After five years of stellar performance, and over a year of very low volatility, global equities became more “normal” during the first quarter of 2014. The S&P 500 returned +1.8% and global equities returned +1.1% overall and volatility spiked upward toward more normal levels. Resisting the gravitational pull, global real estate values continued to race forward, gaining +6.1%, while commodities finally rebounded from their three-year slump, up +2.9%, partially related to increasing agricultural prices as well as a recovery in gold and oil prices. The bond yield curve both fell and flattened during the quarter, causing bonds, especially long-term, high yield and municipal bonds to perform well. Table 1 below shows a snapshot of how some of the major market indices performed during the quarter as well as their annualized trailing total returns.

IndexQ11YR3YR5YR10YR

Table 1Major Index and Currency Performance

|

|||||

| Annualized Trailing Total Return | |||||

| S&P 500 | 1.8 | 21.9 | 14.7 | 21.2 | 7.4 |

| Russell 2000 | 1.1 | 24.9 | 13.2 | 24.3 | 8.5 |

| MSCI Europe, Australasia & Far East | 0.7 | 17.6 | 7.2 | 16.0 | 6.5 |

| MSCI Emerging Markets NR | -0.4 | -1.4 | -2.9 | 14.5 | 10.1 |

| MSCI All Country World Index | 1.1 | 16.6 | 8.6 | 17.8 | 7.0 |

| Barclays US Aggregate Bond TR | 1.8 | -0.1 | 3.8 | 4.8 | 4.5 |

| S&P GS Commodity Index | 2.9 | 1.1 | -3.4 | 6.9 | 0.0 |

| Wilshire Global Real Estate Securities Index TR | 6.1 | 2.8 | 9.7 | 25.5 | 8.6 |

Indices are unmanaged and have no fees. An investment may not be made directly in an index.

Source: Morningstar.

State of the U.S. Economy: We’re not singing the Blues, but we ain’t whistling Dixie, either.

Earlier this month at the 2014 National Interagency Community Reinvestment Conference in Chicago, Janet Yellen summarized the state of the economy and the labor market. She stated that each has strengthened considerably from the depths of the Great Recession. Although unemployment has dropped from approximately 10% in October 2009 to 6.7% today, we are still well above 5.5%, the level that is considered to be full employment. Moreover, she cautioned that the labor market is actually worse than what should be inferred from the current rate.

She went on to say that the there is “no doubt that the economy and the job market are not back to normal health.” She further recognized that the “recovery still feels like a recession to many Americans, and it also looks that way in some economic statistics… in some ways, the job market is tougher now than in any recession. The numbers of people who have been trying to find work for more than six months or more than a year are much higher today than they ever were since records began decades ago.” She concluded that the Fed’s “extraordinary commitment” to provide support for the economy will continue for some time. Although we have no reason to doubt the Fed’s resolve, we also recognize that the incremental impact of any additional intervention is limited. So, we are not counting on much impact, if any, of the Fed’s actions on investment returns going forward.

As value-oriented investors we prefer to own less expensive assets compared to more expensive ones.

US Equities: Proceed. But proceed with caution.

Over the roughly five-year period from March 9, 2009 through March 31, 2014, the S&P 500 and Nasdaq have generated cumulative total returns of +177% and +190%, respectively. No doubt, the Federal Reserve’s actions contributed to the recovery in asset prices, which is a good thing. However, we are long-term, value-oriented investors. As long-term investors, we do not engage in market timing and have written extensively about the perils of attempting to do so. Although recent cumulative returns have been impressive, they are only slightly above average when compared to historical bull markets, so we need to remain invested in the market. As value-oriented investors, however, we prefer to own less expensive assets compared to more expensive ones. So, given our investment philosophy, what can we do in the current environment? Answer: remain fully invested, but overweight (or “tilt”) our portfolios toward relatively inexpensive assets. Aspiriant portfolios already have a significant and deliberate value tilt, and we expect to tilt further in that direction in the coming months.

