Many of us have experienced layers of emotions related to extreme volatility in the financial markets. I’ve worked through a few economic downturns over my career and seen firsthand how clients who possessed a solid foundation of wealth management knowledge and a clear vision of what they’d like to achieve staved off fear and stayed on the path to financial success.

The following seven basic wealth management principles will give you a perspective on your money that will add context, clarity and confidence to your financial decisions during good times and bad.

#1: Align your money decisions with your values

The best way I know to begin any personal financial discussion is to acknowledge there are two sides of money. One side is the technical — the side most people concentrate on. It has everything to do with numbers, math, contracts and other legal documents.

Then there’s the emotional side of money — the heart and soul. This is the side I encourage clients to focus on first. It’s essential to examine your feelings about money and the money messages and stories you’ve carried with you throughout your life.

Whether they came to us directly or indirectly, we often make meaning out of these messages and develop our own set of beliefs that drive our many financial choices, often without even being aware of it. That’s because these messages often turn into attitudes and behaviors about money that may cause us to avoid it, forever pursue more of it, envy it, or even obsessively save it.

By increasing your awareness, you can let go of the messages that no longer serve you well and embrace the ones you want to live by and convey to others. This goes a long way to helping you articulate your personal core values and then align your financial decisions with those values.

#2: Understand the “why” behind your financial goals

Determine the purpose of your wealth and what you’re looking to achieve with it. Knowing the purpose of your money will guide you toward intentional financial decision-making that keeps you on track to meet your life goals.

Perhaps your objective is to save enough money for an early retirement. Or maybe making sure your spouse has enough resources to pay bills if you died unexpectedly is foremost on your mind. You might want to give generously to others but know you must ensure you have enough money to cover your own needs first.

Whatever your “why” is, internalize it by reminding yourself of the purpose of your money so that you stay focused on what you’re striving to achieve. This will allow you to be more confident with your financial decisions and help you avoid choices that aren’t aligned with your goals.

#3: Take inventory of what you have and be intentional with spending

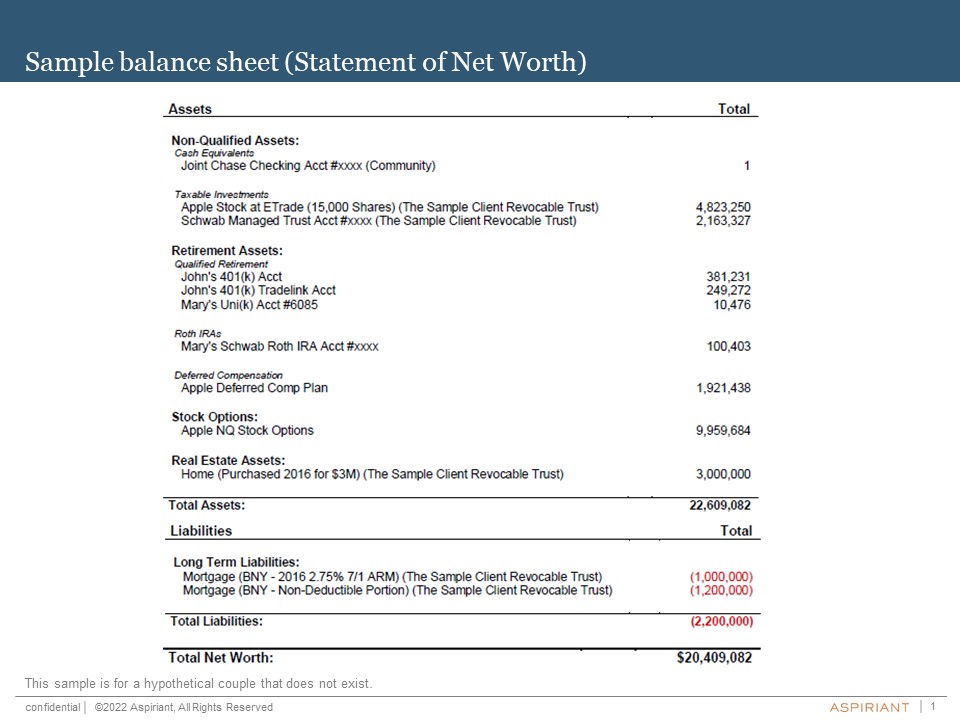

To be intentional with your spending, you do need to embrace the technical side of money by accessing what your assets and core liabilities are.

- Assets: Resources with economic value

- Liabilities: A debt or financial obligation you’re responsible for

A personal balance sheet (aka net worth statement) allows you to see your financial situation at a glance. By listing all assets and liabilities as of a particular date, it keeps you organized and allows you to track changes over time. It helps you ensure there’s always enough money in your checking account to pay your bills.

Set aside time each month to keep track of your financial affairs. Review credit card statements and bank account activity to make sure there aren’t any fraudulent transactions. If you find budgeting keeps you on track with your spending goals, a budgeting program can also help you monitor your activity. (Mint, YNAB and Quicken are popular.)

