Rising interest rates and inflation can create challenges as we navigate our financial lives. But they can also create opportunities. One great savings opportunity this year is Series I savings bonds, which are offering rates we haven’t seen in decades.

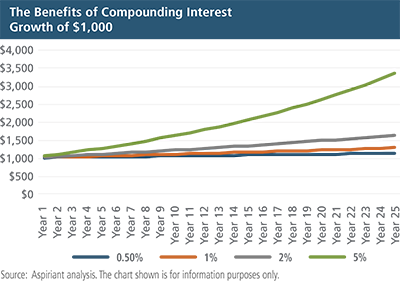

If you buy these bonds before October 31, 2022, you will get six months of interest at a rate of 9.62%, and a new interest rate will be set in October for the second six months. These bonds, issued by the U.S. Treasury, compare favorably to other government-insured bank savings and money market fund investments which currently top out near 0.5%. Over the long term, the benefits of compounding interest work in your favor (see chart).

While the Series I savings bonds’ current 9.62% rate may not hold for long, you can see how starting today with a higher rate can lead to greater long-term income through compounding.

Another benefit is that unlike bank savings, the interest on Series I bonds is exempt from state and local income taxes. Federal income taxes still apply.

However, investment in Series I bonds is currently limited to $10,000 a year. (There have been calls to increase the limit to $100,000.) And there are holding periods. Series I bonds must be held for at least one year before redemption. If the bonds are redeemed before five years you will forfeit the last three months of interest.

You can set up your own account and purchase up to $10,000 of paperless Series I bonds on treasurydirect.gov. You may also purchase up to $5,000 of these bonds with your federal tax refund using Form 8888.

A simple hedge against inflation

Since the Global Financial Crisis in 2008, low interest rates have severely limited the growth of cash savings with yields close to zero. These low interest rates have been somewhat easier to live with coming off years of relatively low inflation. However, this is all changing in 2022 with both interest rates and inflation moving higher.

In a high-inflation environment, bank savings and bond-market investments are less desirable as long-term investments because they tend to lose purchasing power. High inflation is especially painful for people relying on bonds or bank savings to cover living expenses. Some economists believe that recent inflation peaked in March at 8.8% for the consumer price index (CPI) and 6.5% for Core-CPI, which excludes food and energy.

Using the Rule of 70, we can expect to see prices double about every 35 years with 2% inflation. If the current inflation environment persists with Core-CPI running higher than 3%, we can expect to see prices double in 23 years or less. Higher inflation has led to increases in wages and Social Security benefits, but inflation expectations remain an important consideration in financial planning. Holding a diversified portfolio that includes real assets in addition to stocks and bonds can help protect against inflation.

Inflation is a real concern for my parents who are using the proceeds from the recent sale of a house for their living expenses. I helped them use $20,000 ($10,000 for each of them) to buy Series I bonds. They can continue buying $20,000 every year and build to a $100,000 investment in less than five years (by January 2026).

If inflation persists, my parents will have another hedge against inflation in addition to their Social Security payments. They must meet the one-year minimum holding period to access the initial investment. And if they wait 15 months, they will get a full year of the interest return. If they hold the bonds for five years, they will get 100% of the interest return.

Series I savings bonds may be a good option for anyone holding cash reserves with a time horizon of greater than one year. The current 9.62% interest rate is a gift from the federal government with very limited downside. Although, they do add the complexity of creating an electronic account and tracking another password. Be sure to consult your financial advisor to see if they fit into your financial plan.

Talk to us

Talk to us