Don’t look now, but everything is dropping ─ and not just stocks and bonds. We’re looking at commodities, sentiment, home sales and real incomes, just to name a few. Some of the decreases, such as the change in commodity prices, are exactly what the Federal Reserve is looking for. Yet, investors continue to evaluate whether the Fed will go too far.

Unaffordable homes

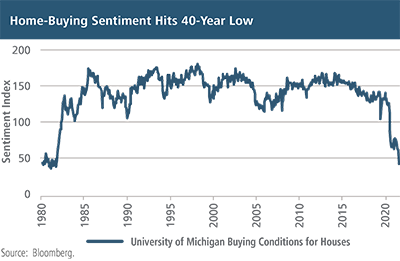

Home buyers have been feeling the pain of high prices over the last couple of years. In the last year alone, average home prices jumped 20%. Meanwhile, 30-year mortgage rates increased by 3%, with most of the increase happening in the last six months. This rate increase is significantly more than we’ve seen in past cycles. These two factors combined increase a monthly mortgage payment by about 65%! And that’s why home-buying sentiment is the worst since the early 1980s.

Home buyers have been feeling the pain of high prices over the last couple of years. In the last year alone, average home prices jumped 20%. Meanwhile, 30-year mortgage rates increased by 3%, with most of the increase happening in the last six months. This rate increase is significantly more than we’ve seen in past cycles. These two factors combined increase a monthly mortgage payment by about 65%! And that’s why home-buying sentiment is the worst since the early 1980s.

There is a saying in Economics 101, “The best cure for high prices is high prices.” The two-fold increase in home costs is already hitting the market. May existing home sales were 8% lower than the previous year. Retail sales also unexpectedly turned negative in May, falling 0.3% for the month. These are just cracks at this point but highlight the narrow landing the Fed is working with.

Commodity prices saw the writing on the wall

Commodity markets see the Fed-induced slowdown in the economy. Probably surprising to some, but many industrial metals and lumber prices hit their highs in March just as the Fed started raising short-term rates. The metals are 30% off the highs, while lumber is more than 50% lower.

What does this mean for earnings?

The Fed is now doing the hard work we have been expecting. The initial increases in the Federal Funds rate were long overdue. Current economic conditions make a soft landing exceedingly difficult, but not impossible. Discussion of an impending recession has increased almost exponentially over the last couple of weeks. This has helped bring down longer-term interest rates. However, it is extremely unusual that earnings expectations have not fallen yet. Earnings historically fall 30% on average during recessions, with a range of 20% to 50%. While nobody knows when the market will bottom, it’s rare to reach bottom prior to earnings estimates being revised downward. The market will pay particularly close attention to executives’ comments regarding the future in second quarter earnings announcements.

Be cautionary, but look for opportunities

While these are difficult times for investors, we’ve been through them before. Prudently navigating volatility provides better long-term returns for patient investors.

Important Disclosures

Aspiriant is an investment adviser registered with the Securities and Exchange Commission (“SEC”), which does not suggest a certain level of skill and training. Additional information regarding Aspiriant and its advisory practices can be obtained via the following link: https://aspiriant.com.

Investing in securities involves the risk of a partial or total loss of investment that an investor should be prepared to bear.

Any information provided herein does not constitute investment or tax advice and should not be construed as a promotion of advisory services.

The views and opinions expressed herein are those of Aspiriant’s investment professionals as of the date of this article and may change at any time without prior notification. The charts and illustrations shown are for information purposes only.

All information contained herein was sourced from independent third-party sources we believe are reliable, but the accuracy of such information is not guaranteed by Aspirant. Any statistical information in this article was obtained from publicly available market data (such as but not limited to data published by Bloomberg Finance L.P. and its affiliates), internal research and regulatory filings.

Talk to us

Talk to us