We began as an idea to fill a need. Now we are one of the nation’s top independent registered investment advisor (RIA) firms and we’re breaking the traditional wealth management mold. Our unique 100% employee-ownership model allows us to make objective decisions that truly benefit our clients and employees. Because our employees are financially invested in our firm – our clients’ success is our success. Here is the Aspiriant story - a story that is still growing.

The inspiration for Aspiriant was born in the late 1990s – a period when wealth was created, and complexity expanded. During that time many of our founders served clients, and newly affluent executives, who needed help aligning their values with resources.

There were a few independent financial advisors around, but many lacked the continuity clients needed. The other available resources — like banks and brokerage houses — were compensated by selling products. Affluent families were experiencing unprecedented complexity, but few firms existed to address the needs of these clients in the way our founders believed we could help them.

Our founders came together in 2008 to help clients navigate that complexity. These kindred spirits established Aspiriant with the shared commitment to building a best-in-class independent wealth management firm.

Each of these entrepreneurs would make vital contributions to our vision. This includes creating a model that truly differentiates Aspiriant from other wealth management firms – one that allows us to uphold our vision and mission for our clients.

We wanted to provide clients with unprecedented personal attention and expert guidance.

To do it:

We organized ourselves to remain durably independent and objective, with a thoughtfully designed succession model and 100% employee ownership. And we created a culture aligning our dedication to helping clients live their best life.

Our pursuit of this “holy grail” of wealth management has attracted a community of people. This extends to both clients and team members, whose partnership over the years has shaped everything we do.

Everyone has a unique story about how and why they became connected to the firm. Together, their stories create a larger narrative that unfolds in real time as each new client and team member joins and remains part of the Aspiriant family.

During our first decade, we established ourselves as leaders in the independent wealth management business. We expanded our services, invested in our team and infrastructure, and built a sustainable ownership model that intends to ensure us ongoing independence. Additionally, we’ve created six not-for-profit “access vehicles” that allow clients to pool their assets, drive down costs and benefit from investment opportunities they would not have access to as an individual investor.