It’s also worth noting that we do not tend to be overly preoccupied by headline news… whether good or bad. Such behavior can lead to “knee jerk” reactions, which can increase trading costs, reduce tax efficiency and depress long-term returns. Instead, we take a substantially more thoughtful and methodical approach to investing. As such, the tilts we employ are metered-in over time and always with a focus on the very long-term. Moreover, before we employ any tilts, we continually challenge our theses to ensure that we are properly identifying and analyzing risks as well as opportunities. We ask ourselves questions like, “What has changed?,” “Is it important?,” “What, if anything, should we do about it?” and “What if we’re wrong?”

So, for US equities, we are encouraging clients to proceed, but proceed with caution. Indeed, although the Q1 Market Snapshot paints a rosy picture, the second quarter has begun with a nearly audible sigh.

European Equities: Eye of the Tiger

Following the global financial crisis, the European Union and International Monetary Fund put forth a broad and sweeping reform package designed to accomplish two goals: reduce government spending and increase tax revenue. These policies are generally referred to as “austerity measures.” Austerity has the noble goal of balancing budgets to reduce national deficits. However, as John Maynard Keynes wrote, “The boom, not the slump, is the right time for austerity.” That’s because one person’s spending is another person’s income. So, austerity measures, implemented when economic growth is weak, can lead to negative unintended consequences. Fortunately, the EU has recognized austerity’s negative side effects and, moving forward, has adopted a more balanced approach to reform that promotes fiscal accountability while encouraging near-term growth.

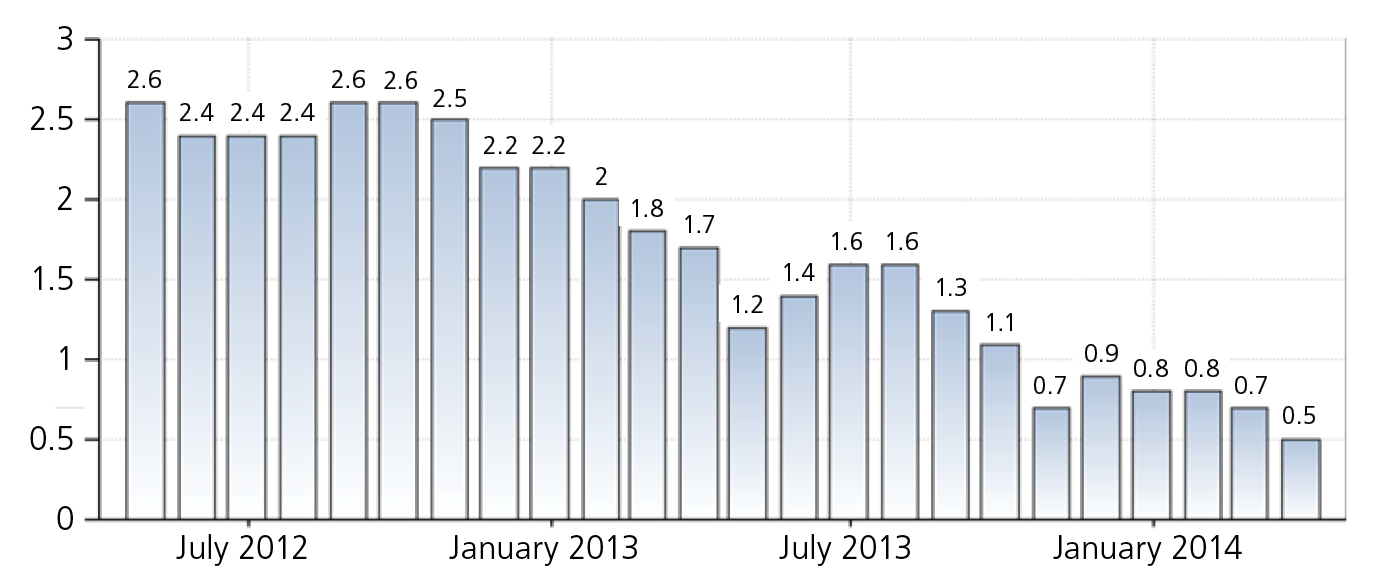

As we noted last quarter, unemployment across the Eurozone has remained high; growth has been anemic and aggregate prices are teetering on deflation (see Chart 1). Deflation, or falling wages and prices, can prompt consumers to defer purchases, exacerbating slow growth, increasing unemployment and reducing tax revenue.

