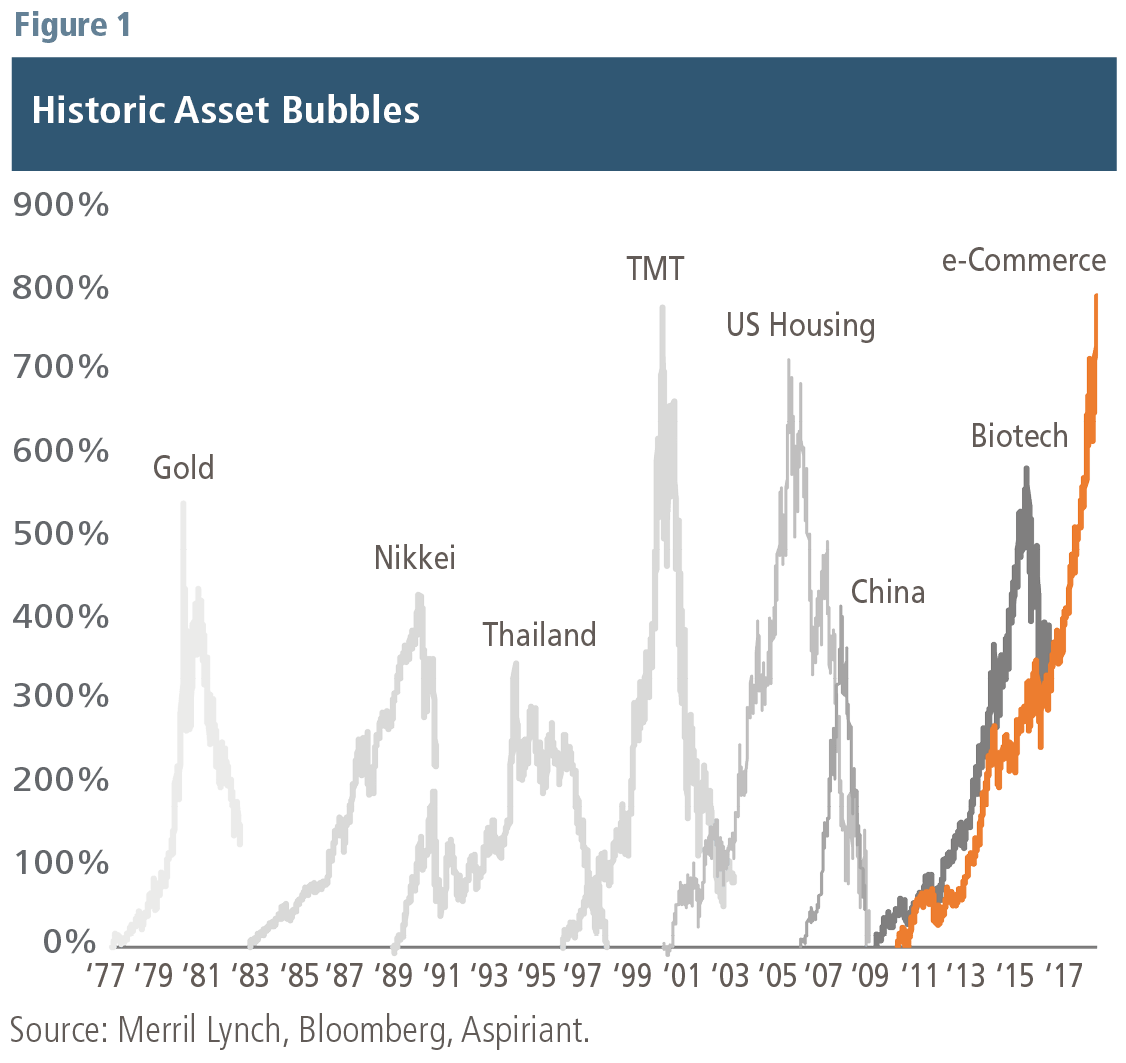

All too often, unrelenting popularity ends in desolation. Figure 1 captures eight examples of asset bubbles since the late 1970s. Note four important observations:

- First, bubbles have occurred much more frequently1 than they should if markets were always efficient. So, it appears that markets are generally, but not always, efficient.