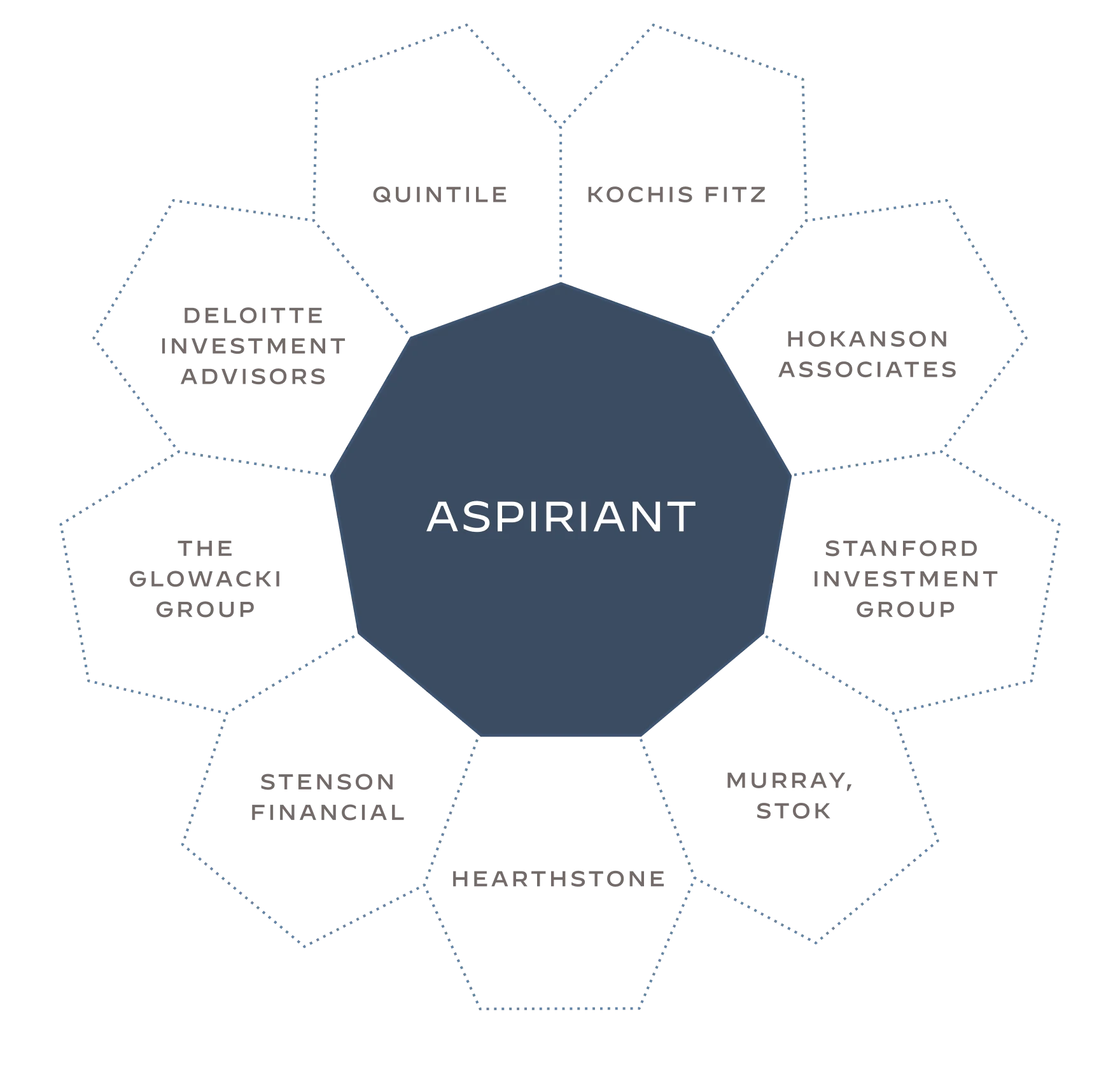

Today, Aspiriant is the product of nine stellar organizations combined as one team to do more for those we serve – our clients. We have approximately 220 team members, one-third of whom are partners in the firm. We serve clients in 47 states across the country, from 10 offices coast to coast, and manage $13 billion in client assets.

We strive for clients to retain an intimate relationship with their advisor team — and they now have even more specialists available when needed. Clients can also pool assets with other Aspiriant clients and invest with multi-billion-dollar leverage. It’s the opposite of growth for growth’s sake. It’s growth for client’s sake.

We’ve made major progress since the early days of Aspiriant. In many ways, though, we’ve only just begun to deliver on our full potential. Each year, our methodical growth fuels our ability to attract talent, expand services, lower certain product costs, provide better training for team members and more — all to continue upgrading the client experience.

We’re inspired by what we’re building on our client’s behalf and proud of our progress. Still, we believe the best is yet to come.

Employees

AUM

Average Partner Age

The inspiration for Aspiriant was born in the late 1990s – a period when wealth was created, and complexity expanded. During that time many of our founders served clients, and newly affluent executives, who needed help aligning their values with resources.

There were a few independent financial advisors around, but many lacked the continuity clients needed. The other available resources — like banks and brokerage houses — were compensated by selling products. Affluent families were experiencing unprecedented complexity, but few firms existed to address the needs of these clients in the way our founders believed we could help them.

We wanted to provide clients with unprecedented personal attention and expert guidance.

To do it:

We organized ourselves to remain durably independent and objective, with a thoughtfully designed succession model and 100% employee ownership. And we created a culture aligning our dedication to helping clients live their best life.

During our first decade, we established ourselves as leaders in the independent wealth management business. We expanded our services, invested in our team and infrastructure, and built a sustainable ownership model that intends to ensure us ongoing independence. Additionally, we’ve created six not-for-profit “access vehicles” that allow clients to pool their assets, drive down costs and benefit from investment opportunities they would not have access to as an individual investor.

We’ve made major progress since the early days of Aspiriant. In many ways, though, we’ve only just begun to deliver on our full potential. Each year, our methodical growth fuels our ability to attract talent, expand services, lower certain product costs, provide better training for team members and more — all to continue upgrading the client experience.

We’re inspired by what we’re building on our client’s behalf and proud of our progress. Still, we believe the best is yet to come.

Employees

AUM

Average Partner Age

We began as an idea to fill a need. Now we are one of the nation’s top independent registered investment advisor (RIA) firms and we’re breaking the traditional wealth management mold. Our unique 100% employee-ownership model allows us to make objective decisions that truly benefit our clients and employees. Because our employees are financially invested in our firm – our clients’ success is our success. Here is the Aspiriant story - a story that is still growing.

Our founders came together in 2008 to help clients navigate that complexity. These kindred spirits established Aspiriant with the shared commitment to building a best-in-class independent wealth management firm.

Each of these entrepreneurs would make vital contributions to our vision. This includes creating a model that truly differentiates Aspiriant from other wealth management firms – one that allows us to uphold our vision and mission for our clients.

Our pursuit of this “holy grail” of wealth management has attracted a community of people. This extends to both clients and team members, whose partnership over the years has shaped everything we do.

