America’s consumer economy is driven by credit. And young adults who start establishing credit habits early are a major force.

Today, 56% of college students have a credit card, according to a survey by student loan lender Sallie Mae last year. Nearly half of them use their credit cards for everyday purchases. They actually carry three credit cards, on average, with a combined balance of $906. Other than student loans, credit is the largest outstanding debt type among 18- to 24-year-olds.

The bottom line is credit is a fact of life in America. It’s easy to get and easy to use, and there are benefits if you use credit responsibly. But make no mistake: How you use credit will impact your finances and your lifestyle throughout your life.

How credit works

Credit allows you to purchase goods or services now and pay later, usually with monthly payments. If you pay your statement balance in full every month, you are not charged interest on the money you borrowed. If, however, you don’t pay the balance off every month, you will be charged ongoing interest on the balance until it is paid in full.

There are three main types of credit used by young adults:

- Installment loans — Long-term loans for education, autos, furniture

- Store credit cards — Revolving accounts for specific store use only

- Major credit cards — For large and small purchases almost anywhere

Credit purchasing will allow you to buy and enjoy home furnishings, a car, education and other life basics, many of which may be far too expensive to pay immediately with your earnings or savings.

How do creditors figure out whether you are you “creditworthy,” that is, your ability and intention to pay? Big Data tells them. Nearly everything you do with credit is automatically recorded, gathered by credit reporting agencies and compiled into your credit report. There are three credit bureaus that track your credit — Equifax, TransUnion and Experian. They automatically analyze your financial position and past credit payment behavior based upon their own formulas to assign you a credit score, known as the FICO® Score.

The FICO Score

The FICO Score (a service of Fair Isaac Company) is the nearly universal measure of your creditworthiness used by banks, mortgage companies, retailers, landlords and credit card companies — even prospective employers and some government agencies.

In a nutshell, your credit score will determine your access to credit throughout your lifetime — whether you’ll be approved, for how much money, and at what interest rate.

The good news is that many young people already understand this. The Sallie Mae survey found that 67% of college students know about credit reports, and about half have viewed theirs. And the number one reason they apply for a credit card is to begin building a credit history.

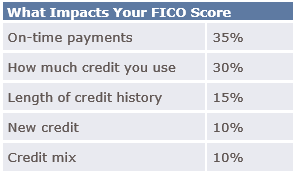

Your FICO Score is determined by a mathematical formula that analyzes the data in your cumulative credit history, weighing these factors:

Clearly, not overloading yourself with credit balances and paying installments on time are the largest factors in your FICO Score. Notice, having high income or net worth are not factors at all. In fact, even some wealthy people fall into common credit traps.

FICO Scores range from a high (best) rating of 850 down to 300. A score of 700 and above usually suggests good credit management. A lower FICO Score means you are a greater risk and, if you can get credit at all, will be charged a much higher interest rate.

“To understand how a good credit score can translate to more money in your pocket, consider two borrowers who applied for a five-year, $30,000 car loan,” explains Myles Rush, a manager in wealth planning at Aspiriant. “Borrower A has a 750 credit score and is offered a 6% rate, and borrower B a 550 score and is offered 16.16%. Borrower B will pay an extra $9,127 in interest over the life of the loan!”

So it pays to protect your FICO Score by using credit responsibly. One component of your score is how much of your credit card limit you use. We recommend not exceeding 30% of your available credit limit. In other words, don’t max out your credit cards.

Also, review your credit reports and score at least once a year to make sure there’s no incorrect or fraudulent information. Federal law requires that each bureau provide you with a free credit report every year.

“We recommend you review your credit report not from just one of the credit bureaus, but from all three, because they may have different information and a lender can pull your credit from any one of them,” says Myles.

You can easily access all three reports at AnnualCreditReport.com — the only government-authorized website to provide free copies. However, this website does not disclose credit scores. So check with your bank; many financial institutions offer access to your numbers.

Selecting the right card

As you earn more income and pay your everyday bills on time, credit card companies will start sending you applications. But be selective. Don’t just apply for the first major card offer you receive, or for a card at every one of your favorite stores.

Depending on your lifestyle, some cards offer generous perks that make it worthwhile to charge items, as long as you can pay off the statement balance each month. Rewards points and cash back are the top two reasons why college students choose a specific card, according to the Sallie Mae study. For example, if you travel a lot, then cards with travel benefits may be worthwhile.

Also compare annual fees and regular interest rates, in case you need to carry payments on a large purchase for a while. And look out for low introductory interest rates that can skyrocket after a period of time.

The slippery slope

For decades, we’ve had credit purchasing power right in the palms of our hands, literally, with the nearly universal use of credit cards — sometimes simplifying our lives, sometimes tempting us to purchase recklessly. More than 60% of college students agree that credit cards make impulse buying too easy.

And it can be very hard to pay back once you get in over your head. If you don’t use credit wisely, it will hurt your credit score and your financial future for a long time.

The best defense against overcharging is to carefully budget your expenses each month — and stay within the limits you can actually afford.

Talk to us

Talk to us