- Second, the bubbles occurred across broad and disparate asset classes, countries and sectors. As a result, no asset class seems immune to the illness of excess.

- Third, popularity propelled each bubble to extraordinary heights over relatively short periods of time. In fact, the average bubble shown increased a whopping 600% over 60 months!

- Fourth, all the bubbles burst, shedding much, if not all, of their fleeting gains. Indeed, the first seven bubbles lost an average of 60% over the 26 months after their peak price. Time will tell how much of the current run-up in eCommerce companies will be lost.

In a more narrowly defined reincarnation of the Technology, Media and Telecommunications (TMT) bubble of the late 1990s, the ascent of the eCommerce companies listed on Figure 2 is unmatched in scale by other speculative extremes. Certainly, both Graham and Buffett would have advised an intelligent investor to sell or reduce exposure to each index as its respective market strengthened. In so doing, the portfolio would have grown, but not by as much as perfectly timing each market peak. Likewise, the portfolio would not have lost as much, either.

We believe selling into the strength of the market is far more sensible than selling into its weakness. This valuation-oriented approach allows an investor to have a much more predictable and stable investment experience over time.

The problem with opinions

It seems every investor has an opinion about what will transpire in the future. Novice investors often reference backward-looking data to justify their forward-looking views. For example, today they might say, “Unemployment is low and consumer confidence is high, so the market will likely continue on its upward trajectory.” Or, “Economic growth is strong, and inflation is ticking up, so equities will outperform bonds going forward.” The facts preceding these conclusions are indeed accurate. However, perspectives solely informed by the past frequently misread the future.

Intelligent investors, on the other hand, understand that to generate long-term outperformance, an opinion must have two attributes. First, and quite obviously, it must be accurate. Second, and less obviously, it must differ from the overall market’s expectations. An intelligent investor recognizes that investment returns are driven by how the future unfolds compared to what is generally expected to transpire. Therefore, one must first understand the expectations currently embedded within prevailing stock and bond prices. Developing that understanding not only better equips the investor to anticipate future returns, but importantly helps the investor successfully navigate markets by reducing expensive assets and increasing inexpensive ones.

Over the years, we have developed a comprehensive set of forecasts covering dozens of asset classes. Like driving safely, we use a constant line of sight to remain focused on what’s ahead. To do so, our forecasts assume a fixed horizon of seven years, which is generally consistent with a complete market cycle. Each month, we update our forecasts for the next seven years, which allows our line of sight to adjust over time. A good investor, like a good driver, should always have their “head on a swivel,” paying close attention to new information that may have been overlooked with a fixed horizon.

We employ hundreds of data-driven monitors, which help us keep empirical tabs on the financial system. Combined, our forecasts and asset class monitors allow us to be more intelligent and intentional about the way we invest. We believe skillfully applying the methods we have developed helps us generate attractive risk-adjusted returns over the long term.

Risk comes from not knowing what you’re doing.

