One of the best things about being a young adult is that you’re starting fresh and can decide how you want to live your life. This applies in spades to financial decisions and investing, which can be very exciting.

You’ve got three amazing dynamics on your side by starting to invest for retirement or longer-term goals when you’re young:

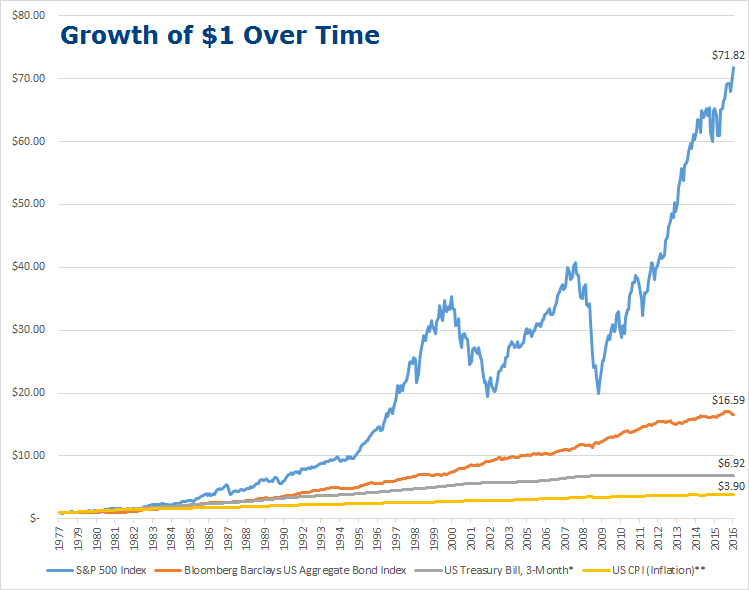

- Time — Just like a roller coaster, investment markets go up and down, sometimes wildly. But over time, these bumps tend to cancel each other out. The more time you have to invest, the smoother the investment return ride. A long time horizon gives you the advantage of focusing on the overall experience of growing your wealth and not the gyrations that are just part of the ride.

- The power of compounding — Once you invest, you earn dividends or interest, and your pot of money grows. Then this larger pot earns more dividends and interest. It’s the snowball effect of compounding math that happens when your dividends and interest earn more dividends and interest. From this dynamic alone, your money can grow faster and faster as the years roll forward.

- Dollar-cost averaging — Dollar-cost averaging is the technique of investing the same dollar amount on a regular schedule so you’ll buy more shares when the market is low and fewer when the market is high. Investing in the markets regularly — even a little bit every month, quarter or year — removes making emotional decisions on when to buy.

If you’re working, a great first step to experience all three of these dynamics is to participate in your employer’s 401(k) plan, if they offer one.

“We always advise funding at least the amount that your employer will match, if that’s available,” says Linda Kitchens, director in wealth management and principal at Aspiriant. “Now you’ve added 100% return on your money before even putting a penny into the market!”

But no matter if you’re investing in an employer retirement plan or on your own, understanding the basics can empower you to get started.

Diversification: Your best approach toward success

You’ve heard the adage: “No risk, no reward.” That greatly applies when it comes to your money.

When you save in traditional bank accounts, the amount you put in is essentially safe. But you earn very little interest, and over time, you won’t come out ahead as inflation and income taxes take a bite out of your earnings. That’s why bank accounts are best for emergency savings and short-term goals.

To stay well ahead of inflation and potentially increase your wealth over the long-term, it’s appropriate to step out into the riskier world of investing with money that you won’t need to tap into for a very long time.

Indices are unmanaged and have no fees. An investment may not be made directly in an index.

The best way to minimize the risk of losing money is through diversification, which is holding a broad mix of asset classes, industries and geographic regions. Much of the time, when some investments drop in value, others go up. So with diversification, you realize smoother returns.

The most common types of investments, also known as asset classes, are:

- Stocks — Shares of ownership in a company, also often called “equities.” Stocks are generally considered riskier. They sometimes distribute income, known as “dividends.”

- Bonds — Loans to a business or government, also called “fixed income.” In most cases, bonds have lower risk than stocks, and therefore lower returns. Bonds typically make regular interest payments.

- Cash — Short-term savings accounts or money market funds with the lowest level of risk. Income is in the form of interest payments.

