July 21, 2017

Aspiriant News

Aa

Aa

As you enter adulthood and take on greater responsibility for your future, how do you reach your bigger financial goals? By beginning disciplined savings habits now.

You may be making ends meet currently while being able to go out with friends and occasionally splurge at the mall. And retirement is decades away — you have plenty of time before having to worry about that, right?

While saving might not be your default priority, your financial stability and future wealth depend on identifying personal goals, carefully budgeting and planning, and then appropriately saving for each of those goals.

“Because of the work I do, my friends frequently ask me about retirement planning and saving,” says Chris Kazmer, an associate in wealth management at Aspiriant. “I’m often shocked by how many of them don’t know the basics.”

The truth is saving is easier today than ever before because many banks and employers can automatically stash away money for you … before you even have a chance to spend it. You’ll find that by making your savings or investment deposit a monthly priority, consistently and automatically, your wealth will quickly grow. And that’s exciting to experience.

Essentially, there are three different types of savings “buckets” to consider funding: emergency reserves, savings for big-ticket purchases, and long-term retirement accounts. Each works in a different way, and there’s no time like the present to begin accumulating money in all three.

Personal emergencies happen to all of us, including you.

A car door opens into your bike lane. Or, your roommate moves out and leaves you with the lease and the rent due. Or, there’s smoke pouring out from your car’s hood. Or you suddenly lost your job, with little warning or severance pay.

Often, when unexpected situations like these arise, you find yourself with an immediate need for cash to help you get out of the pickle. What’s your next move? If you’ve successfully funded an emergency reserve, all you need to do is pull out your smart phone, transfer funds from your emergency savings into your checking account, and pay the bills.

We recommend making it a top priority to put aside at least three to six months of essential living expenses (rent, utilities, transportation, insurance and food) into a basic savings account by using automatic savings deposit features offered by most banks. You’ll earn only pennies on the dollar in this type of account, but it’s the safety and easy access you’ll want for these funds.

Increasingly, it will be up to you to handle the big, expensive purchases, such as a new car, wardrobe, furnishings, appliances and vacations. You may want to buy a home, earn an advanced degree, start a business or pay for a wedding.

Using credit cards for these purchases only makes sense if you’re doing so to benefit from the card’s rewards program and can pay off the bill entirely when it’s due. Otherwise, the accrued interest involved with carrying a balance on credit cards can double the cost of the purchase and take years to repay.

We recommend beginning to save for big-ticket purchases as soon as you identify one on the horizon.

“The savings strategy can be fairly straightforward,” advises Sandi Bragar, a director in wealth management and principal of Aspiriant. “Divide the expected purchase price by the number of months between now and when you expect to make the purchase. The resulting dollar amount is your minimum monthly savings target.”

For these short- to mid-term savings, look for savings accounts that may tie up your funds a bit but pay more interest, such as a certificate of deposit (CD) or a money market account.

“Don’t expose any savings amounts to market risk until your investment time horizon is more than five years,” Sandi adds.

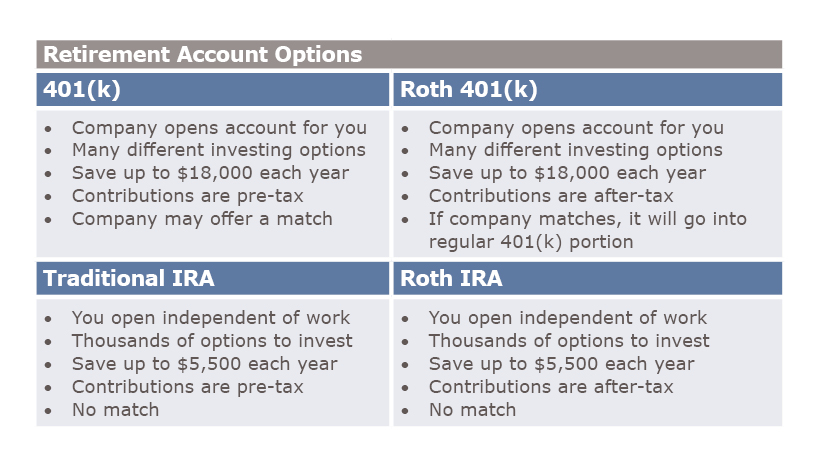

Even though you’re just starting out in your career, you’re probably hoping to have an enjoyable retirement someday. The best way to do that is to start saving for retirement through 401(k)s and Individual Retirement Accounts (IRAs). With these tax-preference accounts, Uncle Sam, and maybe your employer too, can give you a big, long-term financial boost.

If your employer offers a 401(k), fantastic! Take it, especially if the company matches what you save. Try to contribute enough to get the full match from your employer (practically free money). If you don’t have a 401(k) option, you can open an IRA at your bank or a brokerage firm, such as Schwab or Fidelity.

Every dollar you save in your 401(k) or traditional IRA is tax-deferred. In other words, your taxable income for the year is reduced by what you contribute, resulting in a lower current tax bill. However, you will eventually pay taxes on the contributions and earnings later when you take money out for retirement.

There are also Roth IRA and Roth 401(k) accounts. You contribute after-tax dollars to Roth accounts, where they grow for future spending, and you never have to pay taxes on the money when you take it out during retirement.

“I recommend younger savers choose a Roth IRA or Roth 401(k) over the traditional IRA and 401(k) options,” Chris advises. “Generally, since income is lower at the beginning of our careers, taxes will also be the lowest, and we have very long investment time horizons for the money to grow. A Roth account is forever separated from taxes. This separation from taxes will become more valuable as you climb through tax brackets later in life.”

When it comes to retirement plan contributions, there are a few important things to be aware of: First, there’s a limit to how much you can contribute to these types of accounts each year. For 2017, the maximum employee 401(k) contribution is $18,000, and IRA contribution is $5,500. That’s not for each account, but total for all accounts of each type.

Also, withdrawing funds from any of these accounts before retirement will result in taxes and penalties in most cases. The IRS allows some exceptions for early withdrawals. For example, you can withdraw up to $10,000 from either type of an IRA without penalties to buy your first home; and you can take out money from a Roth to pay for qualified education expenses and unreimbursed medical expenses or health insurance if you’re unemployed.

Additionally, retirement accounts are more than just savings — they’re investment accounts, which means you can potentially earn greater returns by investing in stocks and bonds. There is risk involved, and sometimes you will see retirement accounts lose money. But if well-diversified, these accounts are likely to grow over the long term, and you are very likely to come out farther ahead than if you kept the money in a regular savings account.

“The sooner you get started, the less you’ll need to invest in order to meet your long-term financial goals,” says Chris. “Thanks to the power of compounding returns, every dollar invested in your twenties will be immensely more valuable in your seventies.”

Remember, as a young adult, you’ve got the most powerful financial force of all — time — on your side. So start making automatic monthly deposits into these different savings accounts, and let your savings start working for you. If you’re not able to contribute much right away, no problem, save whatever you can. Even small monthly contributions will help you establish discipline and create a financially healthy new habit.

Want the latest wealth management tips, investment insights and Aspiriant news delivered straight to your inbox. Sign up for regular Fathom updates so we can send you the most relevant content you selected below.