— Warren Buffett

Broader implications

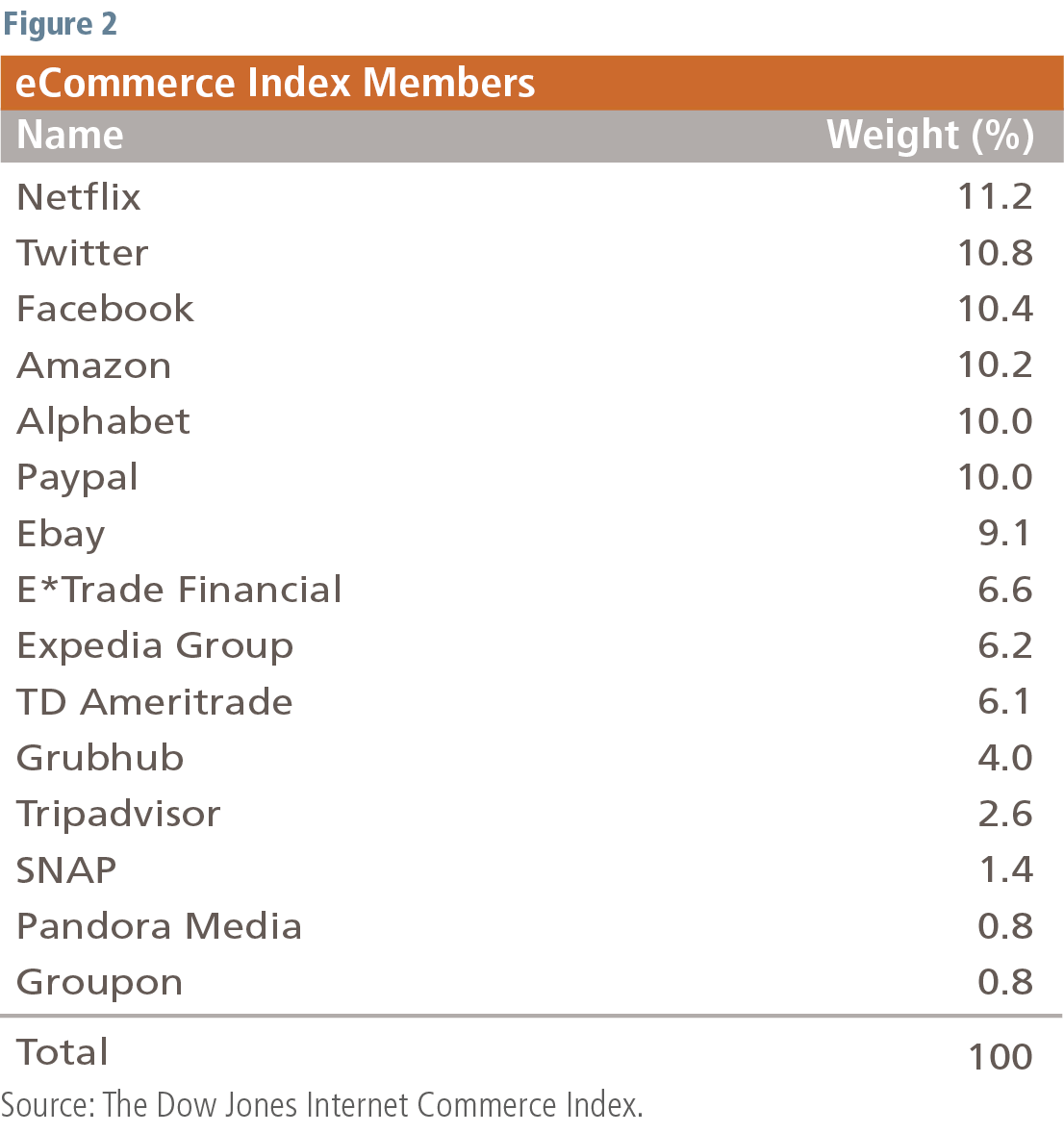

If eCommerce were the only inflated area of the market, then we wouldn’t be overly concerned. We would simply reduce or eliminate those stocks in favor of other more attractive opportunities. Unfortunately, 10 of the 15 companies in the eCommerce index are also constituents of the S&P 500 index. In fact, just those 10 companies accounted for 45% of the S&P 500’s return and 40% of a U.S. balanced portfolio’s2 returns over the past three years! We believe these imbalances are even greater hazards for investors blindly embracing passive management and market capitalization-weighted indexing.

