June 14, 2021

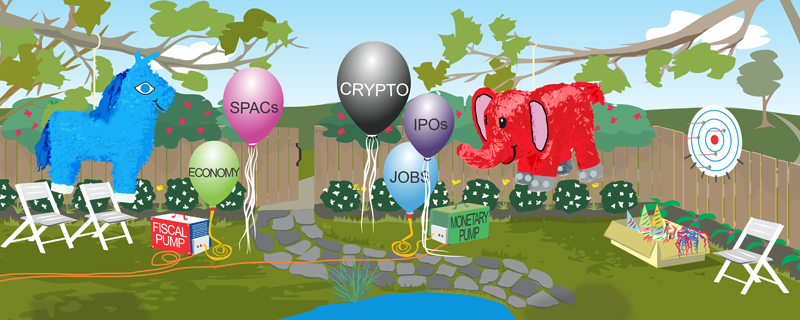

After a worrisome year, society is celebrating as the health pandemic and economic pullback seem largely, but not entirely, behind us. The yet uninterrupted flow of stimulus from fiscal and monetary pumps over the past several years has inflated just about everything, with the pandemic itself exacerbating the government’s deficit spending. Many households have benefited from higher incomes and stimulus payments at the same time they have enjoyed increasing net worth from real assets (like homes) and financial assets (such as equities, bonds and cash savings). Likewise, certain businesses have enjoyed higher earnings and valuations, in part due to lower borrowing costs, taxes and regulations.

Financial assets have floated alarmingly higher than the real economy, with some areas looking ready to pop — including growth stocks, special purpose acquisition companies (SPACs), cryptocurrencies and initial public offerings — especially for those companies with negative earnings.

At this point, it appears that central banks, which control the supply and cost of money, have largely depleted their tanks, while policymakers, which have spending powers, continue to beat the stimulus piñatas. Moreover, across the country and throughout the world, the gaps in education, income, wealth and politics that divide us are widening.

We would all love to say goodbye to COVID-19 this summer, but regrettably, it may be with us for longer. As shown in Figure 1, new and active case counts across the United States have fortunately tapered off considerably. But elsewhere around the world, infections, hospitalizations and deaths are resurging, especially in poorer countries such as India, Brazil, Argentina and Colombia.

As the virus promulgates, there’s a higher probability it will mutate into variants that are more contagious and lethal than existing strains. Therefore, reaching herd immunity, whether by vaccinations or antibodies produced from illness recovery, is critically important. Herd immunity is generally expected to occur when approximately 70% of the U.S. population is no longer susceptible to infection, rendering the virus manageable. At that point, personal and business activities can fully resume with minimal threat.

Figure 2 displays the percentage of the U.S. population who are fully vaccinated. Currently, nearly half of all Americans (approximately 150 million people) have been vaccinated. Plus, about 30 million people have recovered from the virus. Taking a vaccine is a personal choice, and many people are reluctant or opposed to doing so. In fact, daily average vaccination doses peaked around 3.3 million in early April, falling to about 1.1 million more recently. Nevertheless, we appear on our way to resuming life as normal, although it could take several more months to reach herd immunity.

So, we don’t expect COVID-19 to restrain economic growth going forward. However, it is less clear whether monetary and fiscal policy will remain accommodative — at least to the same degree they have been over the past several months. Rising inflation that triggers higher interest rates or widening political divides that produce gridlock could close down what has been one heck of an economic party. Among other factors, Goldman Sachs suggests the stimulus will indeed wane, with economic growth resetting to 1.5% by the fourth quarter of 2022.

Figure 3 depicts both nominal and real interest rates over time for U.S. 10-year Treasury bonds. Its yield serves as a reasonable proxy for the government’s overall cost of borrowing as well as a reference benchmark for investors pricing credit or risk. As shown, both nominal and real rates, which are net of inflation, have trended downward and currently sit at or near historical lows. As such, the Federal Reserve’s ability to reduce rates further is limited. Therefore, it can do little to spin the economic flywheel by incentivizing households and companies to borrow and spend more.

Given today’s prevailing conditions, the Fed’s best option may be to keep short-term nominal rates (not shown) anchored at zero with the hope that inflation climbs higher, thereby driving down real interest rates. However, that outcome isn’t easily engineered and ushers in a set of other risks.

