How your emotions could sabotage your best-laid plans

In these uncharted times — as the coronavirus pandemic spreads, we’re increasingly isolated from friends and coworkers, and the investment markets plunge — our emotions will very often try to take the best of us. That’s absolutely normal and to be expected.

As wealth managers we are accustomed to managing through volatile markets. And even though we don’t have all the answers of what the future months will bring, one thing we know is that emotions and personal biases lead to behaviors that can sabotage a sound investment strategy.

Awareness of these nine common investing behaviors may improve your financial decision-making:

1. Recency bias. The tendency to infer that the immediate past is predictive of the long-term future by overweighting the value of new, more recent information.

2. Hindsight. A tendency to exaggerate what could have been anticipated in foresight based on knowledge of what actually happened. This leads to errors in predicting future events based on past events.

3. Overconfidence. Investor tendency to overstate their ability to time the market, pick winning stocks or make precise estimates.

4. Anchoring. A tendency to rely (anchor) too much on pre-existing information or the first information presented when estimating prices, distances, weights and other numerical values.

5. Framing. The way investments are framed can influence how we assess whether the investment was good or bad.

6. Herd mentality. The tendency to accept “conventional wisdom” and buy or sell what everyone else is buying or selling.

7. FOMO. “Fear of missing out” can induce investors to follow the herd and buy securities at times when it is wiser to sell or sit on the sidelines.

8. Confirmation bias. A tendency to overemphasize information that confirms our beliefs while overlooking or assigning less weight to unconfirming information.

9. Home bias. The tendency for investors to invest the majority of their assets in domestic stocks, ignoring the benefits of international diversification.

Stay calm

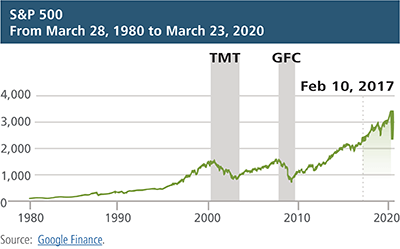

Even though the primary stock indices,  and likely your portfolio value, have dropped precipitously in the last few weeks, remember that we are coming off a historic bull market. In reality, the stock markets are about where they were in early 2017.

and likely your portfolio value, have dropped precipitously in the last few weeks, remember that we are coming off a historic bull market. In reality, the stock markets are about where they were in early 2017.

As I’ve explained before, true losses can be avoided. If you have a longer investment horizon, you will likely recover. The key is a well-diversified portfolio. And if you are currently living off your investment income or reaching one of your investment goals, such as paying for college, then talk to your wealth manager about what short-term options are available to you to get through this difficult period. It’s times like these when a trusted advisor will help you through your anxieties and keep you on financial track.

Talk to us

Talk to us