Chart 1: Euro Area Inflation Rate: Annual Change on Consumer Price Index

Source: www.tradingeconomics.com | Eurostat

To combat the mounting problems across Europe, European Central Bank policymakers unanimously agreed earlier this month that they were prepared to use “unconventional” tools to stimulate the economy. In addition, IMF officials have urged Mario Draghi, President of the ECB, to take more aggressive action. However, the situation in Europe is more complicated than in the US; although the countries share one common currency, they do not share a common debt burden. So, implementing a US-style quantitative easing plan (i.e., lowering interest rates and buying bonds in the open market) would be more challenging… but not impossible. Amongst others, IMF First Deputy Managing Director David Lipton suggested that the ECB should consider buying assets directly from European banks instead of buying bonds in the open market. At this point, no decision has been made, but we believe that the common foe of deflation will prompt policymakers to hammer-out, and begin implementing, a stimulus plan in the not too distant future.

Looking across developed equity markets, we are beginning to see more relative value within Europe.

Since the market trough in March 2009, European equities have lagged other public equities. For example, over the trailing three years ending March 2014, the cumulative total return on the MSCI European Index is approximately +30% compared to the S&P 500 at approximately +50%. As a result, looking across developed equity markets, we are beginning to see more relative value within Europe. Although the overseas recovery appears to be more fragile than the US, over the long-run, we expect to be adequately compensated for accepting these risks. Additionally, the adoption of more balanced reforms and a potentially more engaged ECB could provide much-needed fiscal and monetary policy support that could benefit European equities. As long-term value investors, this kind of opportunity fits squarely in our wheelhouse.

Emerging Markets Equities: Long-term Opportunistic

In the first two years following the global financial crisis, equities in developing economies skyrocketed upward, recovering nearly all of the losses they had sustained during the downturn. However, in the past three years, the MSCI Emerging Markets Index has generated a negative cumulative return of approximately -10%. During that time, we have been overweight emerging equities, which has been a detractor to performance. However, over the longer-term (e.g., the previous ten years), emerging equities have well-outperformed every other broad index (see Table 1), and Aspiriant’s historic tilt toward emerging markets has worked out well. We expect the same going forward: long-term outperformance accompanied by volatile, interim periods of lackluster performance.

As a result, we are maintaining our overweight to emerging equities and believe they will be a positive contributor to investment portfolios over the long-term. Our conviction in emerging equities stems from major themes we have been researching and writing about over the past several years: urbanization, convergence and technological change (see sidebar).

The Role of Bonds

We are staunch proponents of the importance of diversification across asset classes. A well-diversified portfolio not only helps to reduce risk, it can also help to increase returns over a full market cycle. So, while some investors may be in the enviable position of being able to comfortably hold predominantly equity portfolios, most investors can benefit from holding a meaningful allocation to bonds.

For the past few years, our fixed income portfolios (primarily municipal bonds) have been tilted toward higher yielding, longer duration and lower liquidity bonds. That decision has served our clients well, including thus far in 2014. However, given our concern about the dissipating impact of Fed intervention along with its more recent tapering decision (reducing its purchases of longer term bonds to depress long-term rates), we have reduced duration. In doing so, we expect to face less sensitivity to changes in the yield curve, especially on the short- and long-end of the curve. We’re maintaining, however, the tilt toward higher-yielding bonds, which continue to look attractive.

What’s Driving Emerging Markets?

As people move from rural areas into developed cities, they have an opportunity to gain efficiencies and increase productivity which, in turn, spurs economic growth. In addition, economic growth theory predicts that a country with a lower stock of productive capital (machines, technology) will grow more rapidly during the period of capital deepening. This “catch-up” period is referred to as convergence. And lastly, technological change bestows additional efficiencies, reducing frictional costs associated with trading goods and services.