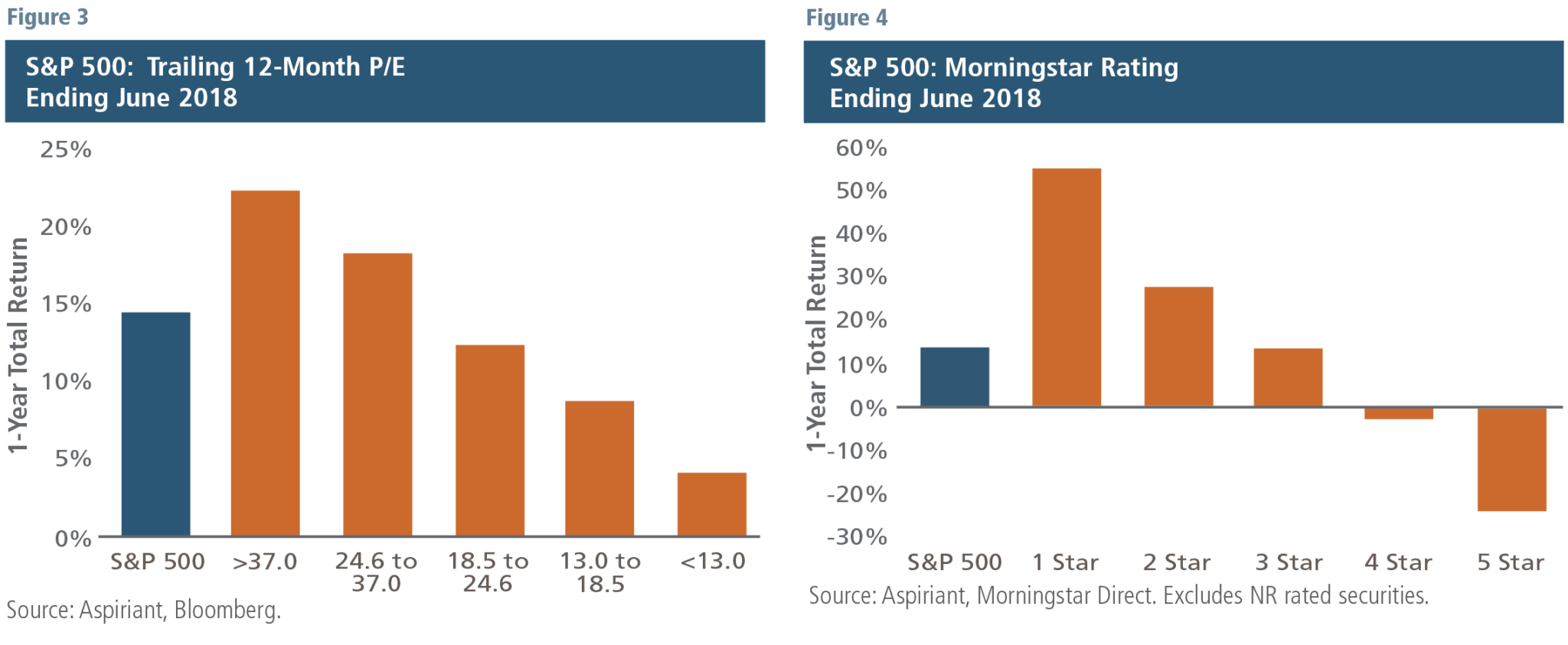

While eCommerce stocks are a prime example of excesses in the market today, they are by no means the only area of concern. Figures 3 and 4 illustrate just how irrational other pockets of U.S. equities have become. The blue bars display the return of the overall S&P 500 over the 12 months ending June 30, 2018. During the period, the market capitalization-weighted index returned 14%. The orange bars break the index into five distinct subsets of companies. Figure 3 organizes the companies by most expensive to least expensive based upon their price-to-earnings (P/E) ratio. Figure 4 organizes the companies from lowest rated to highest rated, according to Morningstar.3 The remarkable takeaway is that the companies offering virtually no margin of safety — because their current share price far exceeds their fair value — have demonstrably outperformed over the past year.

Historically, market gains tend to concentrate within a thinning set of names during the later stages of an investment cycle; a condition that bears striking resemblance to today. To that end, eCommerce, high P/E and low-rated companies account for a stunningly large portion of the market’s recent gains. If it weren’t for those companies, the bull market would have likely already come to an end. If some of those companies fall short by even a small margin in meeting the lofty expectations assumed by their stock prices, then the market could react swiftly. Such a miss may prompt investors to recalibrate their expectations across other risky investments, collectively leading to a meaningful market pullback.

Case in point — As we went to press with this Insight, NetFlix reported a shortfall in new subscribers for the second quarter 2018. The company was expected to add 6.2 million users, but instead added 5.2 million users during the quarter. In total, NetFlix now has more than 130 million customers. So, falling short by 1 million in a particular quarter doesn’t seem all that material. However, overnight futures for the stock immediately traded down 14% on the news. The following day, the stock pared the losses, retreating approximately 10% over the next few trading days. Nevertheless, this example illustrates the fragility of investments that are priced to perfection.

Danger: Bear tracks ahead?

