Spheres of Influence

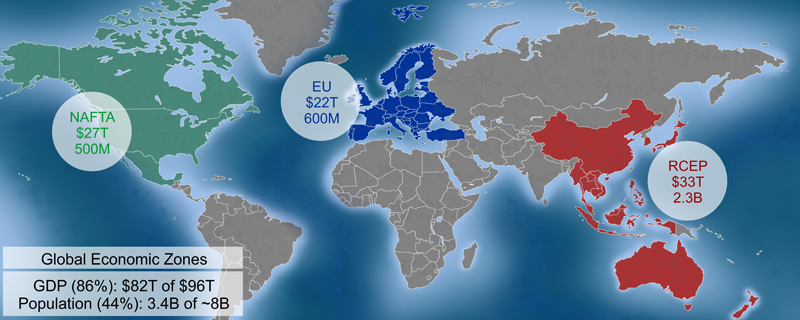

Powerful geopolitical developments underway with respect to nations, alliances, trade and economies are creating a strong tidal effect on today’s markets. Three dominant economic zones around the world, which collectively account for about 86% of global Gross Domestic Product (GDP) and 44% of the world’s population, vie with each other for a larger piece of the global prosperity pie:

- The United States, Mexico and Canada (USMCA) agreement, which replaced the North American Free Trade Act (NAFTA) a couple of years ago

- The European Union (EU)

- The Regional Comprehensive Economic Partnership (RCEP)

Each zone, or alliance, offers preferred trading status and benefits to its members, such as low or no tariffs, standardized rules of trade and intellectual property rights. Importantly, most countries belong to several trading organizations, not just the three shown on our map. But we’re highlighting these spheres of influence due to their sheer size and presence on the world stage.

Lesser known of the three is the RCEP, which became effective this January. That agreement was partly a response by some member countries to the U.S.’s withdrawal from the Trans-Pacific Partnership (TPP) in 2017.

Compared to the other two economic zones, the RCEP is several trillion dollars bigger in terms of GDP and more than 1.5 billion people larger. It includes 15 member states, including some with geopolitical clout in their own right, such as China, Japan and Australia. So, the RCEP clearly has some heft, and we suspect we’ll be hearing more about it in years ahead.

Implication of receding globalization

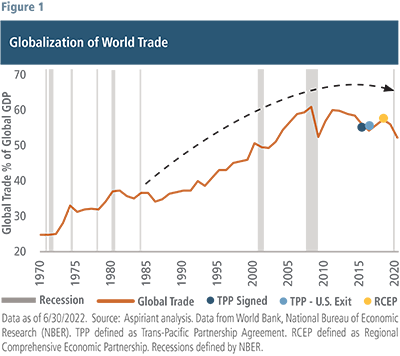

Figure 1 measures the total amount of goods and services traded across countries relative to the total amount of goods and services produced, which is global GDP. Therefore, the line serves as a proxy for how much countries and companies have been globalizing over the past 50 years.

Between the mid-1980’s and early-2010’s, countries and companies rapidly globalized business, trade, manufacturing and supply chains. Increasing globalization leads to lower prices of goods and services as companies scale the costs of their inputs, labor and capital. In other words, it is deflationary. However, in recent years, the pace of globalization slowed, possibly due to the diminishing returns of additional outsourcing and offshoring. You can see that with the cresting of the line since the mid-2000’s.

Moreover, supply chain disruptions, including those caused by conflict, have prompted countries and companies to reconsider how best to ensure the availability of food, water, energy and resources. Understandably, most countries prioritize the security and stability of their people and economies. However, this nationalism comes at a price since a slower pace of globalization likely leads to slower economic growth and higher inflation.

Importantly, the countries and economies of the world are far too integrated today to completely deglobalize. So, onshoring, reshoring or friend-shoring are unlikely to occur en masse. However, we expect to continue seeing discrete examples of nationalism related to energy independence (especially in Europe), critical component manufacturing (such as the recent passing of the Chips and Science Act), and environmental, social and governance advocacy (like McDonald’s leaving Russia after it invaded Ukraine).

In the grand scheme of global commerce, these decisions will occur on the margin. However, at a minimum, we expect the level of globalization to, at best, crest and, at worst, recede. In either case, the deflationary undercurrents that have offset prevailing inflationary pressures in the past may finally give way.

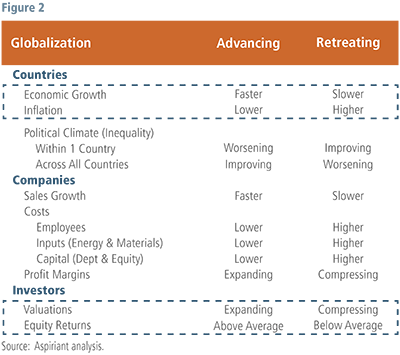

The Globalization table (Figure 2) presents the profound changes that could occur if globalization crests or recedes. The first column displays how advancing globalization affects countries, companies and investors across several dimensions. The second column presents the implications in an environment of retreating globalization.

The dashed boxes highlight some of the most critical elements. For countries, lower levels of globalization would likely lead to slower growth and higher inflation, perhaps even stagflation. No doubt, the political climate would change as inequality within and across countries changes. Among other factors, companies would experience a slower pace of revenue growth and lower profits. As a result, investors would likely experience a period of below-average investment returns as valuation multiples compress to reflect the new environment.

This is a meaty topic with far-reaching consequences, which we will continue to monitor and explain. Understanding the transformation and developing insights will prove critical to successfully navigating market volatility.

Important Disclosures

Aspiriant is an investment adviser registered with the Securities and Exchange Commission (SEC), which does not suggest a certain level of skill and training. Additional information regarding Aspiriant and its advisory practices can be obtained via the following link: https://aspiriant.com.

Investing in securities involves the risk of a partial or total loss of investment that an investor should be prepared to bear.

Any information provided herein does not constitute investment or tax advice and should not be construed as a promotion of advisory services.

The views and opinion expressed herein are those of Aspiriant’s portfolio management team as of the date of this article and may change at any time without prior notification. Any information provided herein does not constitute investment or tax advice and should not be construed as a promotion of advisory services.

Past performance is no guarantee of future performance. All investments can lose value. Indices are unmanaged and you cannot invest directly in an index. The volatility of any index may be materially different than that of a model. The charts and illustrations shown are for information purposes only. All information contained herein was sourced from independent third-party sources we believe are reliable, but the accuracy of such information is not guaranteed by Aspirant. Any statistical information in this article was obtained from publicly available market data (such as but not limited to data published by Bloomberg Finance L.P. and its affiliates), internal research and regulatory filings.

Talk to us

Talk to us