In addition to setting interest rates, the Fed can purchase U.S. Treasurys and mortgage-backed securities to spur economic growth. As shown in Figure 4, the Fed dramatically expanded its balance sheet with asset purchases in two large tranches. The first was in response to the Global Financial Crisis (GFC), when it added $3.5 trillion in assets over a 90-month period. The second stemmed from the global health pandemic, when it added $3.2 trillion over just 10 months. That amount grows by $120 billion monthly as the Fed continues to buy financial assets.

While this activity, known as quantitative easing, has the effect of capping or decreasing long-term interest rates, we believe it primarily fuels a recovery in the pricing of financial assets. Unfortunately, little of that incremental wealth spills over into the real economy in the form of higher spending because financial assets are disproportionately held by the top 10% of households, who are less inclined to spend an extra dollar on goods and services. That became quite clear in the years following the GFC when economic growth averaged just 2% per year.

So, we find ourselves at a time where fiscal policy is taking the lead in stirring a resurgence in economic activity. Congress, in conjunction with past and current presidential administrations, has passed about $5.5 trillion in relief legislation. And more spending is possibly on the way. The $2.3 trillion American Jobs Plan, somewhat mischaracterized as the infrastructure plan (as most of the proposed spending was targeted to other areas), was unveiled in March. In late-April, President Joe Biden shared his $1.8 trillion American Families Plan that includes funding for paid family leave, universal pre-kindergarten, free community college, child-care subsidies and other measures.

Will any of these new initiatives move from a proposal to actual legislation? Possibly, especially if the plans are revised lower, but clearly not a certainty. The American Jobs Plan has already been whittled down to approximately $1 trillion, and passage remains uncertain. Assuming no Republican support for the packages as currently outlined, the Democrats can lose only four votes in the House and no votes in the Senate, so the margin for error is razor thin. In any event, fiscal spending, regardless of its shape, is expected to remain elevated, translating into deficit spending of around 15% of gross domestic product (GDP) for 2020 and 2021, as shown in Figure 5.

This level of deficit spending dwarfs anything in the recent past, including the GFC years when deficits reached nearly 10% of GDP. On a longer-time scale, the current and expected budget deficits are only rivaled by the war-time years of the 1940s, when deficits ranged from 15% to 30% of GDP.

Naturally, this level of deficit spending raises growing concerns around the country’s fiscal health, and quite frankly, our standing in the world. Total public debt-to-GDP is now at 110%, up from 68% at the end of 2008. That may seem like an alarming increase because it is. But, to date, it has not impaired the country’s ability to borrow because the cost of servicing that debt has been quite manageable with interest rates near historical lows.

Figure 6 shows net interest outlays as a percentage of GDP over the past 50 years and projected over the next 10 years. On this basis, we may not feel the deficit hangover for the next several years. For 2020, net interest costs to GDP was 1.6%, fairly consistent with the 20-year average of 1.5%. And, according to Congressional Budget Office forecasts, net interest costs to GDP will not breach 2% until 2030.

This analysis may embolden politicians to go all-in on new spending programs. But, racking up massive national debts carries a number of risks. A large chunk of our debt is held by international investors (including central banks), and the average maturity on our public debt is around five years, which means we regularly go back into the market to refinance past debts at the same time we are financing new fiscal gaps. So, any change in appetite for U.S. credit could have severe implications for interest rates, inflation and the dollar, as well as the country’s overall financial wherewithal. We will leave those questions and concerns for another day. For now, politicians, at least those currently in power, are moving aggressively to use the fiscal lever to stimulate the economy.

As we have referenced, the federal government passed about $5.5 trillion in relief packages over the past year. By any yardstick, that is a staggering amount of support to the economy and families.

Indeed, despite unemployment spiking above 14% in 2020, government transfer payments caused overall household income to increase rather than decrease! In fact, personal income grew by the fastest rate in 25 years, at about 6%.

The combined government programs helped the U.S. economy retrace much of the initial economic losses, finishing the year with a growth rate of negative 3.5%. While an incredible achievement, the economy didn’t fully recover because many households chose to cautiously spend the monies received by the government. As shown in Figure 7, year-over-year monthly declines in real discretionary spending reached 16% at their trough. However, spending was off just 1% for the entire 2020 calendar year.