As we mentioned above, you have the benefit of time on your side if you start investing now. So a portfolio with a heavy investment in a variety of stocks is typically recommended for someone in their late teens and early 20s. But ultimately, the amount of risk you take should be based upon your long-term goals.

The easiest and most cost-effective way for investors to diversify is through pooled funds, which hold a basket of stocks or bonds. Essentially, these funds pool money from thousands of different investors, and you buy shares of the fund. Some funds focus on specific types of investments, such as the largest U.S. companies or tax-free municipal bonds, and others are all-in-one funds that are more diversified.

Two types of pooled funds are best for new investors:

- Mutual funds — Mutual funds are professionally managed collections of stocks or bonds. Some are more actively managed, meaning there are frequent buying and selling of assets inside the fund as the manager tries to outperform the market. Others are index funds that are designed to mimic (track) market indexes such as the S&P 500 or Barclays U.S. Aggregate Bond Index, and are therefore “passively” managed.

- Exchange traded funds (ETFs) — ETFs are similar to index mutual funds but are traded throughout the day like individual stocks and bonds, whereas mutual funds are traded based on their end-of-day values.

It’s important to note that when you invest in a fund, you pay fees to the fund manager. So look for funds with low fees, otherwise known as “expense ratios,” relative to other similar funds. As you might expect, the more complicated the investment strategy, the more you’ll typically (but not always) pay the manager. Passively managed ETFs and index funds tend to have lower expense ratios than actively managed funds.

“When considering investing in an actively managed mutual fund, you’ll want to examine the performance track record relative to its benchmark index, risks associated with the underlying investments of the fund, and the fund’s expense ratios, among other factors, before deciding if it’s a good investment opportunity,” says Ryan Nelson, a manager in investment advisory at Aspiriant.

Getting started is easy

In today’s tech-driven world, becoming an investor is not hard.

First, make sure you have set aside enough regular savings for emergencies and short-term goals. Then start investing with a 401(k) or Individual Retirement Account (IRA) that holds diversified mutual funds and ETFs. The benefit of these types of accounts is they offer certain tax advantages.

If your employer offers a 401(k), then you would simply open that account directly through them. These accounts typically offer a pre-selected list of mutual funds to choose from.

If you don’t have access to a 401(k), open an IRA with a brokerage firm, such as Schwab, TD Ameritrade or Fidelity. These days, it’s easy to open accounts and then buy and sell shares online. Brokerages offer a range of account options whereby you can have them automatically manage the money for you, known as “roboadvisors,” or you can do it all yourself. They also have good educational resources and tools to help you establish your own diversified portfolio. Keep in mind that you will pay management fees depending on the level of personal guidance and management you want from them. And you will typically be charged a fee for each trade.

Of course, this is just the beginning, and there’s more to learn. As you accumulate more wealth, become more educated about the nuances of investing, and work with a personal financial advisor, you can open other investment accounts and be more strategic with your investment choices.

By starting early, you’ll really be on your way to making your money work for you and achieving your long-term dreams.

*BofAML US Treasury Bill 3 Month

**US BLS CPI All Urban SA 1982-1984

Important disclosures:

Past performance is not necessarily indicative of future performance. All investments may lose value over time.

S&P 500. The S&P 500 is a market-capitalization weighted index that includes the 500 most widely held companies chosen with respect to market size, liquidity and industry.

Bloomberg Barclays US Aggregate Bond Index. The Barclays U.S. Aggregate Index represents securities that are SEC-registered, taxable and dollar denominated. The index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities and asset-backed securities. These major sectors are subdivided into more specific indices that are calculated and reported on a regular basis.

BofAML US Treasury Bill 3 Month. The BofA Merrill Lynch US 3-Month Treasury Bill Index is an unmanaged market index of U.S. Treasury securities maturing in 90 days that assumes reinvestment of all income.

US BLS CPI All Urban SA 1982-1984. The Consumer Price Index (CPI) measures the change in prices paid by urban consumers for goods and services. The CPIs are based on prices of food, clothing, shelter, fuels, transportation, doctors’ and dentists’ services, drugs, and other goods and services that people buy for day-to-day living. The data is seasonally adjusted with a base rate set to 100 in 1982-1984.

Talk to us

Talk to us