The global pandemic has led to record unemployment, putting a recession-like strain on the economy. The prognosis for the financial sector is a long recovery, even as the country slowly reopens.

Our federal government has taken several measures to help keep our economy afloat. Among them, the Federal Reserve has reduced interest rates to practically zero, impacting both investors and borrowers. Additionally, the IRS has set historically low interest rates for intrafamily loans, which may allow for wealth transfer and personal lending opportunities.

What the Fed has done recently and why

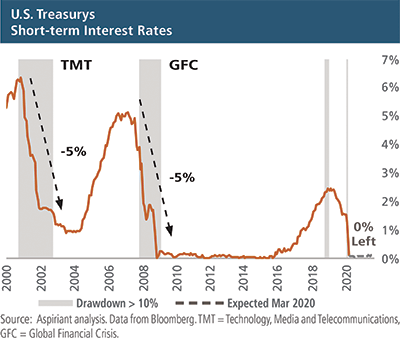

On March 15, the Fed lowered the benchmark for most interest rates, known as the federal funds rate, to a range of 0% – 0.25%. It followed the heels of a rate cut just two weeks before. The last time the rate was this low was during the Global Financial Crisis.

The Fed lowers interest rates to stimulate the economy when it looks like economic activity and the financial markets are headed towards stagnation or decline. Reducing the interest rate makes borrowing money less expensive. This motivates people and businesses to borrow so they have money to spend on homes, school, businesses, cars, etc.  It comes down to making funds available to fuel our economy, which relies on people’s spending and businesses’ investing.

It comes down to making funds available to fuel our economy, which relies on people’s spending and businesses’ investing.

With the federal funds rate at 0.25%, there is almost no room left to lower interest rates further in a downturn, which could result in a prolonged pullback. Our Investment Strategy & Research team described this in more detail last year, before the most recent rate cut, in our Second Quarter 2019 Insight — Part II. However, while prolonged low interest rates may lead to a difficult situation for the economy, there are ways the low rates can benefit you.

Refinance or modify your mortgage

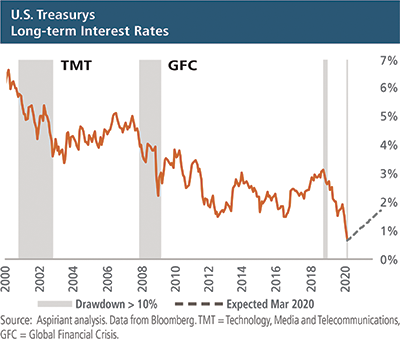

While the federal funds rate serves as the nation’s benchmark for short-term interest rates, mortgages are tied to the 10-year Treasury rate, which is influenced by the fed funds rate and expectations for growth and inflation. As such, banks will often raise or lower their mortgage rates to be in a competitive range to the 10-year Treasury note yields.

Reach out to your mortgage broker or a few local banks and ask for their range of interest rates for your mortgage value and type. They will want to pull your credit report and know the current value of your home in order to decide whether they will underwrite your loan.

Reach out to your mortgage broker or a few local banks and ask for their range of interest rates for your mortgage value and type. They will want to pull your credit report and know the current value of your home in order to decide whether they will underwrite your loan.

Bear in mind, it usually takes at least six months of loan interest payments for the bank to break even on the manpower costs of putting a loan in place. Further, there are also closing costs you will pay. However, the cost to the homeowner of refinancing can usually be recouped after a few months of lower interest payments.

If the offered rates are more than 0.5% lower than your existing rate, it is likely worth the time, cost and effort of a full refinance in order to lock in a better rate for many years.

Another approach is to see if your bank will modify your existing mortgage to a more competitive interest rate. Usually banks will have you wait until your mortgage is at least six months old before doing a modification (for the reason mentioned above). Further, there will usually be a fee that breaks even over the course of a few months, depending on the size of your mortgage and interest rate. However, credit assessments and underwriting are usually not required, so if the modified rate the bank is offering you is attractive, it would be preferable to a full, costly refinance.

The last thing to consider as it pertains to your home financing is what type of mortgage makes sense for you. Most have heard of the amortizing mortgage, meaning that, with each payment, you are buying back a portion of the home’s equity from the bank. Today, the most common amortizing loan is made for a term of 30 years. However, you can get a shorter term – such as 10, 15 or 20 years. The monthly payment will be larger, but you’ll usually pay less interest over time.

When you own your home outright, it usually represents a large percentage of your balance sheet. As investors who believe in diversification, we often recommend that people keep a mortgage on their home in order to diversify out of real estate and free up cash to invest in other assets, such as stocks or bonds. This way, should the real estate market drop, a smaller portion of the homeowner’s balance sheet is affected. However, also consider how long you plan to keep the home because leverage could amplify a potential loss should you need to sell in a down market.

Another option is an interest-only mortgage. This would mean that for a set period — usually five, seven or 10 years — you pay only interest on the loan. This usually means lower interest rates and, because there are no principal payments, your monthly housing expense is smaller and the after-tax cost of the mortgage is lower. The interest rates are lower because after the fixed interest-only period is over, the rate can float and perhaps become unattractive if interest rates rise. Therefore, another refinance may be required, perhaps in a higher interest rate environment. This is known as interest rate risk and is the key reason the interest rates on the shorter duration mortgages are so attractive.

While the investor’s preference is to diversify out of real estate, many people dream to own their home free of debt. If it makes you feel safer to have your home debt free, paying off the mortgage may be the best approach. A wealth manager can crunch mortgage numbers for you and help you decide the best path for you.

Refinance or make loans to family and friends

Some people wish to lend funds to a loved one in order to assist them with a major purchase, like a home or a car, or even help them get through this economic slump. However, under the tax code, interest must be charged on these loans in order to avoid negative tax consequences. Each month, the IRS publishes applicable federal rates (AFRs), which are the minimum required interest rates for such loans and are typically much lower than commercial loan interest rates.

We are currently seeing AFRs at historic lows, as the mid-term AFR for June 2020 is 0.43%! So, if you’re considering lending funds to a loved one, now is the time to do so.

If you already have outstanding loans with family members or friends, you should consider refinancing. Refinancing not only enables you to lower the interest rate on an existing loan, it provides the opportunity to extend the due date, allowing the borrower more time to repay. If you decide to refinance, the borrower should consider providing some consideration for your agreement to lower the interest rate in order to demonstrate the transaction is arms-length.

Seek guidance on the opportunities

The government’s response to the current economic climate has placed borrowers at an advantage. Interest rates are incredibly low, making loan terms increasingly appealing. If you are interested in taking out a mortgage, lending to family or friends, or refinancing debt, discuss your options with your wealth advisor.

Talk to us

Talk to us