Given our valuation concerns, we won’t be surprised if the U.S. experiences a bear market over the next few years. However, long-term investors know that going through a bear market is a necessary part of the journey toward positive returns over time. If we never experienced risk, we would never generate return. Our objective in positioning client portfolios is to limit the downdraft experienced during turbulent times. Since neither we nor anyone we know can perfectly time a market’s peak, we look to reduce risk as the market rises. We believe our defensive posturing will serve clients well, preserving capital whenever the next bear arrives.

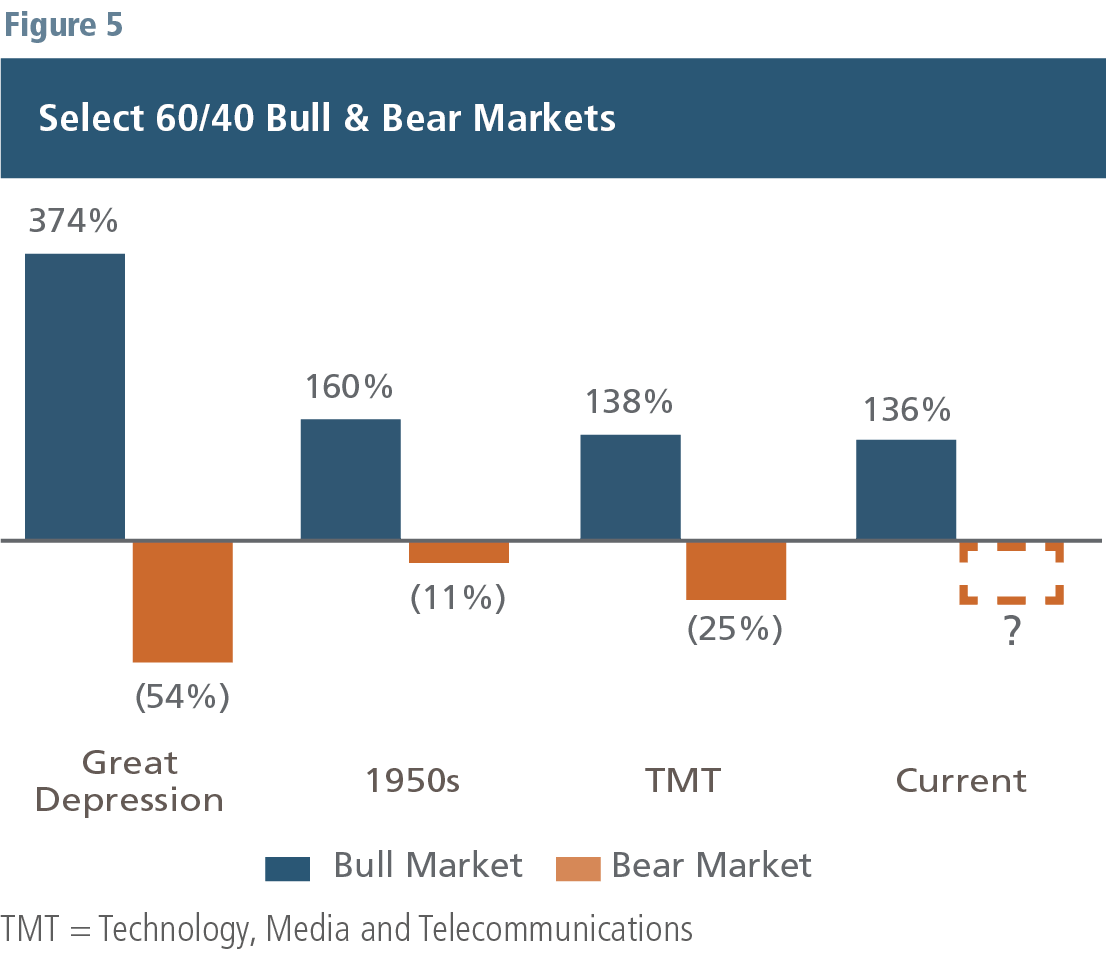

To put bull and bear markets into historical context, since 1900, the U.S. has experienced a number of bull markets followed by bear markets, as seen in Figure 5. The average bull market lasted 3.1 years, with a balanced portfolio gaining 68% along the way. The average ensuing bear market lasted 1.5 years, with a balanced portfolio losing 22%. So on average, a passive market cap-weighted balanced portfolio lost one-third of the gains it had previously generated.