In the context of your broader plan, it’s worth considering how to protect your financial resources in the event of an unexpected or untimely event, such as a natural disaster or the premature death of a key family member. Another important consideration is how best to organize your balance sheet to try to minimize your income tax exposure.

Keep well-organized electronic records so that your financial details and documents are at your fingertips when you need them, particularly tax returns and records to prepare the returns, estate planning documents, and insurance contracts. Most financial institutions make brokerage, bank and credit account statements available online, so set up access for those too.

Establish auto-payments for your essential bills — mortgages and other loans, credit cards, and insurance. Automation makes it easy to avoid late payments and penalties that could blemish your credit score. Calendar payments at the outset of each year for items where auto-payments aren’t available, such as estimated income tax and property taxes, so you don’t miss those.

Set aside time each year to determine what shifts have occurred in your life over the past 12 months, such as changes with your job, marital status, family or housing, including material changes to the value of your home and other real estate. Consider what aspects of your financial plan need to be updated accordingly.

The objective is to keep your financial affairs current and on track. This will help you be prepared for unexpected events — such as a job disruption or stock market dive.

#4: Be vigilant about keeping your financial information secure

Now that so much of our private details are available electronically and stored in the cloud, it’s more important than ever to keep your personal information private and safe.

The coronavirus pandemic is creating challenges in many directions, and that reality is not lost on cybersecurity criminals. This uncertain environment is ripe with opportunity for these thieves. You can expect lots of targeted emails purporting to be “important health notices” or “urgent requests,” or notifications that “your package must be rerouted – click here.”

Here are some key security actions to take at all times:

- Use unique passwords for each device, account, website and app you use

- Use a password manager to generate, change and keep track of your passwords

- Enable multi-factor authentication for email accounts, financial institution websites, and other websites and apps

- Freeze your credit with the three major credit agencies so no one can access it without your permission

- Create an account before a fraudster does it for you at the:

- IRS

- Social Security Administration

- U.S. Postal Service

#5: Understand investing basics

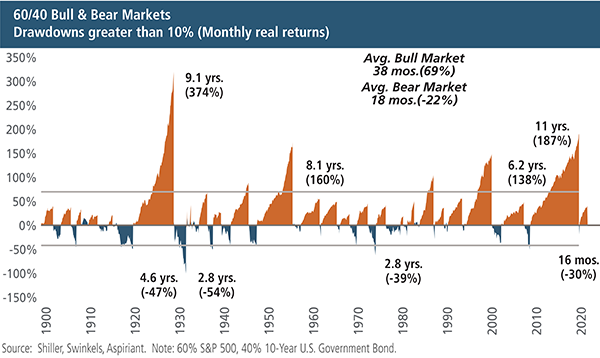

During volatile markets, investors can be their own worst nightmare. A key to investing is trying to limit losses. So it’s common for investors to panic and sell when the markets sink, hoping to avoid further declines. But then the problem is knowing when to jump back in to capture the upside.

True investment losses can be avoided with proper awareness and planning. Just remember, the longer the time horizon, the less the variability in average annual returns. So the longer a risky asset is held, the less the chance of loss.

Develop a well-thought-out investment strategy that is geared toward achieving your unique goals and stick with it.

#6: Maintain a current estate plan

Why have an estate plan? A solid estate plan helps you to retain control of your assets, protect beneficiaries and minimize estate taxes. Importantly, especially during a pandemic, the estate plan also allows you to delegate healthcare and financial decision-making to someone you trust if you become unable to make them yourself.

Everyone should have these key documents:

- Revocable living trust (if this is a commonly used technique in the state you live in)

- Pour-over will

- Assignment of assets

- Durable power of attorney

- Health care document

#7: Harness the power of a skilled and smart advisor

Understanding, organizing and managing your personal finances requires a lot of awareness, time and care. We live in a busy world, and some choose to delegate this work to a myriad of advisors: wealth managers like us, tax accountants and lawyers. Working with an experienced advisor can help you develop and stay on track with your financial plans. You can rely on them to take care of the technical side of your money and help guide you around some of the emotional aspects too.

When you’re searching for a financial advisor, look for the individuals and the firm that demonstrate:

- A focus on you

- Listens and makes you feel comfortable

- Cares about your well-being and puts your interests before theirs

- Is proactive and responsive to your concerns

- Professional guidance

- A Registered Investment Adviser (RIA) is an SEC-regulated firm that must act in your best interests. Mere “suitable” guidance is not good enough.

- Has years of expertise and experience

- Saves you time and takes care of things on your behalf

- Is transparent about how they’re compensated. A fee-based advisor tends to have fewer conflicts of interest.

Regardless of who you choose to work with, be sure to hire well for your unique circumstances, needs and style.

Talk to us

Talk to us