Everyone has a unique story about how and why they became connected to the firm. Together, their stories create a larger narrative that unfolds in real time as each new client and team member joins and remains part of the Aspiriant family.

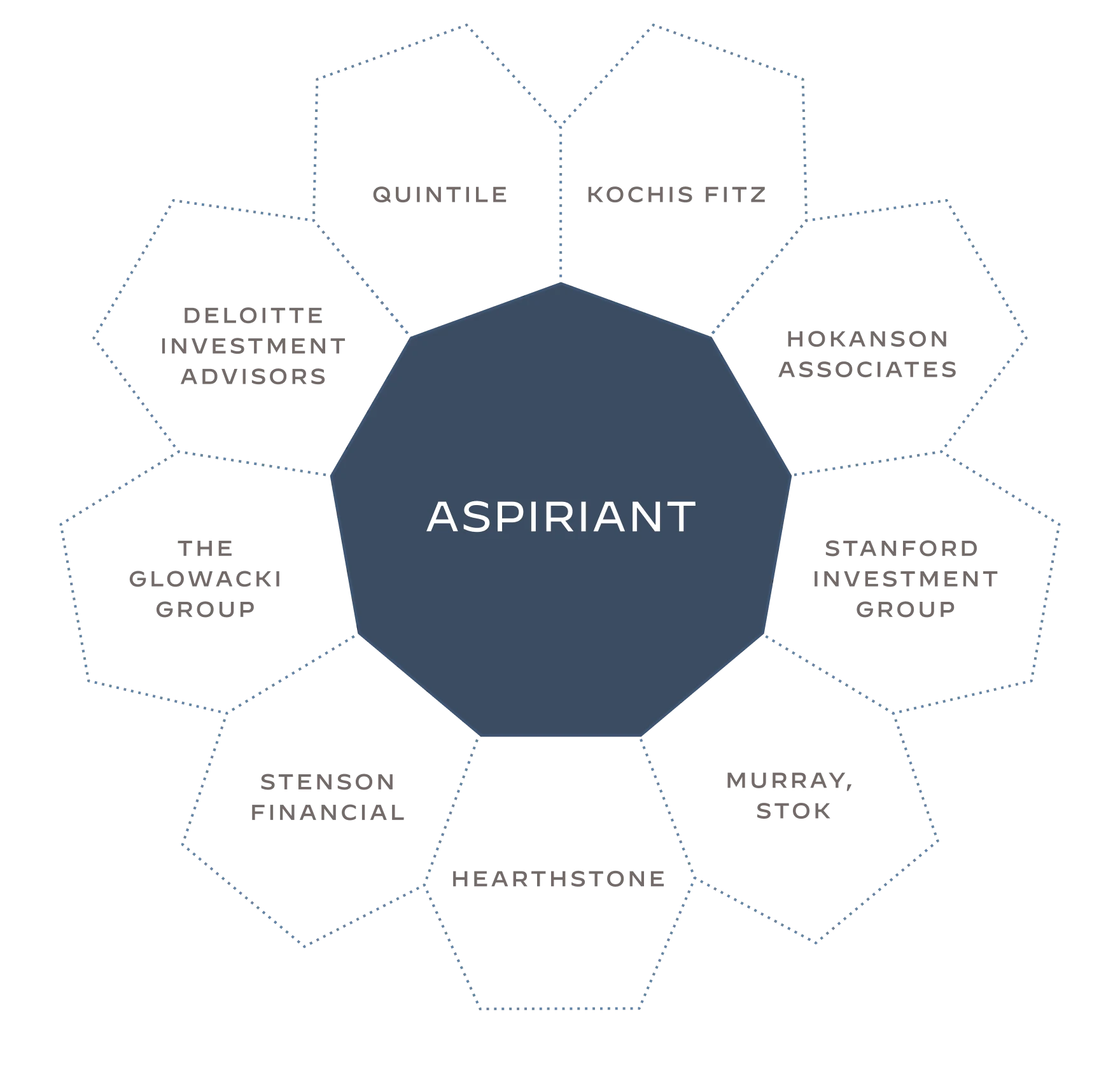

Today, Aspiriant is the product of nine stellar organizations combined as one team to do more for those we serve – our clients. We have approximately 220 team members, one-third of whom are partners in the firm. We serve clients in 47 states across the country, from 10 offices coast to coast, and manage $13 billion in client assets.

We strive for clients to retain an intimate relationship with their advisor team — and they now have even more specialists available when needed. Clients can also pool assets with other Aspiriant clients and invest with multi-billion-dollar leverage. It’s the opposite of growth for growth’s sake. It’s growth for client’s sake.