Consumers are feeling the pinch from inflation, and so are investors. Last quarter, we acknowledged our surprise that bond investors were being laissez-faire with inflation. It came to a sudden end this quarter as we experienced the worst three-month performance for the Bloomberg U.S. Aggregate Bond Index since the early 1980s.

More pain ahead?

The pain from higher rates is not fun. We know the Federal Reserve is going to raise short-term rates over the course of the next 12 months, and maybe beyond, but this does not mean bonds are in for more pain. However, the current pain in bonds could continue at least a little longer.

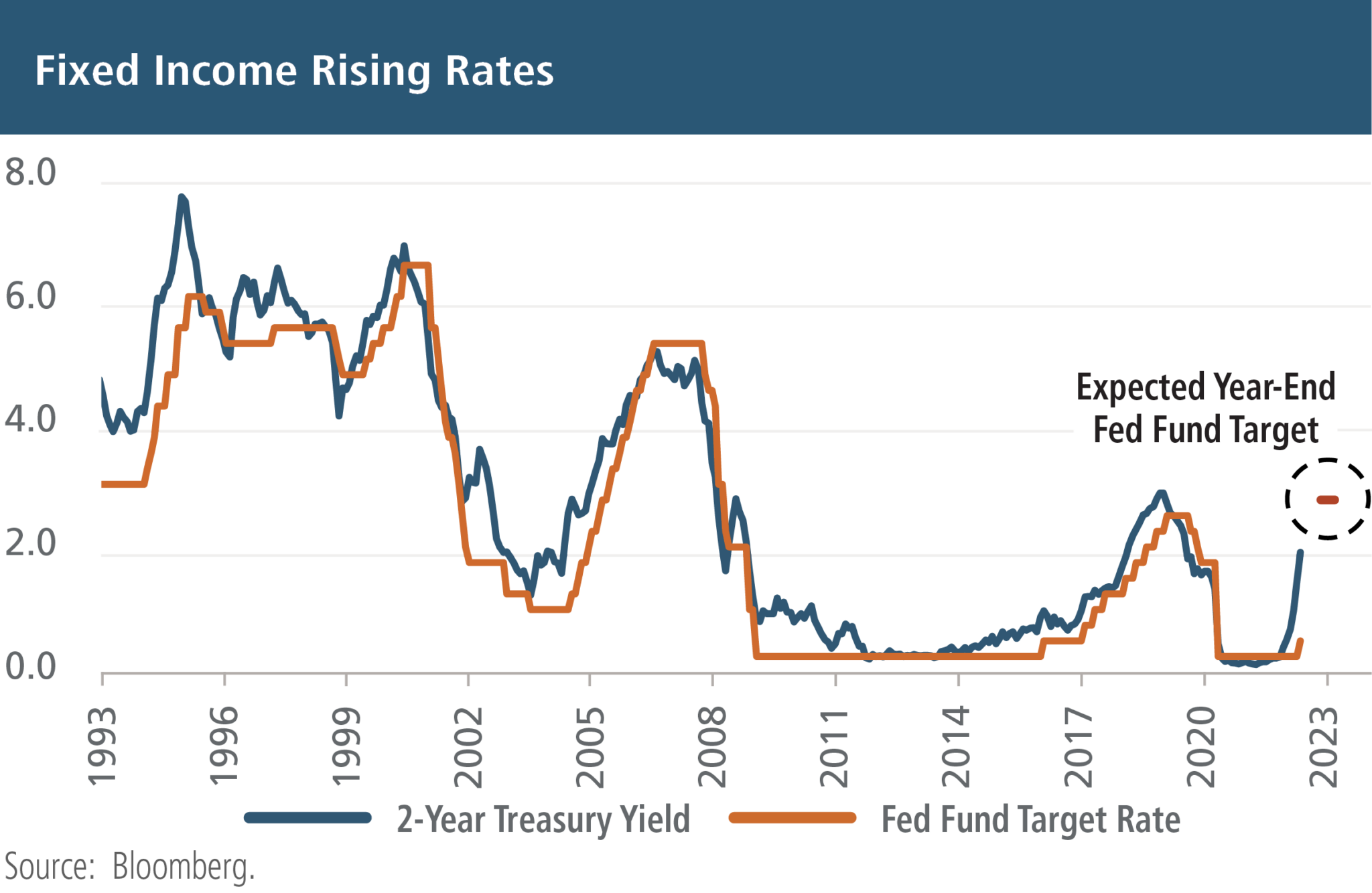

The chart shows the last four Fed Funds rate hike cycles. Two observations from the chart are important. First, the 2-year Treasury yield is a good proxy for where the Fed is going to stop raising rates. When the 2-year stops rising, and maybe begins to drop, the Fed is done raising rates. Second, the market has already priced in a significant portion of the expected Fed Funds rate increase. This is an important concept in understanding why most of the pain in bonds, if not all of it, is behind us. As of the first week of April, the 2-year Treasury yield is up to 2.50% from a low of just 0.09% just over a year ago.

Higher yields DO help bond investors

Higher yields provide a great benefit to bond investors. First, it means more income and better returns going forward. In each of the last four rising interest rate environments, three-year returns in bonds were at or higher than the starting yield. Taking a five-year look at returns provides an even rosier picture of higher rates leading to higher returns.

Higher rates also provide more risk protection to the overall portfolio. Given high equity valuations, we expect higher interest rates and tighter financial conditions to impact significant segments of the equity market. The protection from bonds still provides an important aspect to overall portfolio planning.

Can I get bond safety by looking overseas?

The current rate environment has many asking if they can get the safety of bonds by looking overseas. Unfortunately, much of the world is in a similar environment. Inflation is a problem around the world, and low interest rates are seen in most developed countries. The only developed region not looking at raising rates significantly is Japan. Other developed regions such as Europe, Great Britain, Canada and Australia all have policy rates below 1% currently and are in rate-hiking cycles similar to the Federal Reserve.

Still, there are other factors for investors to consider when buying international bonds, such as the diversification of interest rate cycles and currency exposures.

Important Disclosures

Aspiriant is an investment adviser registered with the Securities and Exchange Commission (“SEC”), which does not suggest a certain level of skill and training. Additional information regarding Aspiriant and its advisory practices can be obtained via the following link: https://aspiriant.com.

Investing in securities involves the risk of a partial or total loss of investment that an investor should be prepared to bear.

Any information provided herein does not constitute investment or tax advice and should not be construed as a promotion of advisory services.

The views and opinions expressed herein are those of Aspiriant’s investment professionals as of the date of this article and may change at any time without prior notification. The charts and illustrations shown are for information purposes only.

All information contained herein was sourced from independent third-party sources we believe are reliable, but the accuracy of such information is not guaranteed by Aspirant. Any statistical information in this article was obtained from publicly available market data (such as but not limited to data published by Bloomberg Finance L.P. and its affiliates), internal research and regulatory filings.

Talk to us

Talk to us