The flip side of subdued spending is an elevated household savings rate. Figure 8 shows savings shot up over 30% during 2020 and now hovers around 14%, double the pre-pandemic level and considerably higher than just about every year over the past 50. With the scars from the pandemic receding, the movement of those savings or excess cash balances to the real economy, and to what degree, will determine how self-sustaining the recovery becomes in the months ahead.

While the economic impacts of monetary and fiscal policy have yet to fully materialize, we have seen the effects of those actions in the asset markets. For 2020, the S&P 500 was up over 18%, the Bloomberg Barclays Aggregate or taxable core fixed income was up almost 8%, and housing, based on the Case Shiller 20 City Composite, was up 10%. As we have noted on multiple occasions, U.S. equity valuations are at or near record levels.

Figures 9.1 and 9.2 capture a similar conclusion using household assets to make the point. The first chart shows the value of household assets as a multiple of the country’s GDP, which currently stands at an all-time high of about 7x. By comparison, the post-World War II average has been approximately 4x. The prior peak was 6x just before the GFC, which was due, in part, to the run up in the housing market. If the multiple reverted back to its long-term average of 4x, our collective net worth would fall by approximately $60 trillion or 42%.

Figure 9.2 divides household financial assets (including equities, bonds, cash and other) by total assets (including housing and other). Disregarding the years immediately after World War II when the housing market had not yet normalized following the Great Depression, the ratio of financial assets to total assets has ranged from 60% to 70%. And again, today, we are above the upper bound of 70%, which could portend the party’s end.

In 2020, the markets clearly outperformed the economy, resulting in valuations, especially for U.S. equities, now resting at or near record levels. Going forward, we may get a reversal with the economy outdoing financial markets. That is not to say markets will necessarily fall, but they could — and perhaps in devastating fashion.

Our response to this set of conditions and uncertainties remains the same. Stay disciplined in your approach, remain open to new opportunities as they emerge, and, importantly, hold a broadly diversified portfolio that is balanced for a variety of potential outcomes. This continues to mean avoiding undue concentration in a narrow set of popular growth stocks, and instead owning cheaper and better-positioned value stocks. Given our concerns about equity valuations in the U.S., we maintain a bias toward international holdings, including emerging markets. We continue to like defensive equities that possess cash flow and balance-sheet resiliency across a range of environments and provide an exposure that should hold up reasonably well if the recovery wobbles or even slips into periods of lower growth.

We recommend holding less fixed income, given low yields and asymmetric risks, and instead prefer lesser-correlated holdings, such as defensive strategies and gold, to shore up the capital preservation properties of a portfolio. And finally, we also believe investors should start considering some real asset exposure to serve as an inflation hedge should price levels move sustainably higher.

Important Disclosures

Aspiriant is an investment adviser registered with the Securities and Exchange Commission (“SEC”), which does not suggest a certain level of skill and training. Additional information regarding Aspiriant and its advisory practices can be obtained via the following link: https://aspiriant.com.

Investing in securities involves the risk of a partial or total loss of investment that an investor should be prepared to bear.

Any information provided herein does not constitute investment or tax advice and should not be construed as a promotion of advisory services.

The views and opinions expressed herein are those of Aspiriant’s investment professionals as of the date of this article and may change at any time without prior notification. The charts and illustrations shown are for information purposes only.

All information contained herein was sourced from independent third-party sources we believe are reliable, but the accuracy of such information is not guaranteed by Aspirant. Any statistical information in this article was obtained from publicly available market data (such as but not limited to data published by Bloomberg Finance L.P. and its affiliates), internal research and regulatory filings.

Bloomberg Barclays U.S. Aggregate Bond index is a broad-based benchmark measuring investment grade, U.S. dollar-denominated, fixed-rate taxable bonds. The S&P 500 is a market-capitalization weighted index that includes the 500 most widely held companies chosen with respect to market size, liquidity and industry. The S&P CoreLogic Case-Shiller 20-City Composite Home Price Index seeks to measures the value of residential real estate in 20 major U.S. metropolitan areas.

Want the latest wealth management tips, investment insights and Aspiriant news delivered straight to your inbox. Sign up for regular Fathom updates so we can send you the most relevant content you selected below.