Of the historical bull-through-bear market cycles, four were comparable to the existing environment in terms of duration and magnitude. Of those, we believe the most similar was the TMT bubble, during which a 60% stock/40% fixed income portfolio gained 138% over 6.2 years, or approximately twice the gain and duration as a typical bull market. The current bull market has achieved a similar gain of 136%, but over a longer period of 9.1 years. When the TMT retreated, passive investors lost 25% of their gains, which is fairly similar to the losses experienced during a typical bear market. So, we’re expecting the next bear market to be fairly routine as these things go. And, we expect our portfolios to compare quite favorably in such an environment.

Those who do not remember the past are condemned to repeat it. — Ben Graham4

Patiently awaiting opportunities

Investing intelligently, like Graham and Buffett, can be challenging at times. Indeed, missing out on or not fully capturing the returns of the most popular investments can try even the most patient investor’s resolve. But it is precisely at those times when one must remain steadfast, investing in good businesses at reasonable prices. Today, many investors appear to be doing the opposite. The splendid mix of low (discount) rates, stable growth and contained inflation has not only encouraged but also rewarded risk-taking over the past several years. In fact, the riskiest and most expensive opportunities have outpaced the rest of the market. U.S. equities, especially eCommerce, high P/E and low-quality stocks have amplified returns across many portfolios, but we expect those effects to dissipate and potentially reduce portfolio returns going forward.

As these underpinnings recede and give way to higher interest rates and greater uncertainty, we think investors will need to reassess the value placed on the future cash flows of these businesses. Cash, with returns now marginally satisfactory for the first time in years, will also increasingly become an acceptable alternative and further hasten this transition. In such an environment, distinctions across companies and markets will become more pronounced and markedly more unforgiving for those stocks with no margin for error.

We maintain our belief that now is not the time to reach for return. We see absolutely no lasting value in tethering our success and your wealth to the speculative excesses of the current market.

The sillier the market’s behavior, the greater the opportunity for the businesslike investor.

— Ben Graham

Institutional-caliber intelligent investor

Given our concerns about the current market environment and future investment returns, we have taken steps to fortify the defensive posturing in our portfolios. For example, today our portfolios emphasize fixed income, defensive strategies and defensive equities, each of which we expect will serve clients well going forward. In addition, we have expanded our roster of institutional-caliber asset managers.5

These managers have developed proven track records of beating their respective benchmarks over many market cycles — successfully outsmarting the market to generate higher investment returns. For the most part, the managers have accomplished that feat by limiting negative outcomes during market selloffs. By curtailing these drawdowns, the managers have tended to generate higher returns with lower risk than their benchmarks and other comparable funds. As a result, the managers tend to be held in high regard across institutional investment circles. However, they are less well-known to individual investors because they don’t advertise. These managers selectively choose their investors, as opposed to their investors choosing them. In addition, they tend to require large investments (perhaps exceeding $100 million), which restricts access.

To help establish relationships with these intelligent investors, several years ago Aspiriant became one of the first independent registered investment advisors to create not-for-profit pooled funds on behalf of our clients. These funds allow our clients to invest much like multi-billion-dollar university endowments.

Footnotes:

1If markets were always efficient, bubbles (defined as two standard deviation events) would be random, occurring once every 40 years.

2References the performance of a passive U.S. balanced portfolio, rebalanced monthly with 60% invested in the S&P 500 and 40% invested in U.S. treasuries.

3The Morningstar Rating for stocks compares a stock’s current market price with an estimate of the stock’s fair value. For example, 3 Star stocks are expected to offer an adequate return for the riskiness of the stock.

4The quote was originally by George Santayana and made popular by Winston Churchill.

5The roster includes Bridgewater, Chatham, Coatue, DE Shaw, GMO, Oaktree Capital and Renaissance Technologies.

Illustration by Ken Cummings

Important disclosures

Past performance is no guarantee of future performance. All investments can lose value. Indices are unmanaged and you cannot invest directly in an index. The volatility of any index may be materially different than that of a model.

Equities. The S&P 500 is a market-capitalization weighted index that includes the 500 most widely held companies chosen with respect to market size, liquidity and industry. The Dow Jones Internet Commerce Index (eCommerce) is designed to measure the 15 largest and most actively traded internet commerce stocks.

Talk to us

Talk to us