Lately, international trade concerns, rising interest rates and other economic and political factors have made the stock market a wild ride. The last few months of 2018 were particularly scary as the S&P 500 index dropped more than 19% from its late September peak to the bottom on Christmas Eve. This roller coaster is enough to make the average investor queasy and wonder if they should get off the ride.

But in fact, the dramatic ups and downs, and particularly the steep pullback of late, are to be expected. It’s called volatility. And how much you can stand to lose over a short period of time while maintaining the discipline to stay fully invested until the market recovers is your risk tolerance.

It’s important to identify your risk tolerance, investment objectives and time horizon to arrive at an appropriate level of risk in your portfolio. You should aim toward achieving the maximum total return (net of taxes, fees and expenses) over a complete market cycle (7 to 10 years), rather than focus on near-term returns that can expose you to more risk.

A New Year’s Revelation

To illustrate, we often tell clients the example of two friends, Alex and Bill, who are chatting privately while having a drink at a social gathering on New Year’s Eve in 2017.

Alex turns to his friend and says, “Bill, can you believe the S&P 500 was up 21% this year?”

“Yeah, what a great year,” replies Bill. “I was just looking at my portfolio, and my total return for the year was 14%, which I’m quite happy with. How was your return?”

Alex jumps on the opportunity to boast that his advisor generated him a return of 19% for the year. Bill, an experienced investor, then asks Alex, “How much risk did your advisor take with your assets in order to achieve that 19%?”

Perplexed, Alex does not know how to answer the question.

The reality is that the average investor doesn’t have a good grasp of how much risk is in their portfolio and how it may impact the probability of meeting their financial goals. Here, we’ll explain volatility, why it is important, and how to effectively manage portfolio risk.

What is volatility?

Volatility is a measure of risk in an investment portfolio that is measured by a statistics term called “standard deviation.” Webster’s dictionary defines volatility as “(of prices, values, etc.) tending to fluctuate sharply and regularly.” We can also loosely define volatility as the dispersion of outcomes about the mean (average). For purposes of this discussion, we’ll use risk and volatility interchangeably.

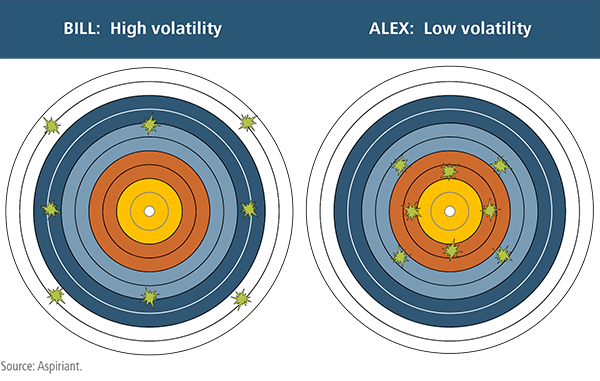

To set the context of volatility in investing, let’s imagine that Alex and Bill are competing in an archery tournament. Alex’s accuracy with the bow and arrow happens to be better than Bill’s. After eight attempts each at the bullseye, both have an average grouping near the bullseye, but Alex’s grouping is much tighter than Bill’s. In investing, we would say that Alex’s volatility of returns, or risk, is much lower than Bill’s. This is exactly what we try to do in portfolio management: keep the grouping of annual returns as close to the expected average annual returns as possible. That is risk management in a nutshell.

Why care about volatility?

There are several reasons why you should care about volatility in your portfolio. Let’s first examine what we call shortfall risk.

Shortfall risk is the risk that we do not meet our financial objectives at some point in the future, whether that objective is to fund a certain capital investment, a wealth transfer goal, a philanthropic goal or a lifestyle spending goal. A lower volatility portfolio, and therefore a more stable and predictable return pattern, will have lower shortfall risk than a higher volatility portfolio.

Then there’s drawdown risk — the peak to trough decline in the price of an asset or market during a measurable period of time. Volatility increases the magnitude and duration of drawdown risk. If a drawdown occurs near the same time you need to take out cash, it can permanently impair your portfolio.

Additionally, higher volatility portfolios have a tougher time recovering from a severe market pullback. Consider a portfolio that has lost 50% of its value in year one. It would require a return of 100% to get back to even. While a lower volatility portfolio with a drawdown of 25% would require only a 33% return to recover its value.

If we limit volatility, and therefore limit drawdown risk, we can compound our future returns off a higher portfolio value. The result is a portfolio that can exceed the total return of a more volatile portfolio, while doing so with less risk.

Lastly, the peace of mind provided by a lower volatility portfolio can add value to an investor by removing the emotional element. Often, investors can’t handle the white-knuckle rides of a highly volatile portfolio and may be tempted to sell out of a position at an inopportune time to reduce their anxiety and emotional stress, even though a market downturn has most likely decreased the portfolio’s risk because asset prices have dropped to a more reasonable valuation. With this in mind, aim to generate portfolio returns that are as stable and predictable as possible.

How can you manage volatility?

Ideally, you’ll want to generate the maximum return per unit of risk, also known as maximizing risk-adjusted returns.

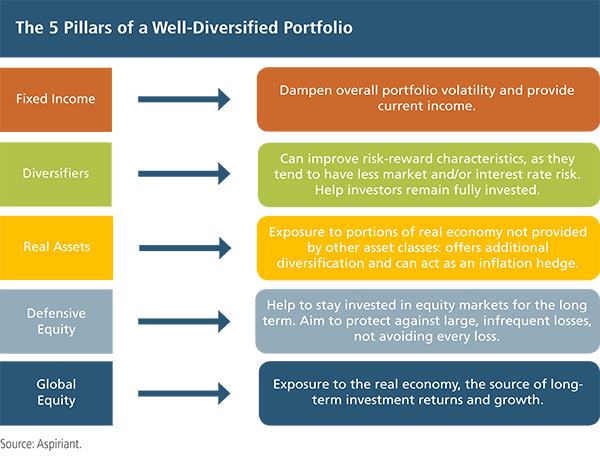

As market risks change, look to tilt away from lower expected return and higher-risk assets toward asset classes with a superior risk-return profile. For example, we’ve been increasing the proportion of defensive equities or fixed income relative to global market-cap weighted equities.

Additionally, we deploy strategies with return patterns that are less correlated to buy-and-hold stock and fixed-income strategies. These strategies broaden diversification, reduce volatility and help reduce drawdown risk as they provide alternative sources of return.

We refer to these investment strategies as “Diversifiers.” These alternative strategies become even more attractive and important when both equity and fixed income valuations are high. We’ll explain more about Diversifiers soon in a future fathom article.

Understand your risk tolerance

It’s impossible to perfectly time the markets. You should expect to take some losses from time to time and confront a bear market as part of a full market cycle. A diversified portfolio with assets that help manage volatility should result in a more stable and predictable return pattern. This, ultimately, enables you to reach your financial goals with less risk … and helps you stomach a wild market ride.

Talk to us

Talk to us