Importantly, increasing levels of education also impact productivity and are arguably one of the most important growth engines for an economy because it doesn’t experience a “decay factor” like urbanization, convergence and technological advances. While those factors can catapult an economy forward for many years or even decades, eventually their incremental impact dissipates and the benefits, although still very real, simply have less impact on overall growth levels. However, education is unbounded. Increasing levels of education across an economy provide enduring benefits related to efficiencies, competitiveness and standards of living.

In addition to the above mentioned themes, which collectively relate to the effectiveness of a workforce, the size of the workforce in an economy also matters… and it matters a lot. The United Nations publishes a statistic known as the dependency ratio, which is the number of non-workers to workers in an economy. In other words, it measures the number of workers (or tax payers) who support non-workers (those people above or below working age). As shown in Table 2, the UN expects the aggregate dependency ratio across developed countries to increase from 55 in 1970 to 72 in 2050. By contrast, they expect the aggregate dependency ratio across emerging countries to decrease from 84 in 1970 to 55 in 2050.

Aggregate Dependency Ratio

Number of Non-Workers for Every 100 Workers

| Historical Data & Projected Estimates | |||||

| 1970 | 1990 | 2010 | 2030 | 2050 | |

|---|---|---|---|---|---|

| Developed Countries | 55 | 48 | 48 | 60 | 72 |

| Emerging Countries | 84 | 65 | 50 | 48 | 55 |

Source: United Nations

These data points are aggregate estimates and obvious exceptions exist. For example, across developed countries, Japan is expected to have a much higher ratio while the United States is expected to have a lower ratio. Across emerging countries, China and Russia are expected to have higher ratios while India and Korea are expected to have lower ratios. The point, however, is to recognize that the combination of increased effectiveness of workforce along with a growing workforce has the propensity to generate exponential growth in an economy. In 2011, Arjun Divecha (Head of Emerging Equities at Grantham, Mayo, Van Otterloo) provided an example of the impact of this non-linear growth:

A simple example can be seen in Chinese auto sales. In the year 2000, China crossed $1,000 per capita GDP. In that year, auto sales first exceeded 1 million vehicles. Ten years later, Chinese GDP more than quadrupled, to $4,400 per capita. What happened to auto sales? Did they go from 1 million to 4 million?

No. They went from 1 million to 17 million!

Looking Ahead

Asset classes across the board have recovered handsomely since March 2009. In fact, many have soared to all-time highs. We have (obviously) welcomed these advances because our clients have benefited from the rising tides. However, we do not expect the trajectory to remain nearly as steep going forward; it would be naive to assume that the next five years will produce comparable returns to the past five years. That said, we don’t foresee any crises on the horizon, although equity values could certainly retrench a bit from their recent highs.

So, we are optimistic, but we are also realistic. We are positioning our portfolios accordingly and are advising our clients to expect more “normal” performance going forward, including occasional setbacks.

1Bureau of Labor Statistics, “Change in Total Nonfarm Payroll Employment” (June 2014).

Important disclosures: Past performance is no guarantee of future performance. All investments can lose value. Indices are unmanaged and you cannot invest directly in an index.

S&P 500 is a market-capitalization weighted index that includes the 500 most widely held companies chosen with respect to market size, liquidity, and industry. The volatility of an index may be materially different than that of a model. You cannot invest directly in an index. Index returns assume the reinvestment of dividends and capital gains. The MSCI ACWI All Cap Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. It is not possible to invest directly in an index. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets. The MSCI EAFE Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the US & Canada. The Russell 2000 Index measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000 is a subset of the Russell 3000 Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership.

S&P GSCI: The S&P GSCI© is a composite index of commodity sector returns representing an unleveraged, long-only investment in commodity futures that is broadly diversified across the spectrum of commodities. The returns are calculated on a fully collateralized basis with full reinvestment.

Wilshire Global RESI: Is a broad measure of the performance of publicly traded global real estate securities, such as Real Estate Investment Trusts (REITs) and Real Estate Operating Companies (REOCs). The index is capitalization-weighted.

Talk to us

Talk to us